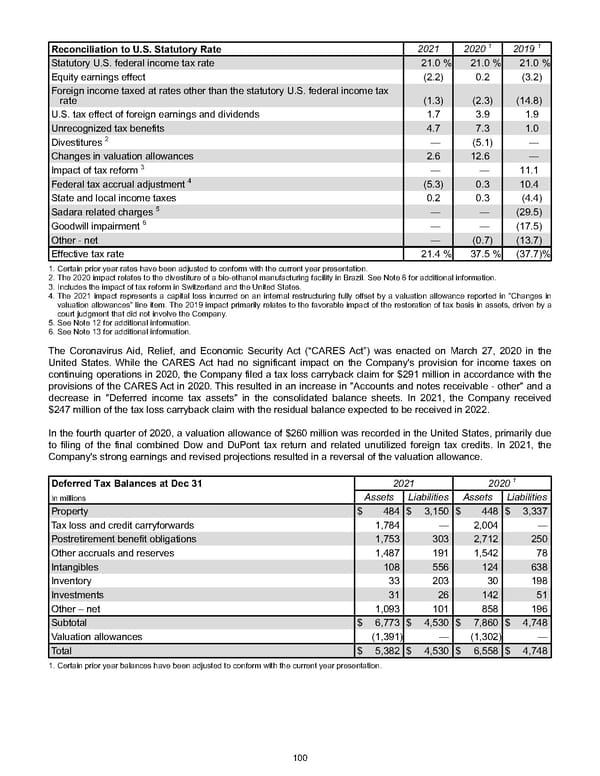

Reconciliation to U.S. Statutory Rate 2021 2020 1 2019 1 Statutory U.S. federal income tax rate 21.0 % 21.0 % 21.0 % Equity earnings effect (2.2) 0.2 (3.2) Foreign income taxed at rates other than the statutory U.S. federal income tax rate (1.3) (2.3) (14.8) U.S. tax effect of foreign earnings and dividends 1.7 3.9 1.9 Unrecognized tax benefits 4.7 7.3 1.0 Divestitures 2 — (5.1) — Changes in valuation allowances 2.6 12.6 — Impact of tax reform 3 — — 11.1 Federal tax accrual adjustment 4 (5.3) 0.3 10.4 State and local income taxes 0.2 0.3 (4.4) Sadara related charges 5 — — (29.5) Goodwill impairment 6 — — (17.5) Other - net — (0.7) (13.7) Effective tax rate 21.4 % 37.5 % (37.7) % 1. Certain prior year rates have been adjusted to conform with the current year presentation. 2. The 2020 impact relates to the divestiture of a bio-ethanol manufacturing facility in Brazil. See Note 6 for additional information. 3. Includes the impact of tax reform in Switzerland and the United States. 4. The 2021 impact represents a capital loss incurred on an internal restructuring fully offset by a valuation allowance reported in "Changes in valuation allowances" line item. The 2019 impact primarily relates to the favorable impact of the restoration of tax basis in assets, driven by a court judgment that did not involve the Company. 5. See Note 12 for additional information. 6. See Note 13 for additional information. The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was enacted on March 27, 2020 in the United States. While the CARES Act had no significant impact on the Company's provision for income taxes on continuing operations in 2020, the Company filed a tax loss carryback claim for $291 million in accordance with the provisions of the CARES Act in 2020. This resulted in an increase in "Accounts and notes receivable - other" and a decrease in "Deferred income tax assets" in the consolidated balance sheets. In 2021, the Company received $247 million of the tax loss carryback claim with the residual balance expected to be received in 2022. In the fourth quarter of 2020 , a valuation allowance of $260 million was recorded in the United States, primarily due to filing of the final combined Dow and DuPont tax return and related unutilized foreign tax credits. In 2021, the Company's strong earnings and revised projections resulted in a reversal of the valuation allowance. Deferred Tax Balances at Dec 31 2021 2020 1 In millions Assets Liabilities Assets Liabilities Property $ 484 $ 3,150 $ 448 $ 3,337 Tax loss and credit carryforwards 1,784 — 2,004 — Postretirement benefit obligations 1,753 303 2,712 250 Other accruals and reserves 1,487 191 1,542 78 Intangibles 108 556 124 638 Inventory 33 203 30 198 Investments 31 26 142 51 Other – net 1,093 101 858 196 Subtotal $ 6,773 $ 4,530 $ 7,860 $ 4,748 Valuation allowances (1,391) — (1,302) — Total $ 5,382 $ 4,530 $ 6,558 $ 4,748 1. Certain prior year balances have been adjusted to conform with the current year presentation. 100

Annual Report Page 109 Page 111

Annual Report Page 109 Page 111