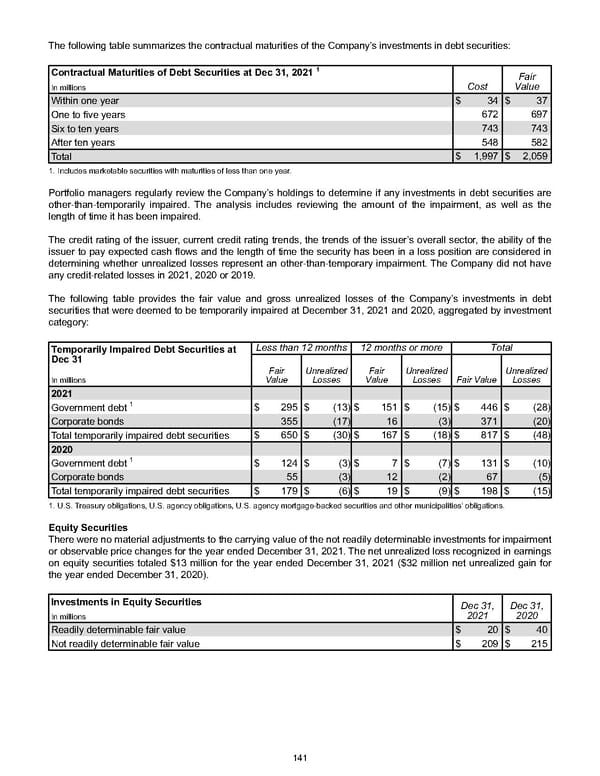

The following table summarizes the contractual maturities of the Company’s investments in debt securities: Contractual Maturities of Debt Securities at Dec 31, 2021 1 Cost Fair Value In millions Within one year $ 34 $ 37 One to five years 672 697 Six to ten years 743 743 After ten years 548 582 Total $ 1,997 $ 2,059 1. Includes marketable securities with maturities of less than one year. Portfolio managers regularly review the Company’s holdings to determine if any investments in debt securities are other-than-temporarily impaired. The analysis includes reviewing the amount of the impairment, as well as the length of time it has been impaired. The credit rating of the issuer, current credit rating trends, the trends of the issuer’s overall sector, the ability of the issuer to pay expected cash flows and the length of time the security has been in a loss position are considered in determining whether unrealized losses represent an other-than-temporary impairment. The Company did not have any credit-related losses in 2021 , 2020 or 2019 . The following table provides the fair value and gross unrealized losses of the Company’s investments in debt securities that were deemed to be temporarily impaired at December 31, 2021 and 2020 , aggregated by investment category: Temporarily Impaired Debt Securities at Dec 31 Less than 12 months 12 months or more Total Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses In millions 2021 Government debt 1 $ 295 $ (13) $ 151 $ (15) $ 446 $ (28) Corporate bonds 355 (17) 16 (3) 371 (20) Total temporarily impaired debt securities $ 650 $ (30) $ 167 $ (18) $ 817 $ (48) 2020 Government debt 1 $ 124 $ (3) $ 7 $ (7) $ 131 $ (10) Corporate bonds 55 (3) 12 (2) 67 (5) Total temporarily impaired debt securities $ 179 $ (6) $ 19 $ (9) $ 198 $ (15) 1. U.S. Treasury obligations, U.S. agency obligations, U.S. agency mortgage-backed securities and other municipalities' obligations. Equity Securities There were no material adjustments to the carrying value of the not readily determinable investments for impairment or observable price changes for the year ended December 31, 2021 . The net unrealized loss recognized in earnings on equity securities totaled $13 million for the year ended December 31, 2021 ( $32 million net unrealized gain for the year ended December 31, 2020 ). Investments in Equity Securities Dec 31, 2021 Dec 31, 2020 In millions Readily determinable fair value $ 20 $ 40 Not readily determinable fair value $ 209 $ 215 141

Annual Report Page 150 Page 152

Annual Report Page 150 Page 152