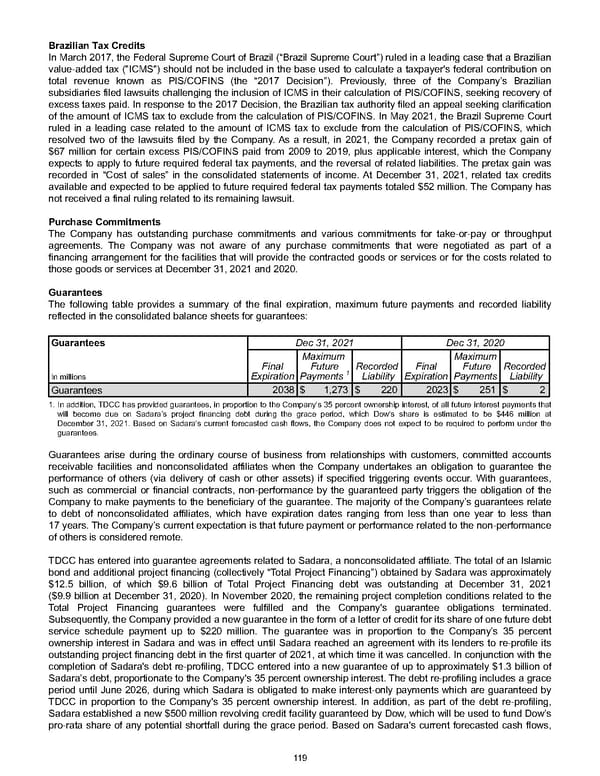

Brazilian Tax Credits In March 2017, the Federal Supreme Court of Brazil (“Brazil Supreme Court”) ruled in a leading case that a Brazilian value-added tax ("ICMS") should not be included in the base used to calculate a taxpayer's federal contribution on total revenue known as PIS/COFINS (the “2017 Decision”). Previously, three of the Company’s Brazilian subsidiaries filed lawsuits challenging the inclusion of ICMS in their calculation of PIS/COFINS, seeking recovery of excess taxes paid. In response to the 2017 Decision, the Brazilian tax authority filed an appeal seeking clarification of the amount of ICMS tax to exclude from the calculation of PIS/COFINS. In May 2021, the Brazil Supreme Court ruled in a leading case related to the amount of ICMS tax to exclude from the calculation of PIS/COFINS, which resolved two of the lawsuits filed by the Company. As a result, in 2021, the Company recorded a pretax gain of $67 million for certain excess PIS/COFINS paid from 2009 to 2019, plus applicable interest, which the Company expects to apply to future required federal tax payments, and the reversal of related liabilities. The pretax gain was recorded in “Cost of sales” in the consolidated statements of income. At December 31, 2021 , related tax credits available and expected to be applied to future required federal tax payments totaled $52 million . The Company has not received a final ruling related to its remaining lawsuit. Purchase Commitments The Company has outstanding purchase commitments and various commitments for take-or-pay or throughput agreements. The Company was not aware of any purchase commitments that were negotiated as part of a financing arrangement for the facilities that will provide the contracted goods or services or for the costs related to those goods or services at December 31, 2021 and 2020 . Guarantees The following table provides a summary of the final expiration, maximum future payments and recorded liability reflected in the consolidated balance sheets for guarantees: Guarantees Dec 31, 2021 Dec 31, 2020 In millions Final Expiration Maximum Future Payments 1 Recorded Liability Final Expiration Maximum Future Payments Recorded Liability Guarantees 2038 $ 1,273 $ 220 2023 $ 251 $ 2 1. In addition, TDCC has provided guarantees, in proportion to the Company's 35 percent ownership interest, of all future interest payments that will become due on Sadara’s project financing debt during the grace period, which Dow's share is estimated to be $446 million at December 31, 2021 . Based on Sadara's current forecasted cash flows, the Company does not expect to be required to perform under the guarantees. Guarantees arise during the ordinary course of business from relationships with customers, committed accounts receivable facilities and nonconsolidated affiliates when the Company undertakes an obligation to guarantee the performance of others (via delivery of cash or other assets) if specified triggering events occur. With guarantees, such as commercial or financial contracts, non-performance by the guaranteed party triggers the obligation of the Company to make payments to the beneficiary of the guarantee. The majority of the Company’s guarantees relate to debt of nonconsolidated affiliates, which have expiration dates ranging from less than one year to less than 17 years. The Company’s current expectation is that future payment or performance related to the non-performance of others is considered remote. TDCC has entered into guarantee agreements related to Sadara, a nonconsolidated affiliate. The total of an Islamic bond and additional project financing (collectively “Total Project Financing”) obtained by Sadara was approximately $12.5 billion , of which $9.6 billion of Total Project Financing debt was outstanding at December 31, 2021 ( $9.9 billion at December 31, 2020 ). In November 2020, the remaining project completion conditions related to the Total Project Financing guarantees were fulfilled and the Company's guarantee obligations terminated. Subsequently, the Company provided a new guarantee in the form of a letter of credit for its share of one future debt service schedule payment up to $220 million . The guarantee was in proportion to the Company’s 35 percent ownership interest in Sadara and was in effect until Sadara reached an agreement with its lenders to re-profile its outstanding project financing debt in the first quarter of 2021, at which time it was cancelled. In conjunction with the completion of Sadara's debt re-profiling, TDCC entered into a new guarantee of up to approximately $1.3 billion of Sadara’s debt, proportionate to the Company's 35 percent ownership interest. The debt re-profiling includes a grace period until June 2026, during which Sadara is obligated to make interest-only payments which are guaranteed by TDCC in proportion to the Company's 35 percent ownership interest. In addition, as part of the debt re-profiling, Sadara established a new $500 million revolving credit facility guaranteed by Dow, which will be used to fund Dow’s pro-rata share of any potential shortfall during the grace period. Based on Sadara's current forecasted cash flows, 119

Annual Report Page 128 Page 130

Annual Report Page 128 Page 130