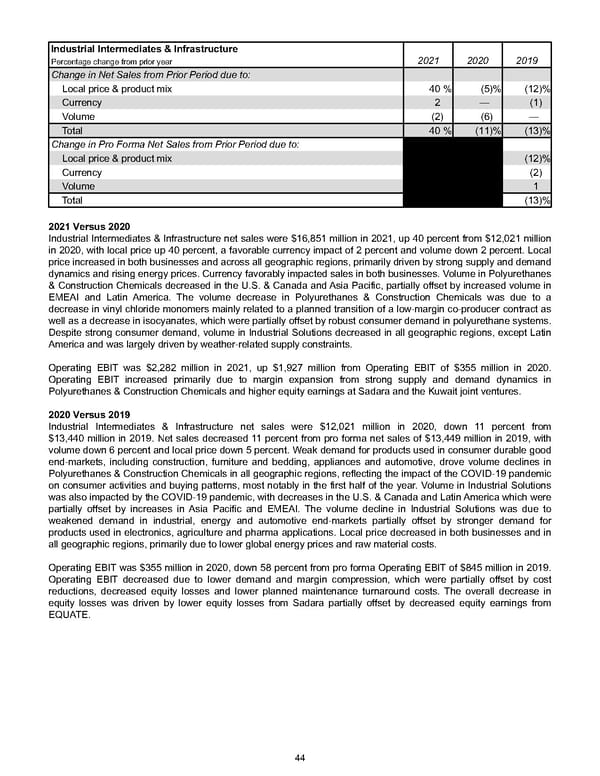

Industrial Intermediates & Infrastructure Percentage change from prior year 2021 2020 2019 Change in Net Sales from Prior Period due to: Local price & product mix 40 % (5) % (12) % Currency 2 — (1) Volume (2) (6) — Total 40 % (11) % (13) % Change in Pro Forma Net Sales from Prior Period due to: Local price & product mix (12) % Currency (2) Volume 1 Total (13) % 2021 Versus 2020 Industrial Intermediates & Infrastructure net sales were $16,851 million in 2021, up 40 percent from $12,021 million in 2020, with local price up 40 percent, a favorable currency impact of 2 percent and volume down 2 percent. Local price increased in both businesses and across all geographic regions, primarily driven by strong supply and demand dynamics and rising energy prices. Currency favorably impacted sales in both businesses. Volume in Polyurethanes & Construction Chemicals decreased in the U.S. & Canada and Asia Pacific, partially offset by increased volume in EMEAI and Latin America. The volume decrease in Polyurethanes & Construction Chemicals was due to a decrease in vinyl chloride monomers mainly related to a planned transition of a low-margin co-producer contract as well as a decrease in isocyanates, which were partially offset by robust consumer demand in polyurethane systems. Despite strong consumer demand, volume in Industrial Solutions decreased in all geographic regions, except Latin America and was largely driven by weather-related supply constraints. Operating EBIT was $2,282 million in 2021, up $1,927 million from Operating EBIT of $355 million in 2020. Operating EBIT increased primarily due to margin expansion from strong supply and demand dynamics in Polyurethanes & Construction Chemicals and higher equity earnings at Sadara and the Kuwait joint ventures. 2020 Versus 2019 Industrial Intermediates & Infrastructure net sales were $12,021 million in 2020, down 11 percent from $13,440 million in 2019. Net sales decreased 11 percent from pro forma net sales of $13,449 million in 2019, with volume down 6 percent and local price down 5 percent. Weak demand for products used in consumer durable good end-markets, including construction, furniture and bedding, appliances and automotive, drove volume declines in Polyurethanes & Construction Chemicals in all geographic regions, reflecting the impact of the COVID-19 pandemic on consumer activities and buying patterns, most notably in the first half of the year. Volume in Industrial Solutions was also impacted by the COVID-19 pandemic, with decreases in the U.S. & Canada and Latin America which were partially offset by increases in Asia Pacific and EMEAI. The volume decline in Industrial Solutions was due to weakened demand in industrial, energy and automotive end-markets partially offset by stronger demand for products used in electronics, agriculture and pharma applications. Local price decreased in both businesses and in all geographic regions, primarily due to lower global energy prices and raw material costs. Operating EBIT was $355 million in 2020, down 58 percent from pro forma Operating EBIT of $845 million in 2019. Operating EBIT decreased due to lower demand and margin compression, which were partially offset by cost reductions, decreased equity losses and lower planned maintenance turnaround costs. The overall decrease in equity losses was driven by lower equity losses from Sadara partially offset by decreased equity earnings from EQUATE. 44

Annual Report Page 53 Page 55

Annual Report Page 53 Page 55