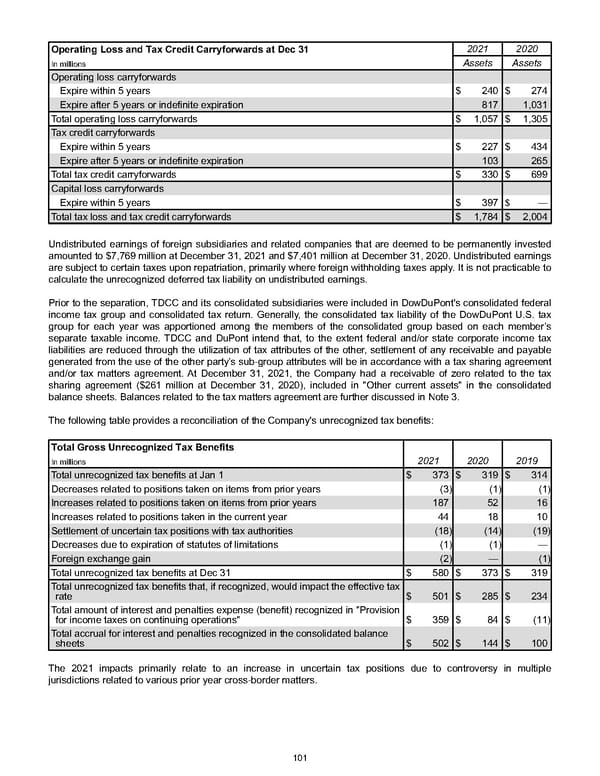

Operating Loss and Tax Credit Carryforwards at Dec 31 2021 2020 In millions Assets Assets Operating loss carryforwards Expire within 5 years $ 240 $ 274 Expire after 5 years or indefinite expiration 817 1,031 Total operating loss carryforwards $ 1,057 $ 1,305 Tax credit carryforwards Expire within 5 years $ 227 $ 434 Expire after 5 years or indefinite expiration 103 265 Total tax credit carryforwards $ 330 $ 699 Capital loss carryforwards Expire within 5 years $ 397 $ — Total tax loss and tax credit carryforwards $ 1,784 $ 2,004 Undistributed earnings of foreign subsidiaries and related companies that are deemed to be permanently invested amounted to $7,769 million at December 31, 2021 and $7,401 million at December 31, 2020 . Undistributed earnings are subject to certain taxes upon repatriation, primarily where foreign withholding taxes apply. It is not practicable to calculate the unrecognized deferred tax liability on undistributed earnings. Prior to the separation, TDCC and its consolidated subsidiaries were included in DowDuPont's consolidated federal income tax group and consolidated tax return. Generally, the consolidated tax liability of the DowDuPont U.S. tax group for each year was apportioned among the members of the consolidated group based on each member’s separate taxable income. TDCC and DuPont intend that, to the extent federal and/or state corporate income tax liabilities are reduced through the utilization of tax attributes of the other, settlement of any receivable and payable generated from the use of the other party’s sub-group attributes will be in accordance with a tax sharing agreement and/or tax matters agreement. At December 31, 2021 , the Company had a receivable of zero related to the tax sharing agreement ( $261 million at December 31, 2020 ), included in "Other current assets" in the consolidated balance sheets. Balances related to the tax matters agreement are further discussed in Note 3 . The following table provides a reconciliation of the Company's unrecognized tax benefits: Total Gross Unrecognized Tax Benefits In millions 2021 2020 2019 Total unrecognized tax benefits at Jan 1 $ 373 $ 319 $ 314 Decreases related to positions taken on items from prior years (3) (1) (1) Increases related to positions taken on items from prior years 187 52 16 Increases related to positions taken in the current year 44 18 10 Settlement of uncertain tax positions with tax authorities (18) (14) (19) Decreases due to expiration of statutes of limitations (1) (1) — Foreign exchange gain (2) — (1) Total unrecognized tax benefits at Dec 31 $ 580 $ 373 $ 319 Total unrecognized tax benefits that, if recognized, would impact the effective tax rate $ 501 $ 285 $ 234 Total amount of interest and penalties expense (benefit) recognized in "Provision for income taxes on continuing operations" $ 359 $ 84 $ (11) Total accrual for interest and penalties recognized in the consolidated balance sheets $ 502 $ 144 $ 100 The 2021 impacts primarily relate to an increase in uncertain tax positions due to controversy in multiple jurisdictions related to various prior year cross-border matters. 101

Annual Report Page 110 Page 112

Annual Report Page 110 Page 112