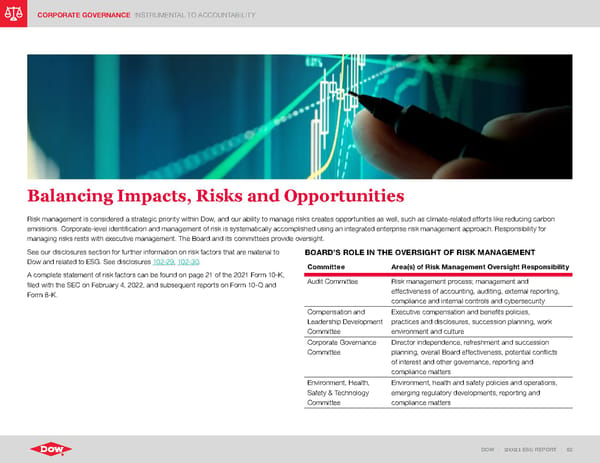

DOW | 2021 ESG REPORT | 82 CORPORATE GOVERNANCE INSTRUMENTAL TO ACCOUNTABILITY Balancing Impacts, Risks and Opportunities Risk management is considered a strategic priority within Dow, and our ability to manage risks creates opportunities as well, such as climate-related efforts like reducing carbon emissions. Corporate-level identification and management of risk is systematically accomplished using an integrated enterprise risk management approach. Responsibility for managing risks rests with executive management. The Board and its committees provide oversight. See our disclosures section for further information on risk factors that are material to Dow and related to ESG. See disclosures 102-29 , 102-30 . A complete statement of risk factors can be found on page 21 of the 2021 Form 10-K, filed with the SEC on February 4, 2022, and subsequent reports on Form 10-Q and Form 8-K. BOARD’S ROLE IN THE OVERSIGHT OF RISK MANAGEMENT Committee Area(s) of Risk Management Oversight Responsibility Audit Committee Risk management process; management and effectiveness of accounting, auditing, external reporting, compliance and internal controls and cybersecurity Compensation and Leadership Development Committee Executive compensation and benefits policies, practices and disclosures, succession planning, work environment and culture Corporate Governance Committee Director independence, refreshment and succession planning, overall Board effectiveness, potential conflicts of interest and other governance, reporting and compliance matters Environment, Health, Safety & Technology Committee Environment, health and safety policies and operations, emerging regulatory developments, reporting and compliance matters

ESG Report | Dow Page 81 Page 83

ESG Report | Dow Page 81 Page 83