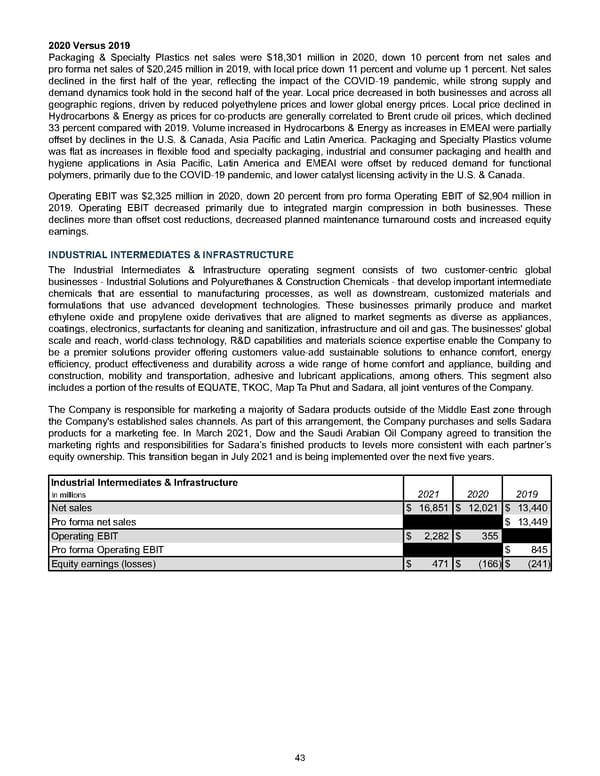

2020 Versus 2019 Packaging & Specialty Plastics net sales were $18,301 million in 2020 , down 10 percent from net sales and pro forma net sales of $20,245 million in 2019 , with local price down 11 percent and volume up 1 percent. Net sales declined in the first half of the year, reflecting the impact of the COVID-19 pandemic, while strong supply and demand dynamics took hold in the second half of the year. Local price decreased in both businesses and across all geographic regions, driven by reduced polyethylene prices and lower global energy prices. Local price declined in Hydrocarbons & Energy as prices for co-products are generally correlated to Brent crude oil prices, which declined 33 percent compared with 2019 . Volume increased in Hydrocarbons & Energy as increases in EMEAI were partially offset by declines in the U.S. & Canada, Asia Pacific and Latin America. Packaging and Specialty Plastics volume was flat as increases in flexible food and specialty packaging, industrial and consumer packaging and health and hygiene applications in Asia Pacific, Latin America and EMEAI were offset by reduced demand for functional polymers, primarily due to the COVID-19 pandemic, and lower catalyst licensing activity in the U.S. & Canada. Operating EBIT was $2,325 million in 2020 , down 20 percent from pro forma Operating EBIT of $2,904 million in 2019 . Operating EBIT decreased primarily due to integrated margin compression in both businesses. These declines more than offset cost reductions, decreased planned maintenance turnaround costs and increased equity earnings. INDUSTRIAL INTERMEDIATES & INFRASTRUCTURE The Industrial Intermediates & Infrastructure operating segment consists of two customer-centric global businesses - Industrial Solutions and Polyurethanes & Construction Chemicals - that develop important intermediate chemicals that are essential to manufacturing processes, as well as downstream, customized materials and formulations that use advanced development technologies. These businesses primarily produce and market ethylene oxide and propylene oxide derivatives that are aligned to market segments as diverse as appliances, coatings, electronics, surfactants for cleaning and sanitization, infrastructure and oil and gas. The businesses' global scale and reach, world-class technology, R&D capabilities and materials science expertise enable the Company to be a premier solutions provider offering customers value-add sustainable solutions to enhance comfort, energy efficiency, product effectiveness and durability across a wide range of home comfort and appliance, building and construction, mobility and transportation, adhesive and lubricant applications, among others. This segment also includes a portion of the results of EQUATE, TKOC, Map Ta Phut and Sadara, all joint ventures of the Company. The Company is responsible for marketing a majority of Sadara products outside of the Middle East zone through the Company's established sales channels. As part of this arrangement, the Company purchases and sells Sadara products for a marketing fee. In March 2021, Dow and the Saudi Arabian Oil Company agreed to transition the marketing rights and responsibilities for Sadara’s finished products to levels more consistent with each partner’s equity ownership. This transition began in July 2021 and is being implemented over the next five years. Industrial Intermediates & Infrastructure In millions 2021 2020 2019 Net sales $ 16,851 $ 12,021 $ 13,440 Pro forma net sales $ 13,449 Operating EBIT $ 2,282 $ 355 Pro forma Operating EBIT $ 845 Equity earnings (losses) $ 471 $ (166) $ (241) 43

Annual Report Page 52 Page 54

Annual Report Page 52 Page 54