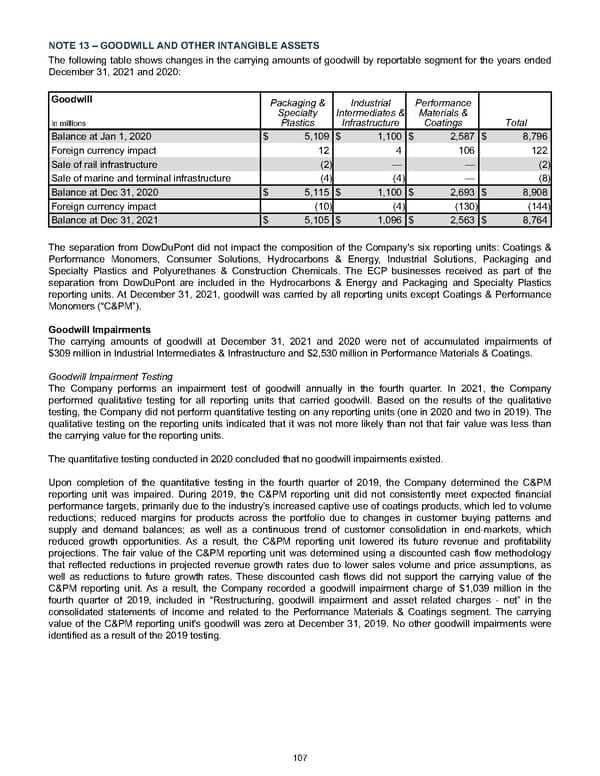

NOTE 13 – GOODWILL AND OTHER INTANGIBLE ASSETS The following table shows changes in the carrying amounts of goodwill by reportable segment for the years ended December 31, 2021 and 2020 : Goodwill Packaging & Specialty Plastics Industrial Intermediates & Infrastructure Performance Materials & Coatings Total In millions Balance at Jan 1, 2020 $ 5,109 $ 1,100 $ 2,587 $ 8,796 Foreign currency impact 12 4 106 122 Sale of rail infrastructure (2) — — (2) Sale of marine and terminal infrastructure (4) (4) — (8) Balance at Dec 31, 2020 $ 5,115 $ 1,100 $ 2,693 $ 8,908 Foreign currency impact (10) (4) (130) (144) Balance at Dec 31, 2021 $ 5,105 $ 1,096 $ 2,563 $ 8,764 The separation from DowDuPont did not impact the composition of the Company's six reporting units: Coatings & Performance Monomers, Consumer Solutions, Hydrocarbons & Energy, Industrial Solutions, Packaging and Specialty Plastics and Polyurethanes & Construction Chemicals. The ECP businesses received as part of the separation from DowDuPont are included in the Hydrocarbons & Energy and Packaging and Specialty Plastics reporting units. At December 31, 2021 , goodwill was carried by all reporting units except Coatings & Performance Monomers (“C&PM”). Goodwill Impairments The carrying amounts of goodwill at December 31, 2021 and 2020 were net of accumulated impairments of $309 million in Industrial Intermediates & Infrastructure and $2,530 million in Performance Materials & Coatings. Goodwill Impairment Testing The Company performs an impairment test of goodwill annually in the fourth quarter. In 2021 , the Company performed qualitative testing for all reporting units that carried goodwill. Based on the results of the qualitative testing, the Company did not perform quantitative testing on any reporting units ( one in 2020 and two in 2019). The qualitative testing on the reporting units indicated that it was not more likely than not that fair value was less than the carrying value for the reporting units. The quantitative testing conducted in 2020 concluded that no goodwill impairments existed. Upon completion of the quantitative testing in the fourth quarter of 2019, the Company determined the C&PM reporting unit was impaired. During 2019, the C&PM reporting unit did not consistently meet expected financial performance targets, primarily due to the industry’s increased captive use of coatings products, which led to volume reductions; reduced margins for products across the portfolio due to changes in customer buying patterns and supply and demand balances; as well as a continuous trend of customer consolidation in end-markets, which reduced growth opportunities. As a result, the C&PM reporting unit lowered its future revenue and profitability projections. The fair value of the C&PM reporting unit was determined using a discounted cash flow methodology that reflected reductions in projected revenue growth rates due to lower sales volume and price assumptions, as well as reductions to future growth rates. These discounted cash flows did not support the carrying value of the C&PM reporting unit. As a result, the Company recorded a goodwill impairment charge of $1,039 million in the fourth quarter of 2019, included in “Restructuring, goodwill impairment and asset related charges - net” in the consolidated statements of income and related to the Performance Materials & Coatings segment. The carrying value of the C&PM reporting unit's goodwill was zero at December 31, 2019. No other goodwill impairments were identified as a result of the 2019 testing. 107

Annual Report Page 116 Page 118

Annual Report Page 116 Page 118