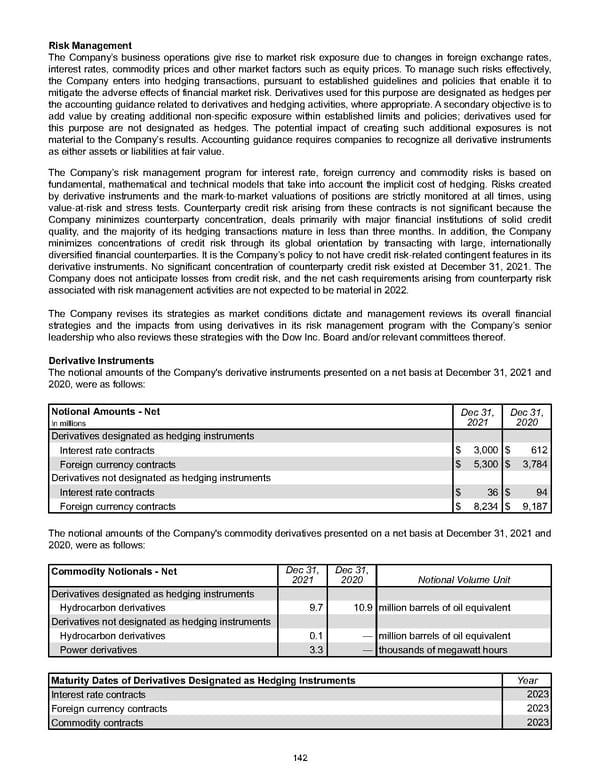

Risk Management The Company’s business operations give rise to market risk exposure due to changes in foreign exchange rates, interest rates, commodity prices and other market factors such as equity prices. To manage such risks effectively, the Company enters into hedging transactions, pursuant to established guidelines and policies that enable it to mitigate the adverse effects of financial market risk. Derivatives used for this purpose are designated as hedges per the accounting guidance related to derivatives and hedging activities, where appropriate. A secondary objective is to add value by creating additional non-specific exposure within established limits and policies; derivatives used for this purpose are not designated as hedges. The potential impact of creating such additional exposures is not material to the Company’s results. Accounting guidance requires companies to recognize all derivative instruments as either assets or liabilities at fair value. The Company’s risk management program for interest rate, foreign currency and commodity risks is based on fundamental, mathematical and technical models that take into account the implicit cost of hedging. Risks created by derivative instruments and the mark-to-market valuations of positions are strictly monitored at all times, using value-at-risk and stress tests. Counterparty credit risk arising from these contracts is not significant because the Company minimizes counterparty concentration, deals primarily with major financial institutions of solid credit quality, and the majority of its hedging transactions mature in less than three months. In addition, the Company minimizes concentrations of credit risk through its global orientation by transacting with large, internationally diversified financial counterparties. It is the Company’s policy to not have credit risk-related contingent features in its derivative instruments. No significant concentration of counterparty credit risk existed at December 31, 2021 . The Company does not anticipate losses from credit risk, and the net cash requirements arising from counterparty risk associated with risk management activities are not expected to be material in 2022 . The Company revises its strategies as market conditions dictate and management reviews its overall financial strategies and the impacts from using derivatives in its risk management program with the Company’s senior leadership who also reviews these strategies with the Dow Inc. Board and/or relevant committees thereof. Derivative Instruments The notional amounts of the Company's derivative instruments presented on a net basis at December 31, 2021 and 2020 , were as follows: Notional Amounts - Net Dec 31, 2021 Dec 31, 2020 In millions Derivatives designated as hedging instruments Interest rate contracts $ 3,000 $ 612 Foreign currency contracts $ 5,300 $ 3,784 Derivatives not designated as hedging instruments Interest rate contracts $ 36 $ 94 Foreign currency contracts $ 8,234 $ 9,187 The notional amounts of the Company's commodity derivatives presented on a net basis at December 31, 2021 and 2020 , were as follows: Commodity Notionals - Net Dec 31, 2021 Dec 31, 2020 Notional Volume Unit Derivatives designated as hedging instruments Hydrocarbon derivatives 9.7 10.9 million barrels of oil equivalent Derivatives not designated as hedging instruments Hydrocarbon derivatives 0.1 — million barrels of oil equivalent Power derivatives 3.3 — thousands of megawatt hours Maturity Dates of Derivatives Designated as Hedging Instruments Year Interest rate contracts 2023 Foreign currency contracts 2023 Commodity contracts 2023 142

Annual Report Page 151 Page 153

Annual Report Page 151 Page 153