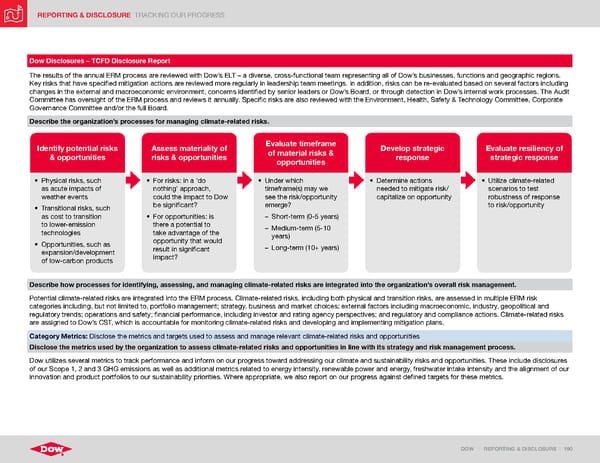

REPORTING & DISCLOSURE TRACKING OUR PROGRESS DOW | REPORTING & DISCLOSURE | 190 Dow Disclosures – TCFD Disclosure Report The results of the annual ERM process are reviewed with Dow’s ELT – a diverse, cross-functional team representing all of Dow’s businesses, functions and geographic regions. Key risks that have specified mitigation actions are reviewed more regularly in leadership team meetings. In addition, risks can be re-evaluated based on several factors including changes in the external and macroeconomic environment, concerns identified by senior leaders or Dow’s Board, or through detection in Dow’s internal work processes. The Audit Committee has oversight of the ERM process and reviews it annually. Specific risks are also reviewed with the Environment, Health, Safety & Technology Committee, Corporate Governance Committee and/or the full Board. Describe the organization’s processes for managing climate-related risks. • Physical risks, such as acute impacts of weather events • Transitional risks, such as cost to transition to lower-emission technologies • Opportunities, such as expansion/development of low-carbon products Identify potential risks & opportunities • Under which timeframe(s) may we see the risk/opportunity emerge? – Short-term (0-5 years) – Medium-term (5-10 years) – Long-term (10+ years) Evaluate timeframe of material risks & opportunities • Utilize climate-related scenarios to test robustness of response to risk/opportunity Evaluate resiliency of strategic response • For risks: in a ‘do nothing’ approach, could the impact to Dow be significant? • For opportunities: is there a potential to take advantage of the opportunity that would result in significant impact? Assess materiality of risks & opportunities • Determine actions needed to mitigate risk/ capitalize on opportunity Develop strategic response Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization’s overall risk management. Potential climate-related risks are integrated into the ERM process. Climate-related risks, including both physical and transition risks, are assessed in multiple ERM risk categories including, but not limited to, portfolio management; strategy, business and market choices; external factors including macroeconomic, industry, geopolitical and regulatory trends; operations and safety; financial performance, including investor and rating agency perspectives; and regulatory and compliance actions. Climate-related risks are assigned to Dow’s CST, which is accountable for monitoring climate-related risks and developing and implementing mitigation plans. Category Metrics: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process. Dow utilizes several metrics to track performance and inform on our progress toward addressing our climate and sustainability risks and opportunities. These include disclosures of our Scope 1, 2 and 3 GHG emissions as well as additional metrics related to energy intensity, renewable power and energy, freshwater intake intensity and the alignment of our innovation and product portfolios to our sustainability priorities. Where appropriate, we also report on our progress against defined targets for these metrics.

ESG Report | Dow Page 189 Page 191

ESG Report | Dow Page 189 Page 191