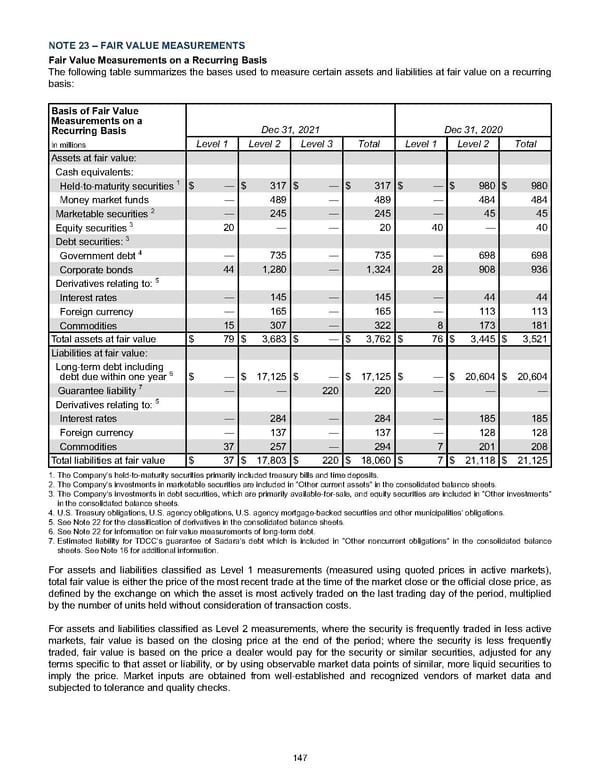

NOTE 23 – FAIR VALUE MEASUREMENTS Fair Value Measurements on a Recurring Basis The following table summarizes the bases used to measure certain assets and liabilities at fair value on a recurring basis: Basis of Fair Value Measurements on a Recurring Basis Dec 31, 2021 Dec 31, 2020 In millions Level 1 Level 2 Level 3 Total Level 1 Level 2 Total Assets at fair value: Cash equivalents: Held-to-maturity securities 1 $ — $ 317 $ — $ 317 $ — $ 980 $ 980 Money market funds — 489 — 489 — 484 484 Marketable securities 2 — 245 — 245 — 45 45 Equity securities 3 20 — — 20 40 — 40 Debt securities: 3 Government debt 4 — 735 — 735 — 698 698 Corporate bonds 44 1,280 — 1,324 28 908 936 Derivatives relating to: 5 Interest rates — 145 — 145 — 44 44 Foreign currency — 165 — 165 — 113 113 Commodities 15 307 — 322 8 173 181 Total assets at fair value $ 79 $ 3,683 $ — $ 3,762 $ 76 $ 3,445 $ 3,521 Liabilities at fair value: Long-term debt including debt due within one year 6 $ — $ 17,125 $ — $ 17,125 $ — $ 20,604 $ 20,604 Guarantee liability 7 — — 220 220 — — — Derivatives relating to: 5 Interest rates — 284 — 284 — 185 185 Foreign currency — 137 — 137 — 128 128 Commodities 37 257 — 294 7 201 208 Total liabilities at fair value $ 37 $ 17,803 $ 220 $ 18,060 $ 7 $ 21,118 $ 21,125 1. The Company's held-to-maturity securities primarily included treasury bills and time deposits. 2. The Company's investments in marketable securities are included in "Other current assets" in the consolidated balance sheets. 3. The Company's investments in debt securities, which are primarily available-for-sale, and equity securities are included in "Other investments" in the consolidated balance sheets. 4. U.S. Treasury obligations, U.S. agency obligations, U.S. agency mortgage-backed securities and other municipalities' obligations. 5. See Note 22 for the classification of derivatives in the consolidated balance sheets. 6. See Note 22 for information on fair value measurements of long-term debt. 7. Estimated liability for TDCC's guarantee of Sadara's debt which is included in "Other noncurrent obligations" in the consolidated balance sheets. See Note 16 for additional information. For assets and liabilities classified as Level 1 measurements (measured using quoted prices in active markets), total fair value is either the price of the most recent trade at the time of the market close or the official close price, as defined by the exchange on which the asset is most actively traded on the last trading day of the period, multiplied by the number of units held without consideration of transaction costs. For assets and liabilities classified as Level 2 measurements, where the security is frequently traded in less active markets, fair value is based on the closing price at the end of the period; where the security is less frequently traded, fair value is based on the price a dealer would pay for the security or similar securities, adjusted for any terms specific to that asset or liability, or by using observable market data points of similar, more liquid securities to imply the price. Market inputs are obtained from well-established and recognized vendors of market data and subjected to tolerance and quality checks. 147

Annual Report Page 156 Page 158

Annual Report Page 156 Page 158