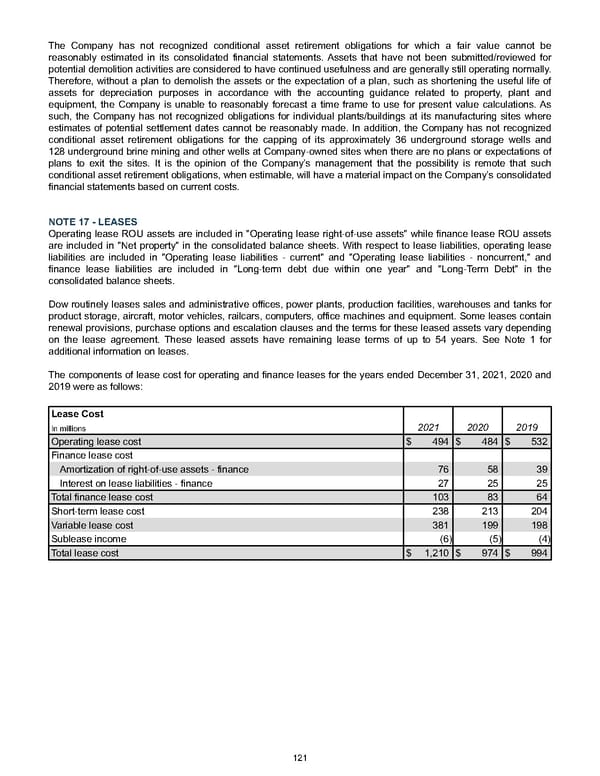

The Company has not recognized conditional asset retirement obligations for which a fair value cannot be reasonably estimated in its consolidated financial statements. Assets that have not been submitted/reviewed for potential demolition activities are considered to have continued usefulness and are generally still operating normally. Therefore, without a plan to demolish the assets or the expectation of a plan, such as shortening the useful life of assets for depreciation purposes in accordance with the accounting guidance related to property, plant and equipment, the Company is unable to reasonably forecast a time frame to use for present value calculations. As such, the Company has not recognized obligations for individual plants/buildings at its manufacturing sites where estimates of potential settlement dates cannot be reasonably made. In addition, the Company has not recognized conditional asset retirement obligations for the capping of its approximately 36 underground storage wells and 128 underground brine mining and other wells at Company-owned sites when there are no plans or expectations of plans to exit the sites. It is the opinion of the Company’s management that the possibility is remote that such conditional asset retirement obligations, when estimable, will have a material impact on the Company’s consolidated financial statements based on current costs. NOTE 17 - LEASES Operating lease ROU assets are included in "Operating lease right-of-use assets" while finance lease ROU assets are included in "Net property" in the consolidated balance sheets. With respect to lease liabilities, operating lease liabilities are included in "Operating lease liabilities - current" and "Operating lease liabilities - noncurrent," and finance lease liabilities are included in "Long-term debt due within one year" and "Long-Term Debt" in the consolidated balance sheets. Dow routinely leases sales and administrative offices, power plants, production facilities, warehouses and tanks for product storage, aircraft, motor vehicles, railcars, computers, office machines and equipment. Some leases contain renewal provisions, purchase options and escalation clauses and the terms for these leased assets vary depending on the lease agreement. These leased assets have remaining lease terms of up to 54 years . See Note 1 for additional information on leases. The components of lease cost for operating and finance leases for the years ended December 31, 2021 , 2020 and 2019 were as follows: Lease Cost 2021 2020 2019 In millions Operating lease cost $ 494 $ 484 $ 532 Finance lease cost Amortization of right-of-use assets - finance 76 58 39 Interest on lease liabilities - finance 27 25 25 Total finance lease cost 103 83 64 Short-term lease cost 238 213 204 Variable lease cost 381 199 198 Sublease income (6) (5) (4) Total lease cost $ 1,210 $ 974 $ 994 121

Annual Report Page 130 Page 132

Annual Report Page 130 Page 132