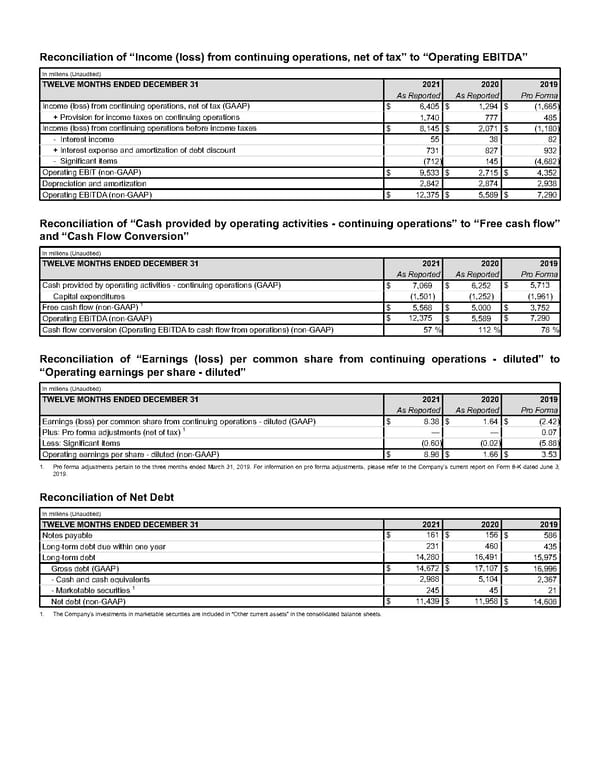

Reconciliation of “Income (loss) from continuing operations, net of tax” to “Operating EBITDA” In millions (Unaudited) TWELVE MONTHS ENDED DECEMBER 31 2021 2020 2019 As Reported As Reported Pro Forma Income (loss) from continuing operations, net of tax (GAAP) $ 6,405 $ 1,294 $ (1,665) + Provision for income taxes on continuing operations 1,740 777 485 Income (loss) from continuing operations before income taxes $ 8,145 $ 2,071 $ (1,180) - Interest income 55 38 82 + Interest expense and amortization of debt discount 731 827 932 - Significant items (712) 145 (4,682) Operating EBIT (non-GAAP) $ 9,533 $ 2,715 $ 4,352 Depreciation and amortization 2,842 2,874 2,938 Operating EBITDA (non-GAAP) $ 12,375 $ 5,589 $ 7,290 Reconciliation of “Cash provided by operating activities - continuing operations” to “Free cash flow” and “Cash Flow Conversion” In millions (Unaudited) TWELVE MONTHS ENDED DECEMBER 31 2021 2020 2019 As Reported As Reported Pro Forma Cash provided by operating activities - continuing operations (GAAP) $ 7,069 $ 6,252 $ 5,713 Capital expenditures (1,501) (1,252) (1,961) Free cash flow (non-GAAP) 1 $ 5,568 $ 5,000 $ 3,752 Operating EBITDA (non-GAAP) $ 12,375 $ 5,589 $ 7,290 Cash flow conversion (Operating EBITDA to cash flow from operations) (non-GAAP) 57 % 112 % 78 % Reconciliation of “Earnings (loss) per common share from continuing operations - diluted” to “Operating earnings per share - diluted” In millions (Unaudited) TWELVE MONTHS ENDED DECEMBER 31 2021 2020 2019 As Reported As Reported Pro Forma Earnings (loss) per common share from continuing operations - diluted (GAAP) $ 8.38 $ 1.64 $ (2.42) Plus: Pro forma adjustments (net of tax) 1 — — 0.07 Less: Significant items (0.60) (0.02) (5.88) Operating earnings per share - diluted (non-GAAP) $ 8.98 $ 1.66 $ 3.53 1. Pro forma adjustments pertain to the three months ended March 31, 2019. For information on pro forma adjustments, please refer to the Company’s current report on Form 8-K dated June 3, 2019. Reconciliation of Net Debt In millions (Unaudited) TWELVE MONTHS ENDED DECEMBER 31 2021 2020 2019 Notes payable $ 161 $ 156 $ 586 Long-term debt due within one year 231 460 435 Long-term debt 14,280 16,491 15,975 Gross debt (GAAP) $ 14,672 $ 17,107 $ 16,996 - Cash and cash equivalents 2,988 5,104 2,367 - Marketable securities 1 245 45 21 Net debt (non-GAAP) $ 11,439 $ 11,958 $ 14,608 1. The Company’s investments in marketable securities are included in “Other current assets” in the consolidated balance sheets.

Annual Report Page 184 Page 186

Annual Report Page 184 Page 186