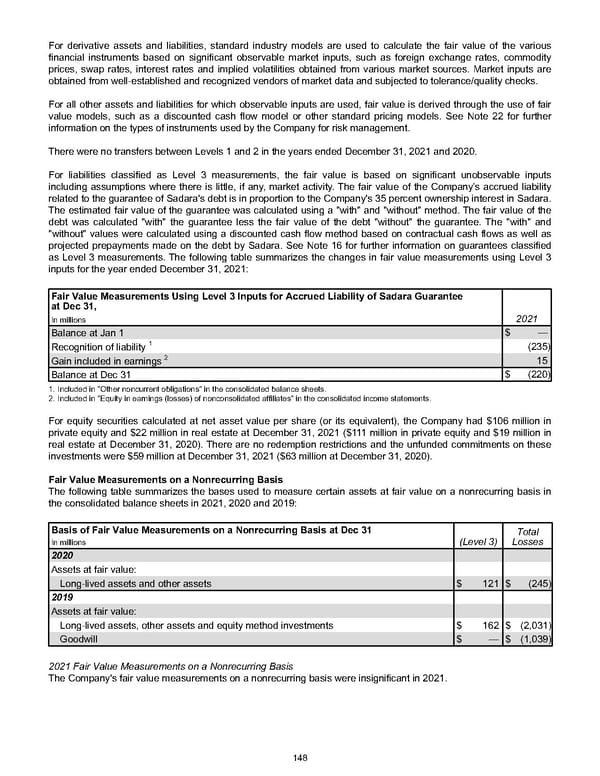

For derivative assets and liabilities, standard industry models are used to calculate the fair value of the various financial instruments based on significant observable market inputs, such as foreign exchange rates, commodity prices, swap rates, interest rates and implied volatilities obtained from various market sources. Market inputs are obtained from well-established and recognized vendors of market data and subjected to tolerance/quality checks. For all other assets and liabilities for which observable inputs are used, fair value is derived through the use of fair value models, such as a discounted cash flow model or other standard pricing models. See Note 22 for further information on the types of instruments used by the Company for risk management. There were no transfers between Levels 1 and 2 in the years ended December 31, 2021 and 2020 . For liabilities classified as Level 3 measurements, the fair value is based on significant unobservable inputs including assumptions where there is little, if any, market activity. The fair value of the Company’s accrued liability related to the guarantee of Sadara's debt is in proportion to the Company's 35 percent ownership interest in Sadara. The estimated fair value of the guarantee was calculated using a "with" and "without" method. The fair value of the debt was calculated "with" the guarantee less the fair value of the debt "without" the guarantee. The "with" and "without" values were calculated using a discounted cash flow method based on contractual cash flows as well as projected prepayments made on the debt by Sadara. See Note 16 for further information on guarantees classified as Level 3 measurements. The following table summarizes the changes in fair value measurements using Level 3 inputs for the year ended December 31, 20 21: Fair Value Measurements Using Level 3 Inputs for Accrued Liability of Sadara Guarantee at Dec 31, 2021 In millions Balance at Jan 1 $ — Recognition of liability 1 (235) Gain included in earnings 2 15 Balance at Dec 31 $ (220) 1. Included in " Other noncurrent obligations" in the consolidated balance sheets. 2. Included in "Equity in earnings (losses) of nonconsolidated affiliates" in the consolidated income statements. For equity securities calculated at net asset value per share (or its equivalent), the Company had $106 million in private equity and $22 million in real estate at December 31, 2021 ( $111 million in private equity and $19 million in real estate at December 31, 2020 ). There are no redemption restrictions and the unfunded commitments on these investments were $59 million at December 31, 2021 ( $63 million at December 31, 2020 ). Fair Value Measurements on a Nonrecurring Basis The following table summarizes the bases used to measure certain assets at fair value on a nonrecurring basis in the consolidated balance sheets in 2021 , 2020 and 2019 : Basis of Fair Value Measurements on a Nonrecurring Basis at Dec 31 (Level 3) Total Losses In millions 2020 Assets at fair value: Long-lived assets and other assets $ 121 $ (245) 2019 Assets at fair value: Long-lived assets, other assets and equity method investments $ 162 $ (2,031) Goodwill $ — $ (1,039) 2021 Fair Value Measurements on a Nonrecurring Basis The Company's fair value measurements on a nonrecurring basis were insignificant in 2021. 148

Annual Report Page 157 Page 159

Annual Report Page 157 Page 159