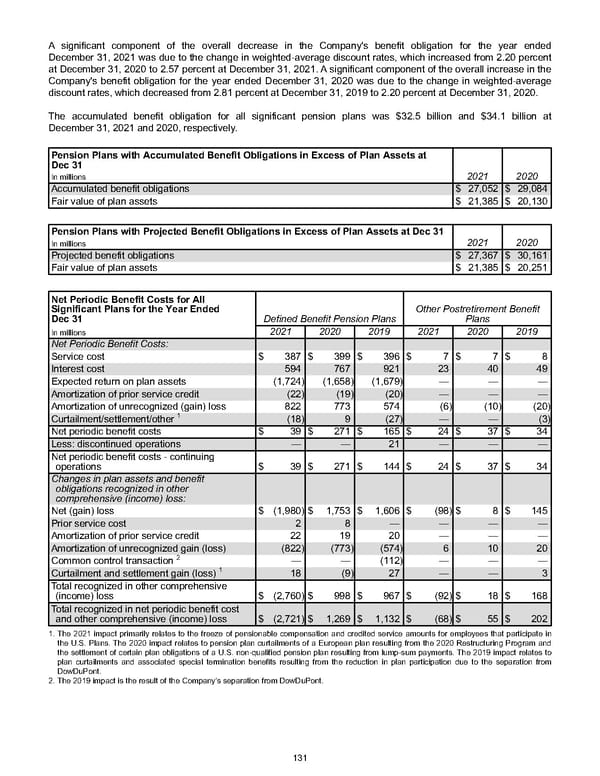

A significant component of the overall decrease in the Company's benefit obligation for the year ended December 31, 2021 was due to the change in weighted-average discount rates, which increased from 2.20 percent at December 31, 2020 to 2.57 percent at December 31, 2021 . A significant component of the overall increase in the Company's benefit obligation for the year ended December 31, 2020 was due to the change in weighted-average discount rates, which decreased from 2.81 percent at December 31, 2019 to 2.20 percent at December 31, 2020 . The accumulated benefit obligation for all significant pension plans was $32.5 billion and $34.1 billion at December 31, 2021 and 2020 , respectively. Pension Plans with Accumulated Benefit Obligations in Excess of Plan Assets at Dec 31 2021 2020 In millions Accumulated benefit obligations $ 27,052 $ 29,084 Fair value of plan assets $ 21,385 $ 20,130 Pension Plans with Projected Benefit Obligations in Excess of Plan Assets at Dec 31 2021 2020 In millions Projected benefit obligations $ 27,367 $ 30,161 Fair value of plan assets $ 21,385 $ 20,251 Net Periodic Benefit Costs for All Significant Plans for the Year Ended Dec 31 Defined Benefit Pension Plans Other Postretirement Benefit Plans In millions 2021 2020 2019 2021 2020 2019 Net Periodic Benefit Costs: Service cost $ 387 $ 399 $ 396 $ 7 $ 7 $ 8 Interest cost 594 767 921 23 40 49 Expected return on plan assets (1,724) (1,658) (1,679) — — — Amortization of prior service credit (22) (19) (20) — — — Amortization of unrecognized (gain) loss 822 773 574 (6) (10) (20) Curtailment/settlement/other 1 (18) 9 (27) — — (3) Net periodic benefit costs $ 39 $ 271 $ 165 $ 24 $ 37 $ 34 Less: discontinued operations — — 21 — — — Net periodic benefit costs - continuing operations $ 39 $ 271 $ 144 $ 24 $ 37 $ 34 Changes in plan assets and benefit obligations recognized in other comprehensive (income) loss: Net (gain) loss $ (1,980) $ 1,753 $ 1,606 $ (98) $ 8 $ 145 Prior service cost 2 8 — — — — Amortization of prior service credit 22 19 20 — — — Amortization of unrecognized gain (loss) (822) (773) (574) 6 10 20 Common control transaction 2 — — (112) — — — Curtailment and settlement gain (loss) 1 18 (9) 27 — — 3 Total recognized in other comprehensive (income) loss $ (2,760) $ 998 $ 967 $ (92) $ 18 $ 168 Total recognized in net periodic benefit cost and other comprehensive (income) loss $ (2,721) $ 1,269 $ 1,132 $ (68) $ 55 $ 202 1. The 2021 impact primarily relates to the freeze of pensionable compensation and credited service amounts for employees that participate in the U.S. Plans. The 2020 impact relates to pension plan curtailments of a European plan resulting from the 2020 Restructuring Program and the settlement of certain plan obligations of a U.S. non-qualified pension plan resulting from lump-sum payments. The 2019 impact relates to plan curtailments and associated special termination benefits resulting from the reduction in plan participation due to the separation from DowDuPont. 2. The 2019 impact is the result of the Company's separation from DowDuPont. 131

Annual Report Page 140 Page 142

Annual Report Page 140 Page 142