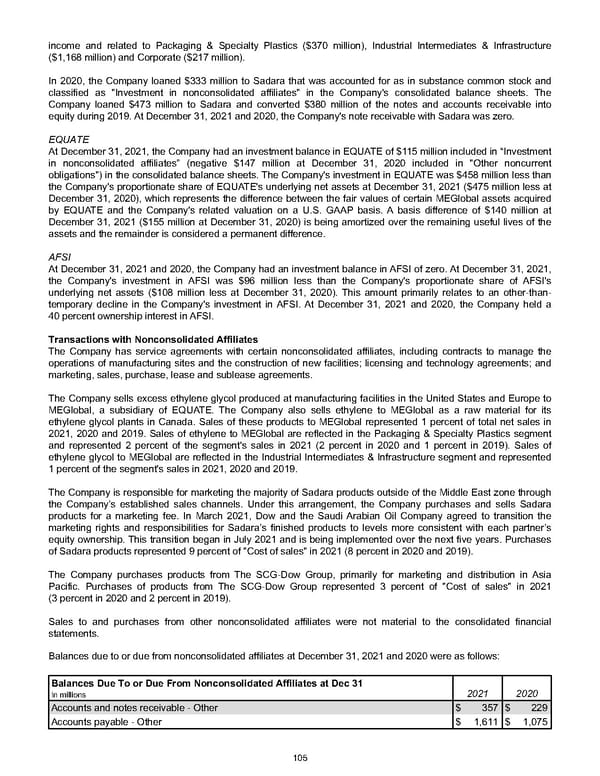

income and related to Packaging & Specialty Plastics ( $370 million ), Industrial Intermediates & Infrastructure ( $1,168 million ) and Corporate ( $217 million ). In 2020 , the Company loaned $333 million to Sadara that was accounted for as in substance common stock and classified as "Investment in nonconsolidated affiliates" in the Company's consolidated balance sheets. The Company loaned $473 million to Sadara and converted $380 million of the notes and accounts receivable into equity during 2019 . At December 31, 2021 and 2020 , the Company's note receivable with Sadara was zero . EQUATE At December 31, 2021 , the Company had an investment balance in EQUATE of $115 million included in “Investment in nonconsolidated affiliates” (negative $147 million at December 31, 2020 included in "Other noncurrent obligations") in the consolidated balance sheets. The Company's investment in EQUATE was $458 million less than the Company's proportionate share of EQUATE's underlying net assets at December 31, 2021 ( $475 million less at December 31, 2020 ), which represents the difference between the fair values of certain MEGlobal assets acquired by EQUATE and the Company's related valuation on a U.S. GAAP basis. A basis difference of $140 million at December 31, 2021 ( $155 million at December 31, 2020 ) is being amortized over the remaining useful lives of the assets and the remainder is considered a permanent difference. AFSI At December 31, 2021 and 2020, the Company had an investment balance in AFSI of zero . At December 31, 2021 , the Company's investment in AFSI was $96 million less than the Company's proportionate share of AFSI's underlying net assets ( $108 million less at December 31, 2020 ). This amount primarily relates to an other-than- temporary decline in the Company's investment in AFSI. At December 31, 2021 and 2020, the Company held a 40 percent ownership interest in AFSI. Transactions with Nonconsolidated Affiliates The Company has service agreements with certain nonconsolidated affiliates, including contracts to manage the operations of manufacturing sites and the construction of new facilities; licensing and technology agreements; and marketing, sales, purchase, lease and sublease agreements. The Company sells excess ethylene glycol produced at manufacturing facilities in the United States and Europe to MEGlobal, a subsidiary of EQUATE. The Company also sells ethylene to MEGlobal as a raw material for its ethylene glycol plants in Canada. Sales of these products to MEGlobal represented 1 percent of total net sales in 2021 , 2020 and 2019 . Sales of ethylene to MEGlobal are reflected in the Packaging & Specialty Plastics segment and represented 2 percent of the segment's sales in 2021 ( 2 percent in 2020 and 1 percent in 2019 ). Sales of ethylene glycol to MEGlobal are reflected in the Industrial Intermediates & Infrastructure segment and represented 1 percent of the segment's sales in 2021 , 2020 and 2019 . The Company is responsible for marketing the majority of Sadara products outside of the Middle East zone through the Company’s established sales channels. Under this arrangement, the Company purchases and sells Sadara products for a marketing fee. In March 2021, Dow and the Saudi Arabian Oil Company agreed to transition the marketing rights and responsibilities for Sadara’s finished products to levels more consistent with each partner’s equity ownership. This transition began in July 2021 and is being implemented over the next five years. Purchases of Sadara products represented 9 percent of "Cost of sales" in 2021 ( 8 percent in 2020 and 2019 ). The Company purchases products from The SCG-Dow Group, primarily for marketing and distribution in Asia Pacific. Purchases of products from The SCG-Dow Group represented 3 percent of "Cost of sales" in 2021 ( 3 percent in 2020 and 2 percent in 2019 ). Sales to and purchases from other nonconsolidated affiliates were not material to the consolidated financial statements. Balances due to or due from nonconsolidated affiliates at December 31, 2021 and 2020 were as follows: Balances Due To or Due From Nonconsolidated Affiliates at Dec 31 2021 2020 In millions Accounts and notes receivable - Other $ 357 $ 229 Accounts payable - Other $ 1,611 $ 1,075 105

Annual Report Page 114 Page 116

Annual Report Page 114 Page 116