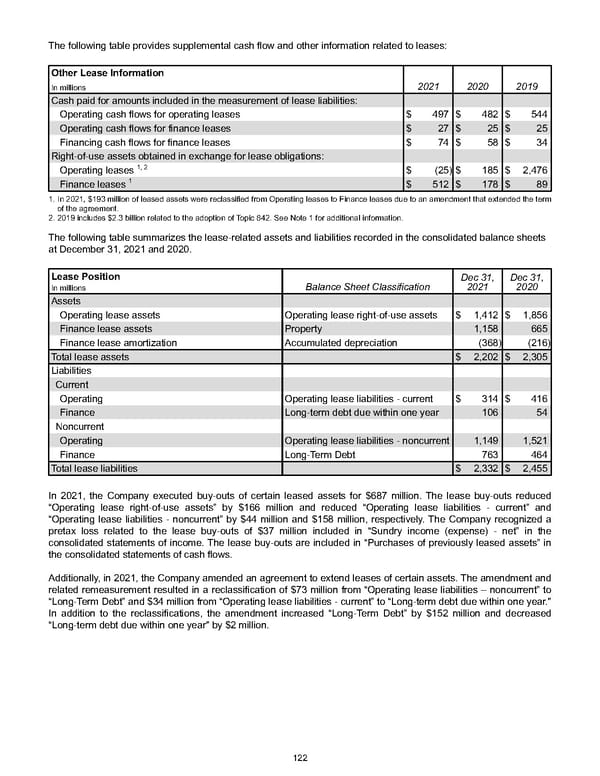

The following table provides supplemental cash flow and other information related to leases: Other Lease Information 2021 2020 2019 In millions Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows for operating leases $ 497 $ 482 $ 544 Operating cash flows for finance leases $ 27 $ 25 $ 25 Financing cash flows for finance leases $ 74 $ 58 $ 34 Right-of-use assets obtained in exchange for lease obligations: Operating leases 1, 2 $ (25) $ 185 $ 2,476 Finance leases 1 $ 512 $ 178 $ 89 1. In 2021, $193 million of leased assets were reclassified from Operating leases to Finance leases due to an amendment that extended the term of the agreement. 2. 2019 includes $2.3 billion related to the adoption of Topic 842. See Note 1 for additional information. The following table summarizes the lease-related assets and liabilities recorded in the consolidated balance sheets at December 31, 2021 and 2020 . Lease Position Balance Sheet Classification Dec 31, 2021 Dec 31, 2020 In millions Assets Operating lease assets Operating lease right-of-use assets $ 1,412 $ 1,856 Finance lease assets Property 1,158 665 Finance lease amortization Accumulated depreciation (368) (216) Total lease assets $ 2,202 $ 2,305 Liabilities Current Operating Operating lease liabilities - current $ 314 $ 416 Finance Long-term debt due within one year 106 54 Noncurrent Operating Operating lease liabilities - noncurrent 1,149 1,521 Finance Long-Term Debt 763 464 Total lease liabilities $ 2,332 $ 2,455 In 2021, the Company executed buy-outs of certain leased assets for $687 million . The lease buy-outs reduced “Operating lease right-of-use assets” by $166 million and reduced “Operating lease liabilities - current” and “Operating lease liabilities - noncurrent” by $44 million and $158 million , respectively. The Company recognized a pretax loss related to the lease buy-outs of $37 million included in “Sundry income (expense) - net” in the consolidated statements of income. The lease buy-outs are included in “Purchases of previously leased assets” in the consolidated statements of cash flows. Additionally, in 2021, the Company amended an agreement to extend leases of certain assets. The amendment and related remeasurement resulted in a reclassification of $73 million from “Operating lease liabilities – noncurrent” to “Long-Term Debt” and $34 million from “Operating lease liabilities - current” to “Long-term debt due within one year." In addition to the reclassifications, the amendment increased “Long-Term Debt” by $152 million and decreased “Long-term debt due within one year" by $2 million . 122

Annual Report Page 131 Page 133

Annual Report Page 131 Page 133