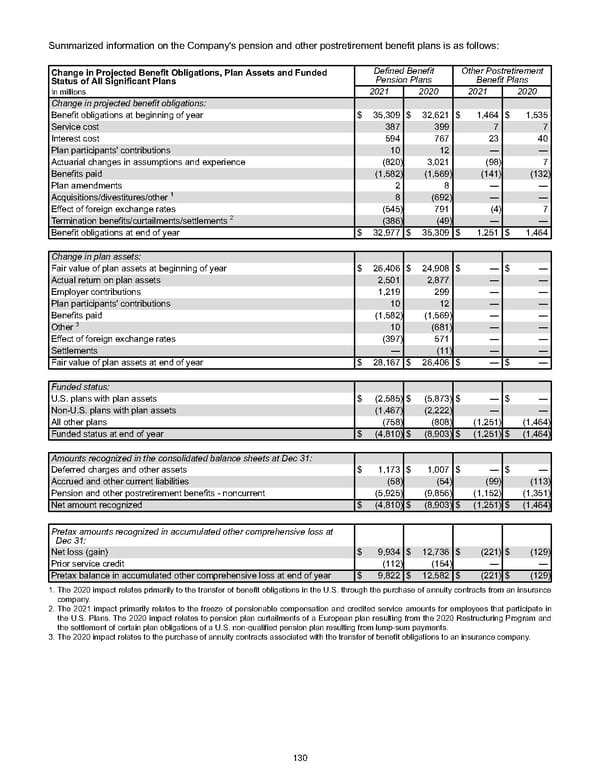

Summarized information on the Company's pension and other postretirement benefit plans is as follows: Change in Projected Benefit Obligations, Plan Assets and Funded Status of All Significant Plans Defined Benefit Pension Plans Other Postretirement Benefit Plans In millions 2021 2020 2021 2020 Change in projected benefit obligations: Benefit obligations at beginning of year $ 35,309 $ 32,621 $ 1,464 $ 1,535 Service cost 387 399 7 7 Interest cost 594 767 23 40 Plan participants' contributions 10 12 — — Actuarial changes in assumptions and experience (820) 3,021 (98) 7 Benefits paid (1,582) (1,569) (141) (132) Plan amendments 2 8 — — Acquisitions/divestitures/other 1 8 (692) — — Effect of foreign exchange rates (545) 791 (4) 7 Termination benefits/curtailments/settlements 2 (386) (49) — — Benefit obligations at end of year $ 32,977 $ 35,309 $ 1,251 $ 1,464 Change in plan assets: Fair value of plan assets at beginning of year $ 26,406 $ 24,908 $ — $ — Actual return on plan assets 2,501 2,877 — — Employer contributions 1,219 299 — — Plan participants' contributions 10 12 — — Benefits paid (1,582) (1,569) — — Other 3 10 (681) — — Effect of foreign exchange rates (397) 571 — — Settlements — (11) — — Fair value of plan assets at end of year $ 28,167 $ 26,406 $ — $ — Funded status: U.S. plans with plan assets $ (2,585) $ (5,873) $ — $ — Non-U.S. plans with plan assets (1,467) (2,222) — — All other plans (758) (808) (1,251) (1,464) Funded status at end of year $ (4,810) $ (8,903) $ (1,251) $ (1,464) Amounts recognized in the consolidated balance sheets at Dec 31: Deferred charges and other assets $ 1,173 $ 1,007 $ — $ — Accrued and other current liabilities (58) (54) (99) (113) Pension and other postretirement benefits - noncurrent (5,925) (9,856) (1,152) (1,351) Net amount recognized $ (4,810) $ (8,903) $ (1,251) $ (1,464) Pretax amounts recognized in accumulated other comprehensive loss at Dec 31: Net loss (gain) $ 9,934 $ 12,736 $ (221) $ (129) Prior service credit (112) (154) — — Pretax balance in accumulated other comprehensive loss at end of year $ 9,822 $ 12,582 $ (221) $ (129) 1. The 2020 impact relates primarily to the transfer of benefit obligations in the U.S. through the purchase of annuity contracts from an insurance company. 2. The 2021 impact primarily relates to the freeze of pensionable compensation and credited service amounts for employees that participate in the U.S. Plans. The 2020 impact relates to pension plan curtailments of a European plan resulting from the 2020 Restructuring Program and the settlement of certain plan obligations of a U.S. non-qualified pension plan resulting from lump-sum payments. 3. The 2020 impact relates to the purchase of annuity contracts associated with the transfer of benefit obligations to an insurance company. 130

Annual Report Page 139 Page 141

Annual Report Page 139 Page 141