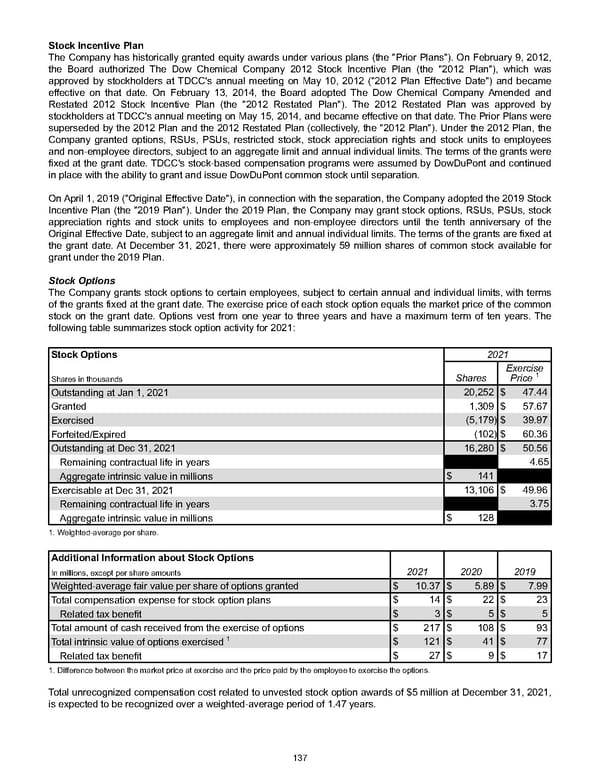

Stock Incentive Plan The Company has historically granted equity awards under various plans (the "Prior Plans"). On February 9, 2012, the Board authorized The Dow Chemical Company 2012 Stock Incentive Plan (the "2012 Plan"), which was approved by stockholders at TDCC's annual meeting on May 10, 2012 ("2012 Plan Effective Date") and became effective on that date. On February 13, 2014, the Board adopted The Dow Chemical Company Amended and Restated 2012 Stock Incentive Plan (the "2012 Restated Plan"). The 2012 Restated Plan was approved by stockholders at TDCC's annual meeting on May 15, 2014, and became effective on that date. The Prior Plans were superseded by the 2012 Plan and the 2012 Restated Plan (collectively, the "2012 Plan"). Under the 2012 Plan, the Company granted options, RSUs, PSUs, restricted stock, stock appreciation rights and stock units to employees and non-employee directors, subject to an aggregate limit and annual individual limits. The terms of the grants were fixed at the grant date. TDCC's stock-based compensation programs were assumed by DowDuPont and continued in place with the ability to grant and issue DowDuPont common stock until separation. On April 1, 2019 ("Original Effective Date"), in connection with the separation, the Company adopted the 2019 Stock Incentive Plan (the "2019 Plan"). Under the 2019 Plan, the Company may grant stock options, RSUs, PSUs, stock appreciation rights and stock units to employees and non-employee directors until the tenth anniversary of the Original Effective Date, subject to an aggregate limit and annual individual limits. The terms of the grants are fixed at the grant date. At December 31, 2021 , there were approximately 59 million shares of common stock available for grant under the 2019 Plan. Stock Options The Company grants stock options to certain employees, subject to certain annual and individual limits, with terms of the grants fixed at the grant date. The exercise price of each stock option equals the market price of the common stock on the grant date. Options vest from one year to three years and have a maximum term of ten years . The following table summarizes stock option activity for 2021 : Stock Options 2021 Shares in thousands Shares Exercise Price 1 Outstanding at Jan 1, 2021 20,252 $ 47.44 Granted 1,309 $ 57.67 Exercised (5,179) $ 39.97 Forfeited/Expired (102) $ 60.36 Outstanding at Dec 31, 2021 16,280 $ 50.56 Remaining contractual life in years 4.65 Aggregate intrinsic value in millions $ 141 Exercisable at Dec 31, 2021 13,106 $ 49.96 Remaining contractual life in years 3.75 Aggregate intrinsic value in millions $ 128 1. Weighted-average per share. Additional Information about Stock Options In millions, except per share amounts 2021 2020 2019 Weighted-average fair value per share of options granted $ 10.37 $ 5.89 $ 7.99 Total compensation expense for stock option plans $ 14 $ 22 $ 23 Related tax benefit $ 3 $ 5 $ 5 Total amount of cash received from the exercise of options $ 217 $ 108 $ 93 Total intrinsic value of options exercised 1 $ 121 $ 41 $ 77 Related tax benefit $ 27 $ 9 $ 17 1. Difference between the market price at exercise and the price paid by the employee to exercise the options. Total unrecognized compensation cost related to unvested stock option awards of $5 million at December 31, 2021 , is expected to be recognized over a weighted-average period of 1.47 years. 137

Annual Report Page 146 Page 148

Annual Report Page 146 Page 148