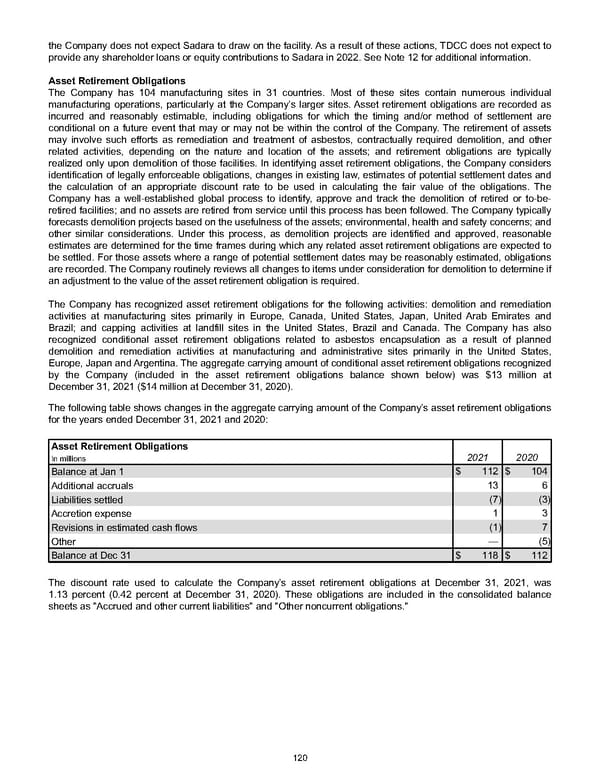

the Company does not expect Sadara to draw on the facility. As a result of these actions, TDCC does not expect to provide any shareholder loans or equity contributions to Sadara in 2022. See Note 12 for additional information. Asset Retirement Obligat ions The Company has 104 manufacturing sites in 31 countries. Most of these sites contain numerous individual manufacturing operations, particularly at the Company’s larger sites. Asset retirement obligations are recorded as incurred and reasonably estimable, including obligations for which the timing and/or method of settlement are conditional on a future event that may or may not be within the control of the Company. The retirement of assets may involve such efforts as remediation and treatment of asbestos, contractually required demolition, and other related activities, depending on the nature and location of the assets; and retirement obligations are typically realized only upon demolition of those facilities. In identifying asset retirement obligations, the Company considers identification of legally enforceable obligations, changes in existing law, estimates of potential settlement dates and the calculation of an appropriate discount rate to be used in calculating the fair value of the obligations. The Company has a well-established global process to identify, approve and track the demolition of retired or to-be- retired facilities; and no assets are retired from service until this process has been followed. The Company typically forecasts demolition projects based on the usefulness of the assets; environmental, health and safety concerns; and other similar considerations. Under this process, as demolition projects are identified and approved, reasonable estimates are determined for the time frames during which any related asset retirement obligations are expected to be settled. For those assets where a range of potential settlement dates may be reasonably estimated, obligations are recorded. The Company routinely reviews all changes to items under consideration for demolition to determine if an adjustment to the value of the asset retirement obligation is required. The Company has recognized asset retirement obligations for the following activities: demolition and remediation activities at manufacturing sites primarily in Europe, Canada, United States, Japan, United Arab Emirates and Brazil; and capping activities at landfill sites in the United States, Brazil and Canada. The Company has also recognized conditional asset retirement obligations related to asbestos encapsulation as a result of planned demolition and remediation activities at manufacturing and administrative sites primarily in the United States, Europe, Japan and Argentina. The aggregate carrying amount of conditional asset retirement obligations recognized by the Company (included in the asset retirement obligations balance shown below) was $13 million at December 31, 2021 ( $14 million at December 31, 2020 ). The following table shows changes in the aggregate carrying amount of the Company’s asset retirement obligations for the years ended December 31, 2021 and 2020 : Asset Retirement Obligations 2021 2020 In millions Balance at Jan 1 $ 112 $ 104 Additional accruals 13 6 Liabilities settled (7) (3) Accretion expense 1 3 Revisions in estimated cash flows (1) 7 Other — (5) Balance at Dec 31 $ 118 $ 112 The discount rate used to calculate the Company’s asset retirement obligations at December 31, 2021 , was 1.13 percent ( 0.42 percent at December 31, 2020 ). These obligations are included in the consolidated balance sheets as "Accrued and other current liabilities" and "Other noncurrent obligations." 120

Annual Report Page 129 Page 131

Annual Report Page 129 Page 131