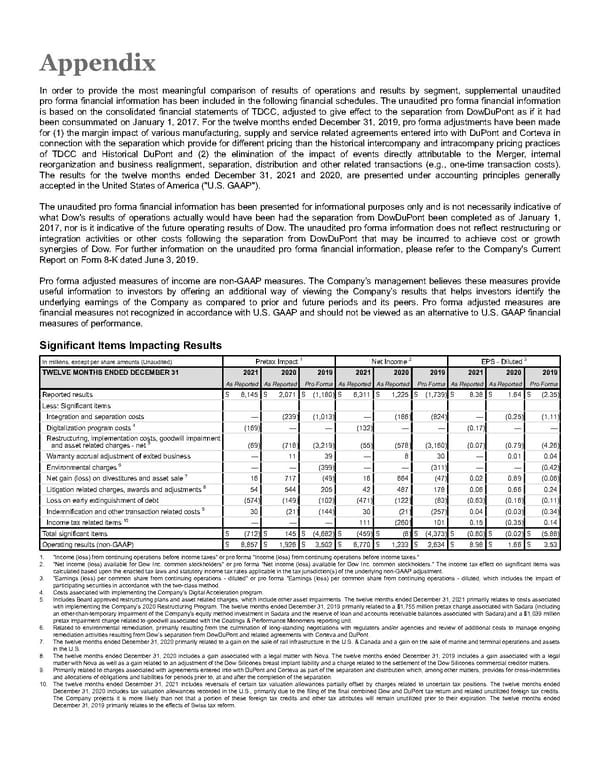

Appendix In order to provide the most meaningful comparison of results of operations and results by segment, supplemental unaudited pro forma financial information has been included in the following financial schedules. The unaudited pro forma financial information is based on the consolidated financial statements of TDCC, adjusted to give effect to the separation from DowDuPont as if it had been consummated on January 1, 2017. For the twelve months ended December 31, 2019, pro forma adjustments have been made for (1) the margin impact of various manufacturing, supply and service related agreements entered into with DuPont and Corteva in connection with the separation which provide for different pricing than the historical intercompany and intracompany pricing practices of TDCC and Historical DuPont and (2) the elimination of the impact of events directly attributable to the Merger, internal reorganization and business realignment, separation, distribution and other related transactions (e.g., one-time transaction costs). The results for the twelve months ended December 31, 2021 and 2020, are presented under accounting principles generally accepted in the United States of America ("U.S. GAAP"). The unaudited pro forma financial information has been presented for informational purposes only and is not necessarily indicative of what Dow's results of operations actually would have been had the separation from DowDuPont been completed as of January 1, 2017, nor is it indicative of the future operating results of Dow. The unaudited pro forma information does not reflect restructuring or integration activities or other costs following the separation from DowDuPont that may be incurred to achieve cost or growth synergies of Dow. For further information on the unaudited pro forma financial information, please refer to the Company's Current Report on Form 8-K dated June 3, 2019. Pro forma adjusted measures of income are non-GAAP measures. The Company’s management believes these measures provide useful information to investors by offering an additional way of viewing the Company’s results that helps investors identify the underlying earnings of the Company as compared to prior and future periods and its peers. Pro forma adjusted measures are financial measures not recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP financial measures of performance. Significant Items Impacting Results In millions, except per share amounts (Unaudited) Pretax Impact 1 Net Income 2 EPS - Diluted 3 TWELVE MONTHS ENDED DECEMBER 31 2021 2020 2019 2021 2020 2019 2021 2020 2019 As Reported As Reported Pro Forma As Reported As Reported Pro Forma As Reported As Reported Pro Forma Reported results $ 8,145 $ 2,071 $ (1,180) $ 6,311 $ 1,225 $ (1,739) $ 8.38 $ 1.64 $ (2.35) Less: Significant items Integration and separation costs — (239) (1,013) — (186) (824) — (0.25) (1.11) Digitalization program costs 4 (169) — — (132) — — (0.17) — — Restructuring, implementation costs, goodwill impairment and asset related charges - net 5 (69) (718) (3,219) (55) (578) (3,160) (0.07) (0.79) (4.26) Warranty accrual adjustment of exited business — 11 39 — 8 30 — 0.01 0.04 Environmental charges 6 — — (399) — — (311) — — (0.42) Net gain (loss) on divestitures and asset sale 7 16 717 (49) 16 664 (47) 0.02 0.89 (0.06) Litigation related charges, awards and adjustments 8 54 544 205 42 487 178 0.06 0.66 0.24 Loss on early extinguishment of debt (574) (149) (102) (471) (122) (83) (0.63) (0.16) (0.11) Indemnification and other transaction related costs 9 30 (21) (144) 30 (21) (257) 0.04 (0.03) (0.34) Income tax related items 10 — — — 111 (260) 101 0.15 (0.35) 0.14 Total significant items $ (712) $ 145 $ (4,682) $ (459) $ (8) $ (4,373) $ (0.60) $ (0.02) $ (5.88) Operating results (non-GAAP) $ 8,857 $ 1,926 $ 3,502 $ 6,770 $ 1,233 $ 2,634 $ 8.98 $ 1.66 $ 3.53 1. "Income (loss) from continuing operations before income taxes" or pro forma "Income (loss) from continuing operations before income taxes." 