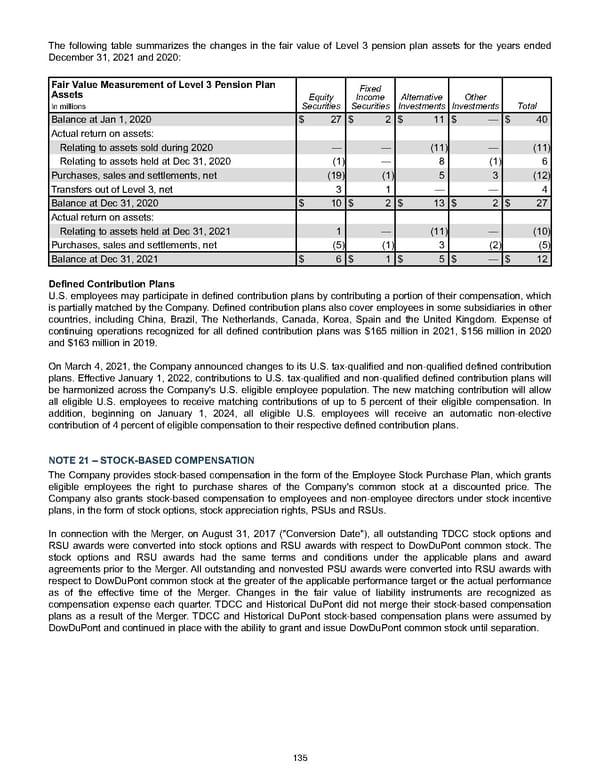

The following table summarizes the changes in the fair value of Level 3 pension plan assets for the years ended December 31, 2021 and 2020 : Fair Value Measurement of Level 3 Pension Plan Assets Equity Securities Fixed Income Securities Alternative Investments Other Investments Total In millions Balance at Jan 1, 2020 $ 27 $ 2 $ 11 $ — $ 40 Actual return on assets: Relating to assets sold during 2020 — — (11) — (11) Relating to assets held at Dec 31, 2020 (1) — 8 (1) 6 Purchases, sales and settlements, net (19) (1) 5 3 (12) Transfers out of Level 3, net 3 1 — — 4 Balance at Dec 31, 2020 $ 10 $ 2 $ 13 $ 2 $ 27 Actual return on assets: Relating to assets held at Dec 31, 2021 1 — (11) — (10) Purchases, sales and settlements, net (5) (1) 3 (2) (5) Balance at Dec 31, 2021 $ 6 $ 1 $ 5 $ — $ 12 Defined Contribution Plans U .S. employees may participate in defined contribution plans by contributing a portion of their compensation, which is partially matched by the Company. Defined contribution plans also cover employees in some subsidiaries in other countries, including China, Brazil, The Netherlands, Canada, Korea, Spain and the United Kingdom. Expense of continuing operations recognized for all defined contribution plans was $165 million in 2021 , $156 million in 2020 and $163 million in 2019 . On March 4, 2021, the Company announced changes to its U.S. tax-qualified and non-qualified defined contribution plans. Effective January 1, 2022, contributions to U.S. tax-qualified and non-qualified defined contribution plans will be harmonized across the Company's U.S. eligible employee population. The new matching contribution will allow all eligible U.S. employees to receive matching contributions of up to 5 percent of their eligible compensation. In addition, beginning on January 1, 2024, all eligible U.S. employees will receive an automatic non-elective contribution of 4 percent of eligible compensation to their respective defined contribution plans. NOTE 21 – STOCK-BASED COMPENSATION The Company provides stock-based compensation in the form of the Employee Stock Purchase Plan, which grants eligible employees the right to purchase shares of the Company's common stock at a discounted price. The Company also grants stock-based compensation to employees and non-employee directors under stock incentive plans, in the form of stock options, stock appreciation rights, PSUs and RSUs. In connection with the Merger, on August 31, 2017 ("Conversion Date"), all outstanding TDCC stock options and RSU awards were converted into stock options and RSU awards with respect to DowDuPont common stock. The stock options and RSU awards had the same terms and conditions under the applicable plans and award agreements prior to the Merger. All outstanding and nonvested PSU awards were converted into RSU awards with respect to DowDuPont common stock at the greater of the applicable performance target or the actual performance as of the effective time of the Merger. Changes in the fair value of liability instruments are recognized as compensation expense each quarter. TDCC and Historical DuPont did not merge their stock-based compensation plans as a result of the Merger. TDCC and Historical DuPont stock-based compensation plans were assumed by DowDuPont and continued in place with the ability to grant and issue DowDuPont common stock until separation. 135

Annual Report Page 144 Page 146

Annual Report Page 144 Page 146