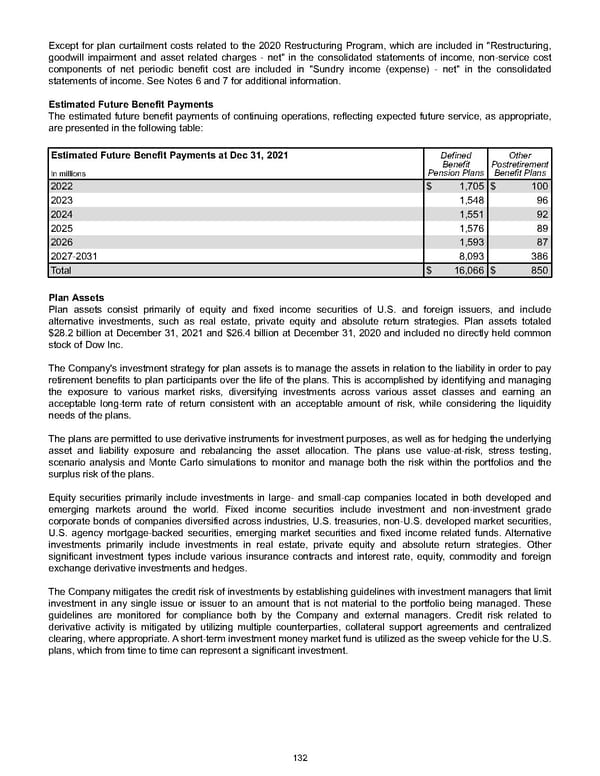

Except for plan curtailment costs related to the 2020 Restructuring Program, which are included in "Restructuring, goodwill impairment and asset related charges - net" in the consolidated statements of income, non-service cost components of net periodic benefit cost are included in "Sundry income (expense) - net" in the consolidated statements of income. See Notes 6 and 7 for additional information . Estimated Future Benefit Payments The estimated future benefit payments of continuing operations, reflecting expected future service, as appropriate, are presented in the following table: Estimated Future Benefit Payments at Dec 31, 2021 Defined Benefit Pension Plans Other Postretirement Benefit Plans In millions 2022 $ 1,705 $ 100 2023 1,548 96 2024 1,551 92 2025 1,576 89 2026 1,593 87 2027-2031 8,093 386 Total $ 16,066 $ 850 Plan Assets Plan assets consist primarily of equity and fixed income securities of U.S. and foreign issuers, and include alternative investments, such as real estate, private equity and absolute return strategies. Plan assets totaled $28.2 billion at December 31, 2021 and $26.4 billion at December 31, 2020 and included no directly held common stock of Dow Inc. The Company's investment strategy for plan assets is to manage the assets in relation to the liability in order to pay retirement benefits to plan participants over the life of the plans. This is accomplished by identifying and managing the exposure to various market risks, diversifying investments across various asset classes and earning an acceptable long-term rate of return consistent with an acceptable amount of risk, while considering the liquidity needs of the plans. The plans are permitted to use derivative instruments for investment purposes, as well as for hedging the underlying asset and liability exposure and rebalancing the asset allocation. The plans use value-at-risk, stress testing, scenario analysis and Monte Carlo simulations to monitor and manage both the risk within the portfolios and the surplus risk of the plans. Equity securities primarily include investments in large- and small-cap companies located in both developed and emerging markets around the world. Fixed income securities include investment and non-investment grade corporate bonds of companies diversified across industries, U.S. treasuries, non-U.S. developed market securities, U.S. agency mortgage-backed securities, emerging market securities and fixed income related funds. Alternative investments primarily include investments in real estate, private equity and absolute return strategies. Other significant investment types include various insurance contracts and interest rate, equity, commodity and foreign exchange derivative investments and hedges. The Company mitigates the credit risk of investments by establishing guidelines with investment managers that limit investment in any single issue or issuer to an amount that is not material to the portfolio being managed. These guidelines are monitored for compliance both by the Company and external managers. Credit risk related to derivative activity is mitigated by utilizing multiple counterparties, collateral support agreements and centralized clearing, where appropriate. A short-term investment money market fund is utilized as the sweep vehicle for the U.S. plans, which from time to time can represent a significant investment. 132

Annual Report Page 141 Page 143

Annual Report Page 141 Page 143