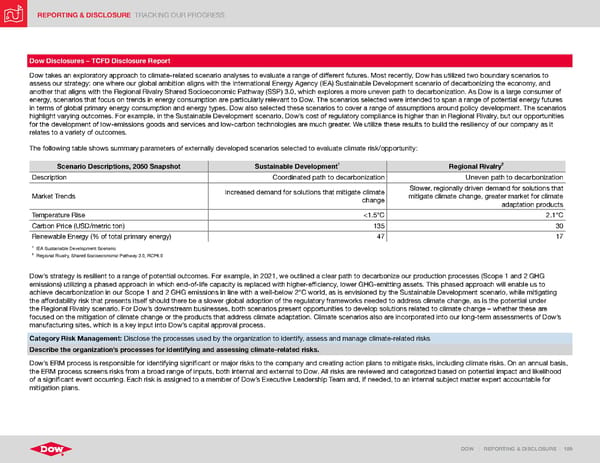

REPORTING & DISCLOSURE TRACKING OUR PROGRESS DOW | REPORTING & DISCLOSURE | 189 Dow Disclosures – TCFD Disclosure Report Dow takes an exploratory approach to climate-related scenario analyses to evaluate a range of different futures. Most recently, Dow has utilized two boundary scenarios to assess our strategy: one where our global ambition aligns with the International Energy Agency (IEA) Sustainable Development scenario of decarbonizing the economy, and another that aligns with the Regional Rivalry Shared Socioeconomic Pathway (SSP) 3.0, which explores a more uneven path to decarbonization. As Dow is a large consumer of energy, scenarios that focus on trends in energy consumption are particularly relevant to Dow. The scenarios selected were intended to span a range of potential energy futures in terms of global primary energy consumption and energy types. Dow also selected these scenarios to cover a range of assumptions around policy development. The scenarios highlight varying outcomes. For example, in the Sustainable Development scenario, Dow’s cost of regulatory compliance is higher than in Regional Rivalry, but our opportunities for the development of low-emissions goods and services and low-carbon technologies are much greater. We utilize these results to build the resiliency of our company as it relates to a variety of outcomes. The following table shows summary parameters of externally developed scenarios selected to evaluate climate risk/opportunity: Scenario Descriptions, 2050 Snapshot Sustainable Development 1 Regional Rivalry 2 Description Coordinated path to decarbonization Uneven path to decarbonization Market Trends Increased demand for solutions that mitigate climate change Slower, regionally driven demand for solutions that mitigate climate change, greater market for climate adaptation products Temperature Rise <1.5°C 2.1°C Carbon Price (USD/metric ton) 135 30 Renewable Energy (% of total primary energy) 47 17 1 IEA Sustainable Development Scenario 2 Regional Rivalry, Shared Socioeconomic Pathway 3.0, RCP6.0 Dow’s strategy is resilient to a range of potential outcomes. For example, in 2021, we outlined a clear path to decarbonize our production processes (Scope 1 and 2 GHG emissions) utilizing a phased approach in which end-of-life capacity is replaced with higher-efficiency, lower GHG-emitting assets. This phased approach will enable us to achieve decarbonization in our Scope 1 and 2 GHG emissions in line with a well-below 2°C world, as is envisioned by the Sustainable Development scenario, while mitigating the affordability risk that presents itself should there be a slower global adoption of the regulatory frameworks needed to address climate change, as is the potential under the Regional Rivalry scenario. For Dow’s downstream businesses, both scenarios present opportunities to develop solutions related to climate change – whether these are focused on the mitigation of climate change or the products that address climate adaptation. Climate scenarios also are incorporated into our long-term assessments of Dow’s manufacturing sites, which is a key input into Dow’s capital approval process. Category Risk Management: Disclose the processes used by the organization to identify, assess and manage climate-related risks Describe the organization’s processes for identifying and assessing climate-related risks. Dow’s ERM process is responsible for identifying significant or major risks to the company and creating action plans to mitigate risks, including climate risks. On an annual basis, the ERM process screens risks from a broad range of inputs, both internal and external to Dow. All risks are reviewed and categorized based on potential impact and likelihood of a significant event occurring. Each risk is assigned to a member of Dow’s Executive Leadership Team and, if needed, to an internal subject matter expert accountable for mitigation plans.

ESG Report | Dow Page 188 Page 190

ESG Report | Dow Page 188 Page 190