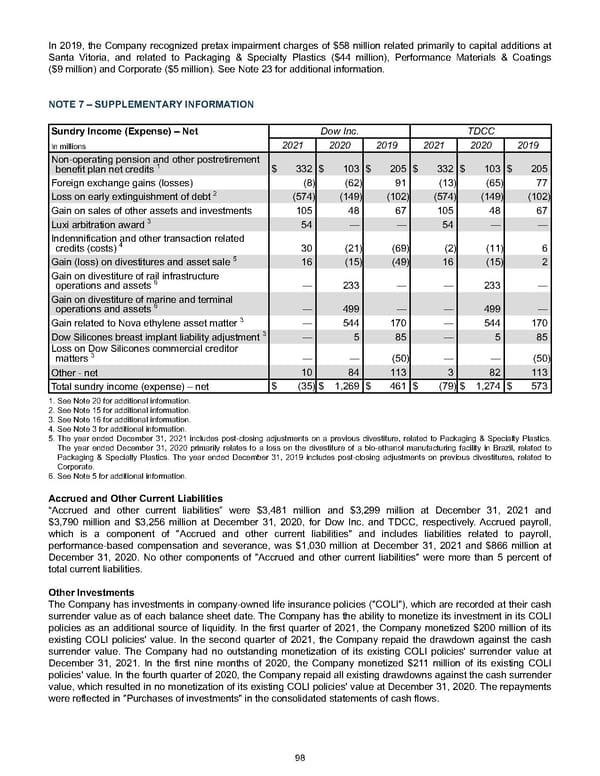

In 2019, the Company recognized pretax impairment charges of $58 million related primarily to capital additions at Santa Vitoria, and related to Packaging & Specialty Plastics ( $44 million ), Performance Materials & Coatings ( $9 million ) and Corporate ( $5 million ). See Note 23 for additional information. N O TE 7 – SUPPLEMENTARY INFORMATION Sundry Income (Expense) – Net Dow Inc. TDCC In millions 2021 2020 2019 2021 2020 2019 Non-operating pension and other postretirement benefit plan net credits 1 $ 332 $ 103 $ 205 $ 332 $ 103 $ 205 Foreign exchange gains (losses) (8) (62) 91 (13) (65) 77 Loss on early extinguishment of debt 2 (574) (149) (102) (574) (149) (102) Gain on sales of other assets and investments 105 48 67 105 48 67 Luxi arbitration award 3 54 — — 54 — — Indemnification and other transaction related credits (costs) 4 30 (21) (69) (2) (11) 6 Gain (loss) on divestitures and asset sale 5 16 (15) (49) 16 (15) 2 Gain on divestiture of rail infrastructure operations and assets 6 — 233 — — 233 — Gain on divestiture of marine and terminal operations and assets 6 — 499 — — 499 — Gain related to Nova ethylene asset matter 3 — 544 170 — 544 170 Dow Silicones breast implant liability adjustment 3 — 5 85 — 5 85 Loss on Dow Silicones commercial creditor matters 3 — — (50) — — (50) Other - net 10 84 113 3 82 113 Total sundry income (expense) – net $ (35) $ 1,269 $ 461 $ (79) $ 1,274 $ 573 1. See Note 20 for additional information. 2. See Note 15 for additional information. 3. See Note 16 for additional information. 4. See Note 3 for additional information. 5. The year ended December 31, 2021 includes post-closing adjustments on a previous divestiture, related to Packaging & Specialty Plastics. The year ended December 31, 2020 primarily relates to a loss on the divestiture of a bio-ethanol manufacturing facility in Brazil, related to Packaging & Specialty Plastics. The year ended December 31, 2019 includes post-closing adjustments on previous divestitures, related to Corporate. 6. See Note 5 for additional information. Accrued and Other Current Liabilities “ Accrued and other current liabilities” were $3,481 million and $3,299 million at December 31, 2021 and $3,790 million and $3,256 million at December 31, 2020 , for Dow Inc. and TDCC, respectively. Accrued payroll, which is a component of "Accrued and other current liabilities" and includes liabilities related to payroll, performance-based compensation and severance, was $1,030 million at December 31, 2021 and $866 million at December 31, 2020 . No other components of "Accrued and other current liabilities" were more than 5 percent of total current liabilities. Other Investments The Company has investments in company-owned life insurance policies ("COLI"), which are recorded at their cash surrender value as of each balance sheet date . The Company has the ability to monetize its investment in its COLI policies as an additional source of liquidity. In the first quarter of 2021, the Company monetized $200 million of its existing COLI policies' value. In the second quarter of 2021, the Company repaid the drawdown against the cash surrender value. The Company had no outstanding monetization of its existing COLI policies' surrender value at December 31, 2021. In the first nine months of 2020, the Company monetized $211 million of its existing COLI policies' value. In the fourth quarter of 2020, the Company repaid all existing drawdowns against the cash surrender value, which resulted in no monetization of its existing COLI policies' value at December 31, 2020. The repayments were reflected in "Purchases of investments" in the consolidated statements of cash flows. 98

Annual Report Page 107 Page 109

Annual Report Page 107 Page 109