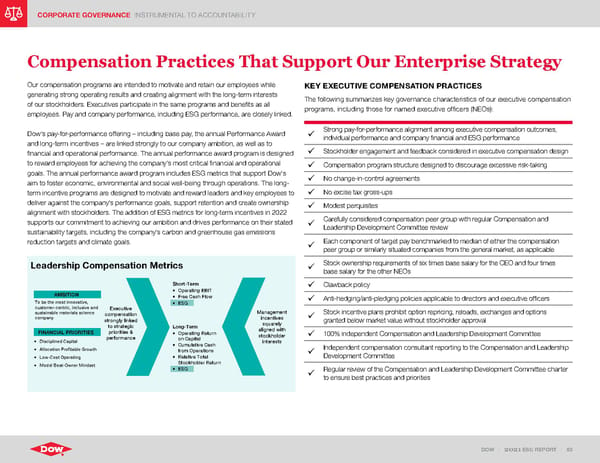

DOW | 2021 ESG REPORT | 83 CORPORATE GOVERNANCE INSTRUMENTAL TO ACCOUNTABILITY Compensation Practices That Support Our Enterprise Strategy Our compensation programs are intended to motivate and retain our employees while generating strong operating results and creating alignment with the long-term interests of our stockholders. Executives participate in the same programs and benefits as all employees. Pay and company performance, including ESG performance, are closely linked. Dow’s pay-for-performance offering – including base pay, the annual Performance Award and long-term incentives – are linked strongly to our company ambition, as well as to financial and operational performance. The annual performance award program is designed to reward employees for achieving the company’s most critical financial and operational goals. The annual performance award program includes ESG metrics that support Dow’s aim to foster economic, environmental and social well-being through operations. The long- term incentive programs are designed to motivate and reward leaders and key employees to deliver against the company’s performance goals, support retention and create ownership alignment with stockholders. The addition of ESG metrics for long-term incentives in 2022 supports our commitment to achieving our ambition and drives performance on their stated sustainability targets, including the company’s carbon and greenhouse gas emissions reduction targets and climate goals. AMBITION FINANCIAL PRIORITIES To be the most innovative, customer-centric, inclusive and sustainable materials science company Executive compensation strongly linked to strategic priorities & performance Management incentives squarely aligned with stockholder interests • Disciplined Capital • Allocation Profitable Growth • Low-Cost Operating • Model Best-Owner Mindset Short-Term • Operating EBIT • Free Cash Flow • ESG Long-Term • Operating Return on Capital • Cumulative Cash from Operations • Relative Total Stockholder Return • ESG Leadership Compensation Metrics Strong pay-for-performance alignment among executive compensation outcomes, individual performance and company financial and ESG performance Stockholder engagement and feedback considered in executive compensation design Compensation program structure designed to discourage excessive risk-taking No change-in-control agreements No excise tax gross-ups Modest perquisites Carefully considered compensation peer group with regular Compensation and Leadership Development Committee review Each component of target pay benchmarked to median of either the compensation peer group or similarly situated companies from the general market, as applicable Stock ownership requirements of six times base salary for the CEO and four times base salary for the other NEOs Clawback policy Anti-hedging/anti-pledging policies applicable to directors and executive officers Stock incentive plans prohibit option repricing, reloads, exchanges and options granted below market value without stockholder approval 100% independent Compensation and Leadership Development Committee Independent compensation consultant reporting to the Compensation and Leadership Development Committee Regular review of the Compensation and Leadership Development Committee charter to ensure best practices and priorities KEY EXECUTIVE COMPENSATION PRACTICES The following summarizes key governance characteristics of our executive compensation programs, including those for named executive officers (NEOs):

ESG Report | Dow Page 82 Page 84

ESG Report | Dow Page 82 Page 84