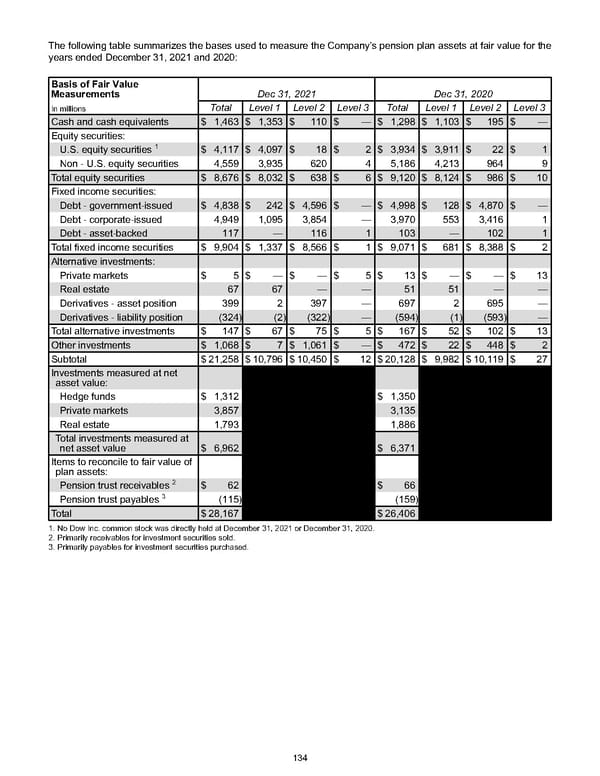

The following table summarizes the bases used to measure the Company’s pension plan assets at fair value for the years ended December 31, 2021 and 2020 : Basis of Fair Value Measurements Dec 31, 2021 Dec 31, 2020 In millions Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Cash and cash equivalents $ 1,463 $ 1,353 $ 110 $ — $ 1,298 $ 1,103 $ 195 $ — Equity securities: U.S. equity securities 1 $ 4,117 $ 4,097 $ 18 $ 2 $ 3,934 $ 3,911 $ 22 $ 1 Non - U.S. equity securities 4,559 3,935 620 4 5,186 4,213 964 9 Total equity securities $ 8,676 $ 8,032 $ 638 $ 6 $ 9,120 $ 8,124 $ 986 $ 10 Fixed income securities: Debt - government-issued $ 4,838 $ 242 $ 4,596 $ — $ 4,998 $ 128 $ 4,870 $ — Debt - corporate-issued 4,949 1,095 3,854 — 3,970 553 3,416 1 Debt - asset-backed 117 — 116 1 103 — 102 1 Total fixed income securities $ 9,904 $ 1,337 $ 8,566 $ 1 $ 9,071 $ 681 $ 8,388 $ 2 Alternative investments: Private markets $ 5 $ — $ — $ 5 $ 13 $ — $ — $ 13 Real estate 67 67 — — 51 51 — — Derivatives - asset position 399 2 397 — 697 2 695 — Derivatives - liability position (324) (2) (322) — (594) (1) (593) — Total alternative investments $ 147 $ 67 $ 75 $ 5 $ 167 $ 52 $ 102 $ 13 Other investments $ 1,068 $ 7 $ 1,061 $ — $ 472 $ 22 $ 448 $ 2 Subtotal $ 21,258 $ 10,796 $ 10,450 $ 12 $ 20,128 $ 9,982 $ 10,119 $ 27 Investments measured at net asset value: Hedge funds $ 1,312 $ 1,350 Private markets 3,857 3,135 Real estate 1,793 1,886 Total investments measured at net asset value $ 6,962 $ 6,371 Items to reconcile to fair value of plan assets: Pension trust receivables 2 $ 62 $ 66 Pension trust payables 3 (115) (159) Total $ 28,167 $ 26,406 1. No Dow Inc. common stock was directly held at December 31, 2021 or December 31, 2020 . 2. Primarily receivables for investment securities sold. 3. Primarily payables for investment securities purchased. 134

Annual Report Page 143 Page 145

Annual Report Page 143 Page 145