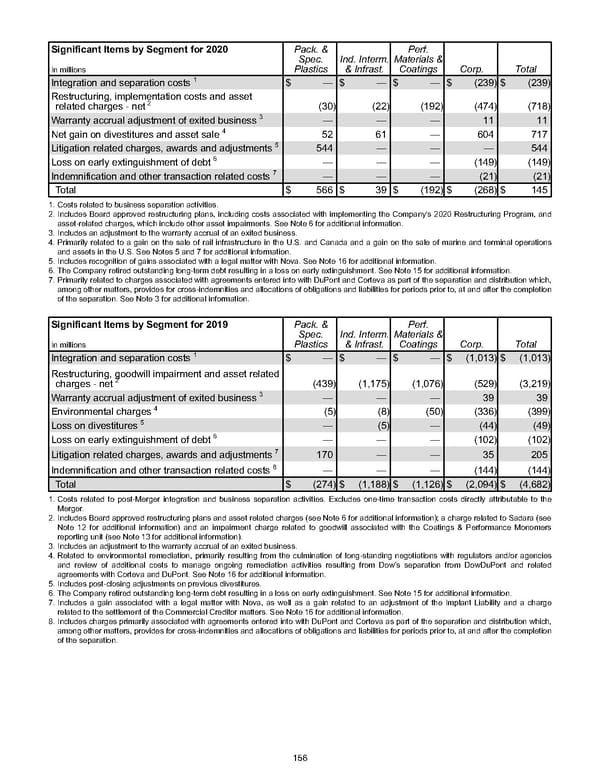

Significant Items by Segment for 2020 Pack. & Spec. Plastics Ind. Interm. & Infrast. Perf. Materials & Coatings Corp. Total In millions Integration and separation costs 1 $ — $ — $ — $ (239) $ (239) Restructuring, implementation costs and asset related charges - net 2 (30) (22) (192) (474) (718) Warranty accrual adjustment of exited business 3 — — — 11 11 Net gain on divestitures and asset sale 4 52 61 — 604 717 Litigation related charges, awards and adjustments 5 544 — — — 544 Loss on early extinguishment of debt 6 — — — (149) (149) Indemnification and other transaction related costs 7 — — — (21) (21) Total $ 566 $ 39 $ (192) $ (268) $ 145 1. Costs related to business separation activities. 2. Includes Board approved restructuring plans, including costs associated with implementing the Company's 2020 Restructuring Program, and asset-related charges, which include other asset impairments. See Note 6 for additional information. 3. Includes an adjustment to the warranty accrual of an exited business. 4. Primarily related to a gain on the sale of rail infrastructure in the U.S. and Canada and a gain on the sale of marine and terminal operations and assets in the U.S. See Notes 5 and 7 for additional information. 5. Includes recognition of gains associated with a legal matter with Nova. See Note 16 for additional information. 6. The Company retired outstanding long-term debt resulting in a loss on early extinguishment. See Note 15 for additional information. 7. Primarily related to charges associated with agreements entered into with DuPont and Corteva as part of the separation and distribution which, among other matters, provides for cross-indemnities and allocations of obligations and liabilities for periods prior to, at and after the completion of the separation. See Note 3 for additional information. Significant Items by Segment for 2019 Pack. & Spec. Plastics Ind. Interm. & Infrast. Perf. Materials & Coatings Corp. Total In millions Integration and separation costs 1 $ — $ — $ — $ (1,013) $ (1,013) Restructuring, goodwill impairment and asset related charges - net 2 (439) (1,175) (1,076) (529) (3,219) Warranty accrual adjustment of exited business 3 — — — 39 39 Environmental charges 4 (5) (8) (50) (336) (399) Loss on divestitures 5 — (5) — (44) (49) Loss on early extinguishment of debt 6 — — — (102) (102) Litigation related charges, awards and adjustments 7 170 — — 35 205 Indemnification and other transaction related costs 8 — — — (144) (144) Total $ (274) $ (1,188) $ (1,126) $ (2,094) $ (4,682) 1. Costs related to post-Merger integration and business separation activities. Excludes one-time transaction costs directly attributable to the Merger. 2. Includes Board approved restructuring plans and asset related charges (see Note 6 for additional information); a charge related to Sadara (see Note 12 for additional information) and an impairment charge related to goodwill associated with the Coatings & Performance Monomers reporting unit (see Note 13 for additional information). 3. Includes an adjustment to the warranty accrual of an exited business. 4. Related to environmental remediation, primarily resulting from the culmination of long-standing negotiations with regulators and/or agencies and review of additional costs to manage ongoing remediation activities resulting from Dow’s separation from DowDuPont and related agreements with Corteva and DuPont. See Note 16 for additional information. 5. Includes post-closing adjustments on previous divestitures. 6. The Company retired outstanding long-term debt resulting in a loss on early extinguishment. See Note 15 for additional information. 7. Includes a gain associated with a legal matter with Nova, as well as a gain related to an adjustment of the Implant Liability and a charge related to the settlement of the Commercial Creditor matters. See Note 16 for additional information. 8. Includes charges primarily associated with agreements entered into with DuPont and Corteva as part of the separation and distribution which, among other matters, provides for cross-indemnities and allocations of obligations and liabilities for periods prior to, at and after the completion of the separation. 156

Annual Report Page 165 Page 167

Annual Report Page 165 Page 167