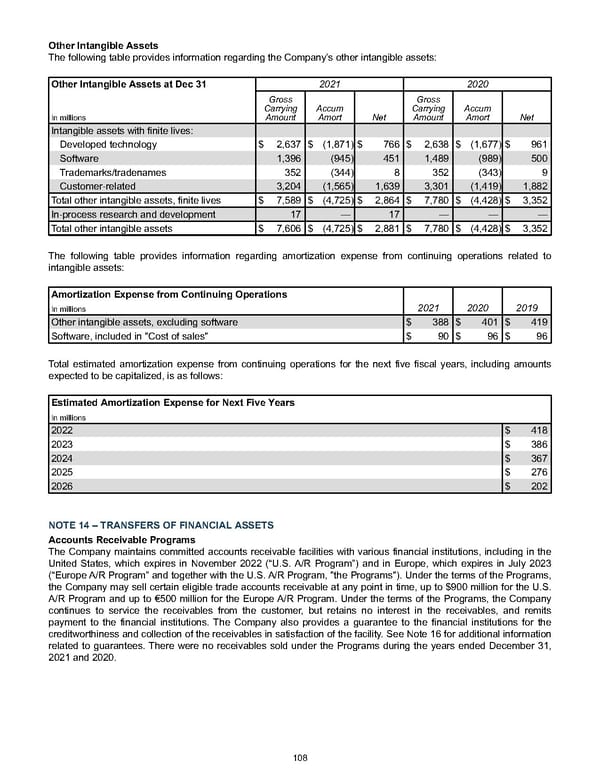

Other Intangible Assets The following table provides information regarding the Company’s other intangible assets: Other Intangible Assets at Dec 31 2021 2020 In millions Gross Carrying Amount Accum Amort Net Gross Carrying Amount Accum Amort Net Intangible assets with finite lives: Developed technology $ 2,637 $ (1,871) $ 766 $ 2,638 $ (1,677) $ 961 Software 1,396 (945) 451 1,489 (989) 500 Trademarks/tradenames 352 (344) 8 352 (343) 9 Customer-related 3,204 (1,565) 1,639 3,301 (1,419) 1,882 Total other intangible assets, finite lives $ 7,589 $ (4,725) $ 2,864 $ 7,780 $ (4,428) $ 3,352 In-process research and development 17 — 17 — — — Total other intangible assets $ 7,606 $ (4,725) $ 2,881 $ 7,780 $ (4,428) $ 3,352 The following table provides information regarding amortization expense from continuing operations related to intangible assets: Amortization Expense from Continuing Operations 2021 2020 2019 In millions Other intangible assets, excluding software $ 388 $ 401 $ 419 Software, included in "Cost of sales" $ 90 $ 96 $ 96 Total estimated amortization expense from continuing operations for the next five fiscal years, including amounts expected to be capitalized, is as follow s : Estimated Amortization Expense for Next Five Years In millions 2022 $ 418 2023 $ 386 2024 $ 367 2025 $ 276 2026 $ 202 NOTE 14 – TRANSFERS OF FINANCIAL ASSETS Accounts Receivable Programs The Company maintains committed accounts receivable facilities with various financial institutions, including in the United States, which expires in November 2022 (“U.S. A/R Program”) and in Europe, which expires in July 2023 (“Europe A/R Program” and together with the U.S. A/R Program, "the Programs"). Under the terms of the Programs, the Company may sell certain eligible trade accounts receivable at any point in time, up to $900 million for the U.S. A/R Program and up to €500 million for the Europe A/R Program. Under the terms of the Programs, the Company continues to service the receivables from the customer, but retains no interest in the receivables, and remits payment to the financial institutions. The Company also provides a guarantee to the financial institutions for the creditworthiness and collection of the receivables in satisfaction of the facility. See Note 16 for additional information related to guarantees. There were no receivables sold under the Programs during the years ended December 31, 2021 and 2020 . 108

Annual Report Page 117 Page 119

Annual Report Page 117 Page 119