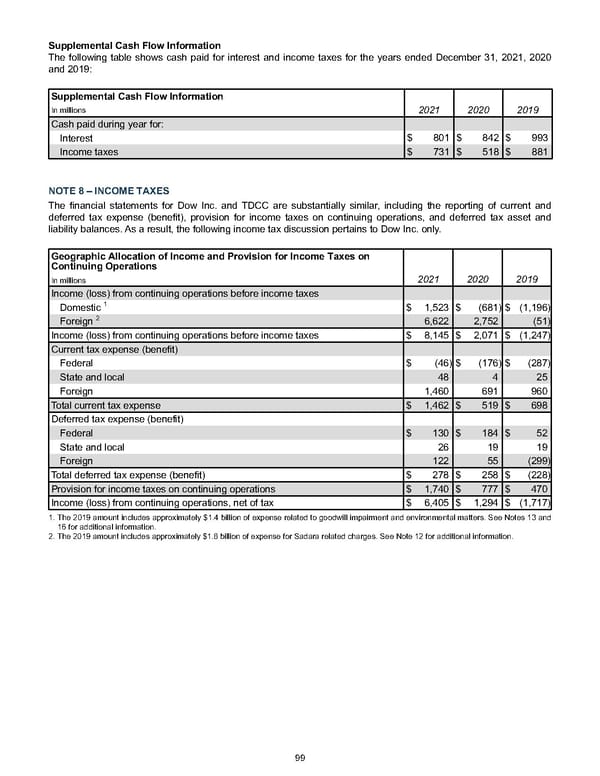

Supplemental Cash Flow Information The following table shows cash paid for interest and income taxes for the years ended December 31, 2021 , 2020 and 2019 : Supplemental Cash Flow Information 2021 2020 2019 In millions Cash paid during year for: Interest $ 801 $ 842 $ 993 Income taxes $ 731 $ 518 $ 881 NOTE 8 – INCOME TAXES The financial statements for Dow Inc. and TDCC are substantially similar, including the reporting of current and deferred tax expense (benefit), provision for income taxes on continuing operations, and deferred tax asset and liability balances. As a result, the following income tax discussion pertains to Dow Inc. only. Geographic Allocation of Income and Provision for Income Taxes on Continuing Operations In millions 2021 2020 2019 Income (loss) from continuing operations before income taxes Domestic 1 $ 1,523 $ (681) $ (1,196) Foreign 2 6,622 2,752 (51) Income (loss) from continuing operations before income taxes $ 8,145 $ 2,071 $ (1,247) Current tax expense (benefit) Federal $ (46) $ (176) $ (287) State and local 48 4 25 Foreign 1,460 691 960 Total current tax expense $ 1,462 $ 519 $ 698 Deferred tax expense (benefit) Federal $ 130 $ 184 $ 52 State and local 26 19 19 Foreign 122 55 (299) Total deferred tax expense (benefit) $ 278 $ 258 $ (228) Provision for income taxes on continuing operations $ 1,740 $ 777 $ 470 Income (loss) from continuing operations, net of tax $ 6,405 $ 1,294 $ (1,717) 1. The 2019 amount includes approximately $1.4 billion of expense related to goodwill impairment and environmental matters. See Notes 13 and 16 for additional information. 2. The 2019 amount includes approximately $1.8 billion of expense for Sadara related charges. See Note 12 for additional information. 99

Annual Report Page 108 Page 110

Annual Report Page 108 Page 110