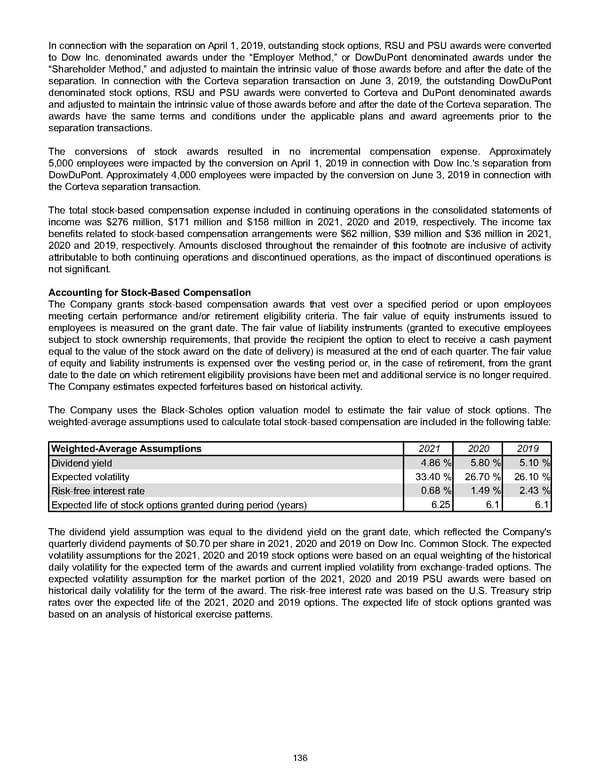

In connection with the separation on April 1, 2019, outstanding stock options, RSU and PSU awards were converted to Dow Inc. denominated awards under the “Employer Method,” or DowDuPont denominated awards under the “Shareholder Method,” and adjusted to maintain the intrinsic value of those awards before and after the date of the separation. In connection with the Corteva separation transaction on June 3, 2019, the outstanding DowDuPont denominated stock options, RSU and PSU awards were converted to Corteva and DuPont denominated awards and adjusted to maintain the intrinsic value of those awards before and after the date of the Corteva separation. The awards have the same terms and conditions under the applicable plans and award agreements prior to the separation transactions. The conversions of stock awards resulted in no incremental compensation expense. Approximately 5,000 employees were impacted by the conversion on April 1, 2019 in connection with Dow Inc.'s separation from DowDuPont. Approximately 4,000 employees were impacted by the conversion on June 3, 2019 in connection with the Corteva separation transaction. The total stock-based compensation expense included in continuing operations in the consolidated statements of income was $276 million , $171 million and $158 million in 2021 , 2020 and 2019 , respectively. The income tax benefits related to stock-based compensation arrangements were $62 million , $39 million and $36 million in 2021 , 2020 and 2019 , respectively. Amounts disclosed throughout the remainder of this footnote are inclusive of activity attributable to both continuing operations and discontinued operations, as the impact of discontinued operations is not significant. Accounting for Stock-Based Compensation The Company grants stock-based compensation awards that vest over a specified period or upon employees meeting certain performance and/or retirement eligibility criteria. The fair value of equity instruments issued to employees is measured on the grant date. The fair value of liability instruments (granted to executive employees subject to stock ownership requirements, that provide the recipient the option to elect to receive a cash payment equal to the value of the stock award on the date of delivery) is measured at the end of each quarter. The fair value of equity and liability instruments is expensed over the vesting period or, in the case of retirement, from the grant date to the date on which retirement eligibility provisions have been met and additional service is no longer required. The Company estimates expected forfeitures based on historical activity. The Company uses the Black-Scholes option valuation model to estimate the fair value of stock options. The weighted-average assumptions used to calculate total stock-based compensation are included in the following table: Weighted-Average Assumptions 2021 2020 2019 Dividend yield 4.86 % 5.80 % 5.10 % Expected volatility 33.40 % 26.70 % 26.10 % Risk-free interest rate 0.68 % 1.49 % 2.43 % Expected life of stock options granted during period (years) 6.25 6.1 6.1 The dividend yield assumption was equal to the dividend yield on the grant date, which reflected the Company's quarterly dividend payments of $0.70 per share in 2021 , 2020 and 2019 on Dow Inc. Common Stock. The expected volatility assumptions for the 2021, 2020 and 2019 stock options were based on an equal weighting of the historical daily volatility for the expected term of the awards and current implied volatility from exchange-traded options. The expected volatility assumption for the market portion of the 2021, 2020 and 2019 PSU awards were based on historical daily volatility for the term of the award. The risk-free interest rate was based on the U.S. Treasury strip rates over the expected life of the 2021, 2020 and 2019 options. The expected life of stock options granted was based on an analysis of historical exercise patterns. 136

Annual Report Page 145 Page 147

Annual Report Page 145 Page 147