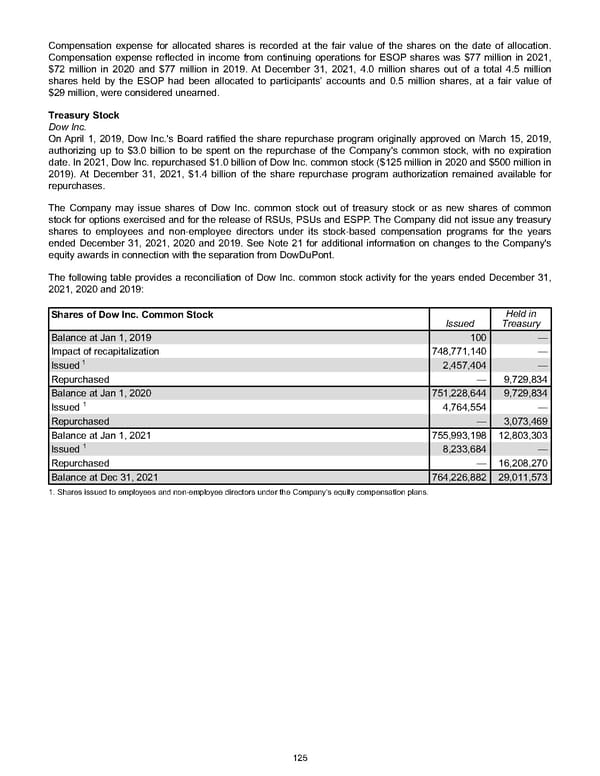

Compensation expense for allocated shares is recorded at the fair value of the shares on the date of allocation. Compensation expense reflected in income from continuing operations for ESOP shares was $77 million in 2021 , $72 million in 2020 and $77 million in 2019 . At December 31, 2021 , 4.0 million shares out of a total 4.5 million shares held by the ESOP had been allocated to participants’ accounts and 0.5 million shares, at a fair value of $29 million , were considered unearned. Treasury Stock Dow Inc. On April 1, 2019, Dow Inc.'s Board ratified the share repurchase program originally approved on March 15, 2019, authorizing up to $3.0 billion to be spent on the repurchase of the Company's common stock, with no expiration date. In 2021, Dow Inc. repurchased $1.0 billion of Dow Inc. common stock ( $125 million in 2020 and $500 million in 2019). At December 31, 2021 , $1.4 billion of the share repurchase program authorization remained available for repurchases. The Company may issue shares of Dow Inc. common stock out of treasury stock or as new shares of common stock for options exercised and for the release of RSUs, PSUs and ESPP. The Company did not issue any treasury shares to employees and non-employee directors under its stock-based compensation programs for the years ended December 31, 2021, 2020 and 2019. See Note 21 for additional information on changes to the Company's equity awards in connection with the separation from DowDuPont. The following table provides a reconciliation of Dow Inc. common stock activity for the years ended December 31, 2021 , 2020 and 2019 : Shares of Dow Inc. Common Stock Issued Held in Treasury Balance at Jan 1, 2019 100 — Impact of recapitalization 748,771,140 — Issued 1 2,457,404 — Repurchased — 9,729,834 Balance at Jan 1, 2020 751,228,644 9,729,834 Issued 1 4,764,554 — Repurchased — 3,073,469 Balance at Jan 1, 2021 755,993,198 12,803,303 Issued 1 8,233,684 — Repurchased — 16,208,270 Balance at Dec 31, 2021 764,226,882 29,011,573 1. Shares issued to employees and non-employee directors under the Company's equity compensation plans. 125

Annual Report Page 134 Page 136

Annual Report Page 134 Page 136