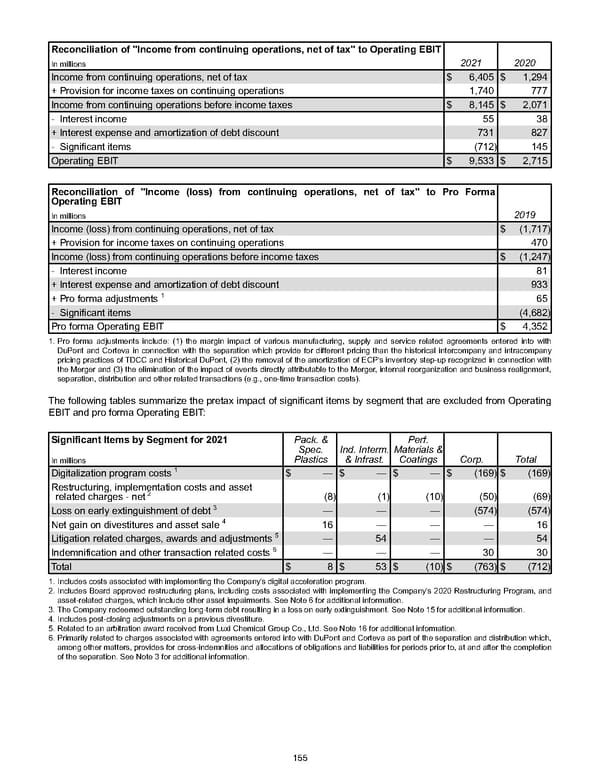

Reconciliation of "Income from continuing operations, net of tax" to Operating EBIT 2021 2020 In millions Income from continuing operations, net of tax $ 6,405 $ 1,294 + Provision for income taxes on continuing operations 1,740 777 Income from continuing operations before income taxes $ 8,145 $ 2,071 - Interest income 55 38 + Interest expense and amortization of debt discount 731 827 - Significant items (712) 145 Operating EBIT $ 9,533 $ 2,715 Reconciliation of "Income (loss) from continuing operations, net of tax" to Pro Forma Operating EBIT 2019 In millions Income (loss) from continuing operations, net of tax $ (1,717) + Provision for income taxes on continuing operations 470 Income (loss) from continuing operations before income taxes $ (1,247) - Interest income 81 + Interest expense and amortization of debt discount 933 + Pro forma adjustments 1 65 - Significant items (4,682) Pro forma Operating EBIT $ 4,352 1. Pro forma adjustments include: (1) the margin impact of various manufacturing, supply and service related agreements entered into with DuPont and Corteva in connection with the separation which provide for different pricing than the historical intercompany and intracompany pricing practices of TDCC and Historical DuPont, (2) the removal of the amortization of ECP's inventory step-up recognized in connection with the Merger and (3) the elimination of the impact of events directly attributable to the Merger, internal reorganization and business realignment, separation, distribution and other related transactions (e.g., one-time transaction costs). The following tables summarize the pretax impact of significant items by segment that are excluded from Operating EBIT and pro forma Operating EBIT: Significant Items by Segment for 2021 Pack. & Spec. Plastics Ind. Interm. & Infrast. Perf. Materials & Coatings Corp. Total In millions Digitalization program costs 1 $ — $ — $ — $ (169) $ (169) Restructuring, implementation costs and asset related charges - net 2 (8) (1) (10) (50) (69) Loss on early extinguishment of debt 3 — — — (574) (574) Net gain on divestitures and asset sale 4 16 — — — 16 Litigation related charges, awards and adjustments 5 — 54 — — 54 Indemnification and other transaction related costs 6 — — — 30 30 Total $ 8 $ 53 $ (10) $ (763) $ (712) 1. Includes costs associated with implementing the Company's digital acceleration program. 2. Includes Board approved restructuring plans, including costs associated with implementing the Company's 2020 Restructuring Program, and asset-related charges, which include other asset impairments. See Note 6 for additional information. 3. The Company redeemed outstanding long-term debt resulting in a loss on early extinguishment. See Note 15 for additional information. 4. Includes post-closing adjustments on a previous divestiture. 5. Related to an arbitration award received from Luxi Chemical Group Co., Ltd. See Note 16 for additional information. 6. Primarily related to charges associated with agreements entered into with DuPont and Corteva as part of the separation and distribution which, among other matters, provides for cross-indemnities and allocations of obligations and liabilities for periods prior to, at and after the completion of the separation. See Note 3 for additional information. 155

Annual Report Page 164 Page 166

Annual Report Page 164 Page 166