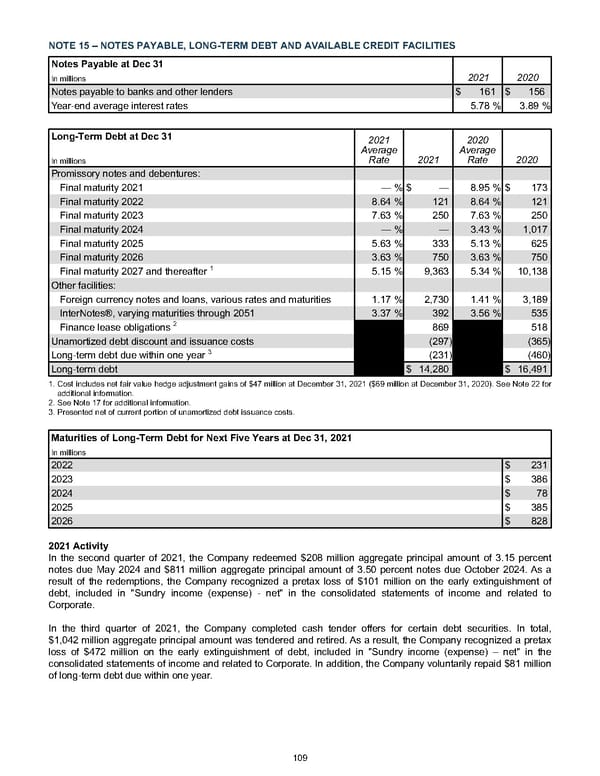

NOTE 15 – NOTES PAYABLE, LONG-TERM DEBT AND AVAILABLE CREDIT FACILITIES Notes Payable at Dec 31 In millions 2021 2020 Notes payable to banks and other lenders $ 161 $ 156 Year-end average interest rates 5.78 % 3.89 % Long-Term Debt at Dec 31 2021 Average Rate 2021 2020 Average Rate 2020 In millions Promissory notes and debentures: Final maturity 2021 — % $ — 8.95 % $ 173 Final maturity 2022 8.64 % 121 8.64 % 121 Final maturity 2023 7.63 % 250 7.63 % 250 Final maturity 2024 — % — 3.43 % 1,017 Final maturity 2025 5.63 % 333 5.13 % 625 Final maturity 2026 3.63 % 750 3.63 % 750 Final maturity 2027 and thereafter 1 5.15 % 9,363 5.34 % 10,138 Other facilities: Foreign currency notes and loans, various rates and maturities 1.17 % 2,730 1.41 % 3,189 InterNotes®, varying maturities through 2051 3.37 % 392 3.56 % 535 Finance lease obligations 2 869 518 Unamortized debt discount and issuance costs (297) (365) Long-term debt due within one year 3 (231) (460) Long-term debt $ 14,280 $ 16,491 1. Cost includes net fair value hedge adjustment gains of $47 million at December 31, 2021 ( $69 million at December 31, 2020 ). See Note 22 for additional information. 2. See Note 17 for additional information. 3. Presented net of current portion of unamortized debt issuance costs. Maturities of Long-Term Debt for Next Five Years at Dec 31, 2021 In millions 2022 $ 231 2023 $ 386 2024 $ 78 2025 $ 385 2026 $ 828 2021 Activity In the second quarter of 2021, the Company redeemed $208 million aggregate principal amount of 3.15 percent notes due May 2024 and $811 million aggregate principal amount of 3.50 percent notes due October 2024. As a result of the redemptions, the Company recognized a pretax loss of $101 million on the early extinguishment of debt, included in "Sundry income (expense) - net" in the consolidated statements of income and related to Corporate. In the third quarter of 2021, the Company completed cash tender offers for certain debt securities. In total, $1,042 million aggregate principal amount was tendered and retired. As a result, the Company recognized a pretax loss of $472 million on the early extinguishment of debt, included in "Sundry income (expense) – net" in the consolidated statements of income and related to Corporate. In addition, the Company voluntarily repaid $81 million of long-term debt due within one year. 109

Annual Report Page 118 Page 120

Annual Report Page 118 Page 120