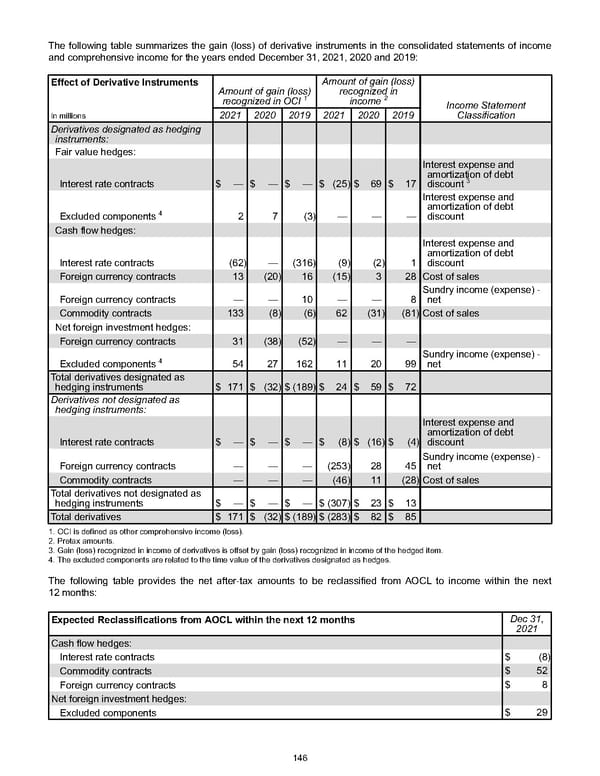

The following table summarizes the gain (loss) of derivative instruments in the consolidated statements of income and comprehensive income for the years ended December 31, 2021 , 2020 and 2019 : Effect of Derivative Instruments Amount of gain (loss) recognized in OCI 1 Amount of gain (loss) recognized in income 2 Income Statement Classification In millions 2021 2020 2019 2021 2020 2019 Derivatives designated as hedging instruments: Fair value hedges: Interest rate contracts $ — $ — $ — $ (25) $ 69 $ 17 Interest expense and amortization of debt discount 3 Excluded components 4 2 7 (3) — — — Interest expense and amortization of debt discount Cash flow hedges: Interest rate contracts (62) — (316) (9) (2) 1 Interest expense and amortization of debt discount Foreign currency contracts 13 (20) 16 (15) 3 28 Cost of sales Foreign currency contracts — — 10 — — 8 Sundry income (expense) - net Commodity contracts 133 (8) (6) 62 (31) (81) Cost of sales Net foreign investment hedges: Foreign currency contracts 31 (38) (52) — — — Excluded components 4 54 27 162 11 20 99 Sundry income (expense) - net Total derivatives designated as hedging instruments $ 171 $ (32) $ (189) $ 24 $ 59 $ 72 Derivatives not designated as hedging instruments: Interest rate contracts $ — $ — $ — $ (8) $ (16) $ (4) Interest expense and amortization of debt discount Foreign currency contracts — — — (253) 28 45 Sundry income (expense) - net Commodity contracts — — — (46) 11 (28) Cost of sales Total derivatives not designated as hedging instruments $ — $ — $ — $ (307) $ 23 $ 13 Total derivatives $ 171 $ (32) $ (189) $ (283) $ 82 $ 85 1. OCI is defined as other comprehensive income (loss). 2. Pretax amounts. 3. Gain (loss) recognized in income of derivatives is offset by gain (loss) recognized in income of the hedged item. 4. The excluded components are related to the time value of the derivatives designated as hedges. The following table provides the net after-tax amounts to be reclassified from AOCL to income within the next 12 months: Expected Reclassifications from AOCL within the next 12 months Dec 31, 2021 Cash flow hedges: Interest rate contracts $ (8) Commodity contracts $ 52 Foreign currency contracts $ 8 Net foreign investment hedges: Excluded components $ 29 146

Annual Report Page 155 Page 157

Annual Report Page 155 Page 157