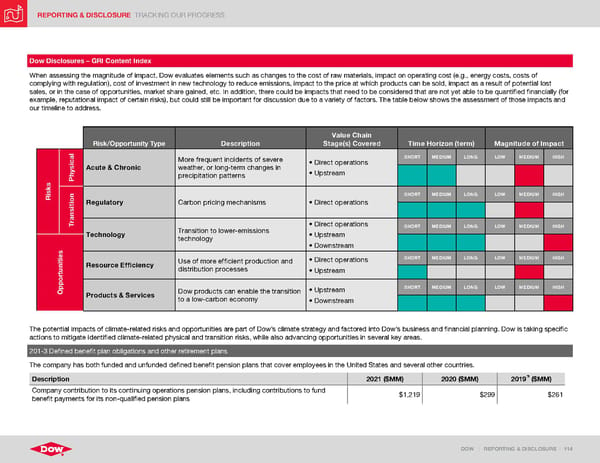

REPORTING & DISCLOSURE TRACKING OUR PROGRESS DOW | REPORTING & DISCLOSURE | 114 Dow Disclosures – GRI Content Index When assessing the magnitude of impact, Dow evaluates elements such as changes to the cost of raw materials, impact on operating cost (e.g., energy costs, costs of complying with regulation), cost of investment in new technology to reduce emissions, impact to the price at which products can be sold, impact as a result of potential lost sales, or in the case of opportunities, market share gained, etc. In addition, there could be impacts that need to be considered that are not yet able to be quantified financially (for example, reputational impact of certain risks), but could still be important for discussion due to a variety of factors. The table below shows the assessment of those impacts and our timeline to address. Risk/Opportunity Type Description Value Chain Stage(s) Covered Time Horizon (term) Magnitude of Impact Risks Physical Acute & Chronic More frequent incidents of severe weather, or long-term changes in precipitation patterns • Direct operations • Upstream SHORT MEDIUM LONG LOW MEDIUM HIGH Transition Regulatory Carbon pricing mechanisms • Direct operations SHORT MEDIUM LONG LOW MEDIUM HIGH Technology Transition to lower-emissions technology • Direct operations • Upstream • Downstream SHORT MEDIUM LONG LOW MEDIUM HIGH Opportunities Resource Efficiency Use of more efficient production and distribution processes • Direct operations • Upstream SHORT MEDIUM LONG LOW MEDIUM HIGH Products & Services Dow products can enable the transition to a low-carbon economy • Upstream • Downstream SHORT MEDIUM LONG LOW MEDIUM HIGH The potential impacts of climate-related risks and opportunities are part of Dow’s climate strategy and factored into Dow’s business and financial planning. Dow is taking specific actions to mitigate identified climate-related physical and transition risks, while also advancing opportunities in several key areas. 201-3 Defined benefit plan obligations and other retirement plans The company has both funded and unfunded defined benefit pension plans that cover employees in the United States and several other countries. Description 2021 ($MM) 2020 ($MM) 2019 ($MM) Company contribution to its continuing operations pension plans, including contributions to fund benefit payments for its non-qualified pension plans $1,219 $299 $261

ESG Report | Dow Page 113 Page 115

ESG Report | Dow Page 113 Page 115