2. "Net income (loss) available for Dow Inc. common stockholders" or pro forma "Net income (loss) available for Dow Inc. common stockholders." The income tax effect on significant items was calculated based upon the enacted tax laws and statutory income tax rates applicable in the tax jurisdiction(s) of the underlying non-GAAP adjustment. 3. "Earnings (loss) per common share from continuing operations - diluted" or pro forma "Earnings (loss) per common share from continuing operations - diluted, which includes the impact of participating securities in accordance with the two-class method. 4. Costs associated with implementing the Company's Digital Acceleration program. 5. Includes Board approved restructuring plans and asset related charges, which include other asset impairments. The twelve months ended December 31, 2021 primarily relates to costs associated with implementing the Company’s 2020 Restructuring Program. The twelve months ended December 31, 2019 primarily related to a $1,755 million pretax charge associated with Sadara (including an other-than-temporary impairment of the Company's equity method investment in Sadara and the reserve of loan and accounts receivable balances associated with Sadara) and a $1,039 million pretax impairment charge related to goodwill associated with the Coatings & Performance Monomers reporting unit. 6. Related to environmental remediation, primarily resulting from the culmination of long-standing negotiations with regulators and/or agencies and review of additional costs to manage ongoing remediation activities resulting from Dow’s separation from DowDuPont and related agreements with Corteva and DuPont. 7. The twelve months ended December 31, 2020 primarily related to a gain on the sale of rail infrastructure in the U.S. & Canada and a gain on the sale of marine and terminal operations and assets in the U.S. 8. The twelve months ended December 31, 2020 includes a gain associated with a legal matter with Nova. The twelve months ended December 31, 2019 includes a gain associated with a legal matter with Nova as well as a gain related to an adjustment of the Dow Silicones breast implant liability and a charge related to the settlement of the Dow Silicones commercial creditor matters. 9. Primarily related to charges associated with agreements entered into with DuPont and Corteva as part of the separation and distribution which, among other matters, provides for cross-indemnities and allocations of obligations and liabilities for periods prior to, at and after the completion of the separation. 10. The twelve months ended December 31, 2021 includes reversals of certain tax valuation allowances partially offset by charges related to uncertain tax positions. The twelve months ended December 31, 2020 includes tax valuation allowances recorded in the U.S., primarily due to the filing of the final combined Dow and DuPont tax return and related unutilized foreign tax credits. The Company projects it is more likely than not that a portion of these foreign tax credits and other tax attributes will remain unutilized prior to their expiration. The twelve months ended December 31, 2019 primarily relates to the effects of Swiss tax reform.

Annual Report Page 183 Page 185

Annual Report Page 183 Page 185