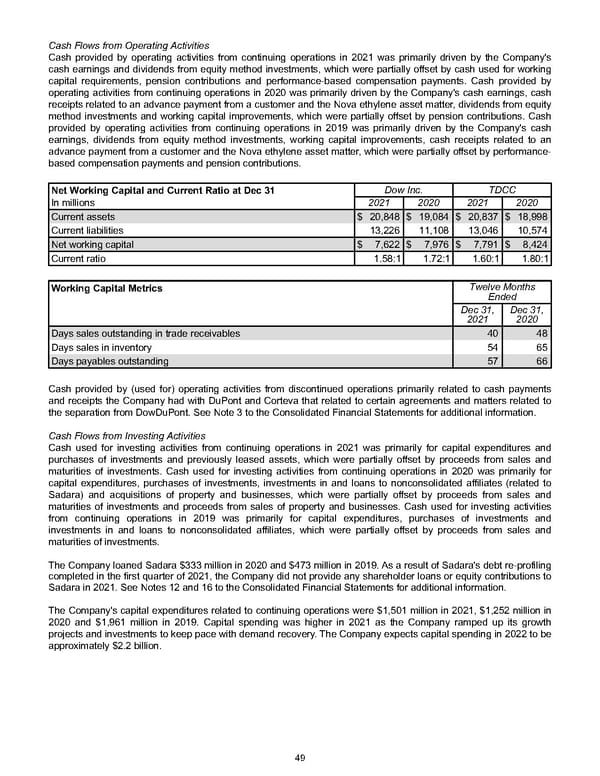

Cash Flows from Operating Activities Cash provided by operating activities from continuing operations in 2021 was primarily driven by the Company's cash earnings and dividends from equity method investments, which were partially offset by cash used for working capital requirements, pension contributions and performance-based compensation payments. Cash provided by operating activities from continuing operations in 2020 was primarily driven by the Company's cash earnings, cash receipts related to an advance payment from a customer and the Nova ethylene asset matter, dividends from equity method investments and working capital improvements, which were partially offset by pension contributions. Cash provided by operating activities from continuing operations in 2019 was primarily driven by the Company's cash earnings, dividends from equity method investments, working capital improvements, cash receipts related to an advance payment from a customer and the Nova ethylene asset matter, which were partially offset by performance- based compensation payments and pension contributions. Net Working Capital and Current Ratio at Dec 31 Dow Inc. TDCC In millions 2021 2020 2021 2020 Current assets $ 20,848 $ 19,084 $ 20,837 $ 18,998 Current liabilities 13,226 11,108 13,046 10,574 Net working capital $ 7,622 $ 7,976 $ 7,791 $ 8,424 Current ratio 1.58:1 1.72:1 1.60:1 1.80:1 Working Capital Metrics Twelve Months Ended Dec 31, 2021 Dec 31, 2020 Days sales outstanding in trade receivables 40 48 Days sales in inventory 54 65 Days payables outstanding 57 66 Cash provided by (used for) operating activities from discontinued operations primarily related to cash payments and receipts the Company had with DuPont and Corteva that related to certain agreements and matters related to the separation from DowDuPont. See Note 3 to the Consolidated Financial Statements for additional information. Cash Flows from Investing Activities Cash used for investing activities from continuing operations in 2021 was primarily for capital expenditures and purchases of investments and previously leased assets, which were partially offset by proceeds from sales and maturities of investments. Cash used for investing activities from continuing operations in 2020 was primarily for capital expenditures, purchases of investments, investments in and loans to nonconsolidated affiliates (related to Sadara) and acquisitions of property and businesses, which were partially offset by proceeds from sales and maturities of investments and proceeds from sales of property and businesses. Cash used for investing activities from continuing operations in 2019 was primarily for capital expenditures, purchases of investments and investments in and loans to nonconsolidated affiliates, which were partially offset by proceeds from sales and maturities of investments. The Company loaned Sadara $333 million in 2020 and $473 million in 2019 . As a result of Sadara's debt re-profiling completed in the first quarter of 2021, the Company did not provide any shareholder loans or equity contributions to Sadara in 2021. See Notes 12 and 16 to the Consolidated Financial Statements for additional information. The Company's capital expenditures related to continuing operations were $1,501 million in 2021 , $1,252 million in 2020 and $1,961 million in 2019 . Capital spending was higher in 2021 as the Company ramped up its growth projects and investments to keep pace with demand recovery. The Company expects capital spending in 2022 to be approximately $2.2 billion. 49

Annual Report Page 58 Page 60

Annual Report Page 58 Page 60