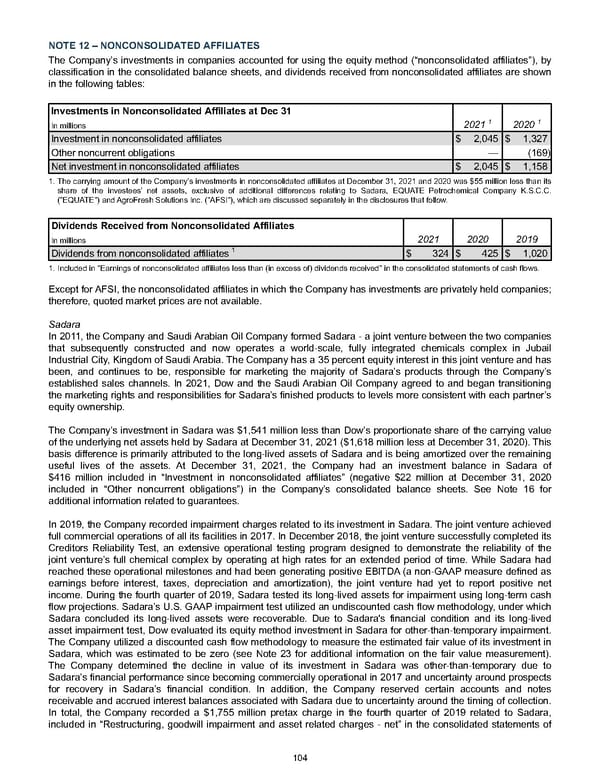

NOTE 12 – NONCONSOLIDATED AFFILIATES The Company ’s investments in companies accounted for using the equity method (“nonconsolidated affiliates”) , by classification in the consolidated balance sheets, and dividends received from nonconsolidated affiliates are shown in the following tables: Investments in Nonconsolidated Affiliates at Dec 31 2021 1 2020 1 In millions Investment in nonconsolidated affiliates $ 2,045 $ 1,327 Other noncurrent obligations — (169) Net investment in nonconsolidated affiliates $ 2,045 $ 1,158 1. The carrying amount of the Company’s investments in nonconsolidated affiliates at December 31, 2021 and 2020 was $55 million less than its share of the investees’ net assets, exclusive of additional differences relating to Sadara, EQUATE Petrochemical Company K.S.C.C. ("EQUATE") and AgroFresh Solutions Inc. ("AFSI"), which are discussed separately in the disclosures that follow. Dividends Received from Nonconsolidated Affiliates 2021 2020 2019 In millions Dividends from nonconsolidated affiliates 1 $ 324 $ 425 $ 1,020 1. Included in "Earnings of nonconsolidated affiliates less than (in excess of) dividends received" in the consolidated statements of cash flows. Except for AFSI, the nonconsolidated affiliates in which the Company has investments are privately held companies; therefore, quoted market prices are not available . Sadara In 2011, the Company and Saudi Arabian Oil Company formed Sadara - a joint venture between the two companies that subsequently constructed and now operates a world-scale, fully integrated chemicals complex in Jubail Industrial City, Kingdom of Saudi Arabia. The Company has a 35 percent equity interest in this joint venture and has been, and continues to be, responsible for marketing the majority of Sadara’s products through the Company’s established sales channels. In 2021, Dow and the Saudi Arabian Oil Company agreed to and began transitioning the marketing rights and responsibilities for Sadara’s finished products to levels more consistent with each partner’s equity ownership. The Company’s investment in Sadara was $1,541 million less than Dow’s proportionate share of the carrying value of the underlying net assets held by Sadara at December 31, 2021 ( $1,618 million less at December 31, 2020 ). This basis difference is primarily attributed to the long-lived assets of Sadara and is being amortized over the remaining useful lives of the assets. At December 31, 2021 , the Company had an investment balance in Sadara of $416 million included in “Investment in nonconsolidated affiliates” (negative $22 million at December 31, 2020 included in “Other noncurrent obligations”) in the Company’s consolidated balance sheets. See Note 16 for additional information related to guarantees. In 2019, the Company recorded impairment charges related to its investment in Sadara. The joint venture achieved full commercial operations of all its facilities in 2017. In December 2018, the joint venture successfully completed its Creditors Reliability Test, an extensive operational testing program designed to demonstrate the reliability of the joint venture’s full chemical complex by operating at high rates for an extended period of time. While Sadara had reached these operational milestones and had been generating positive EBITDA (a non-GAAP measure defined as earnings before interest, taxes, depreciation and amortization), the joint venture had yet to report positive net income. During the fourth quarter of 2019, Sadara tested its long-lived assets for impairment using long-term cash flow projections. Sadara’s U.S. GAAP impairment test utilized an undiscounted cash flow methodology, under which Sadara concluded its long-lived assets were recoverable. Due to Sadara's financial condition and its long-lived asset impairment test, Dow evaluated its equity method investment in Sadara for other-than-temporary impairment. The Company utilized a discounted cash flow methodology to measure the estimated fair value of its investment in Sadara, which was estimated to be zero (see Note 23 for additional information on the fair value measurement). The Company determined the decline in value of its investment in Sadara was other-than-temporary due to Sadara’s financial performance since becoming commercially operational in 2017 and uncertainty around prospects for recovery in Sadara’s financial condition. In addition, the Company reserved certain accounts and notes receivable and accrued interest balances associated with Sadara due to uncertainty around the timing of collection. In total, the Company recorded a $1,755 million pretax charge in the fourth quarter of 2019 related to Sadara, included in “Restructuring, goodwill impairment and asset related charges - net” in the consolidated statements of 104

Annual Report Page 113 Page 115

Annual Report Page 113 Page 115