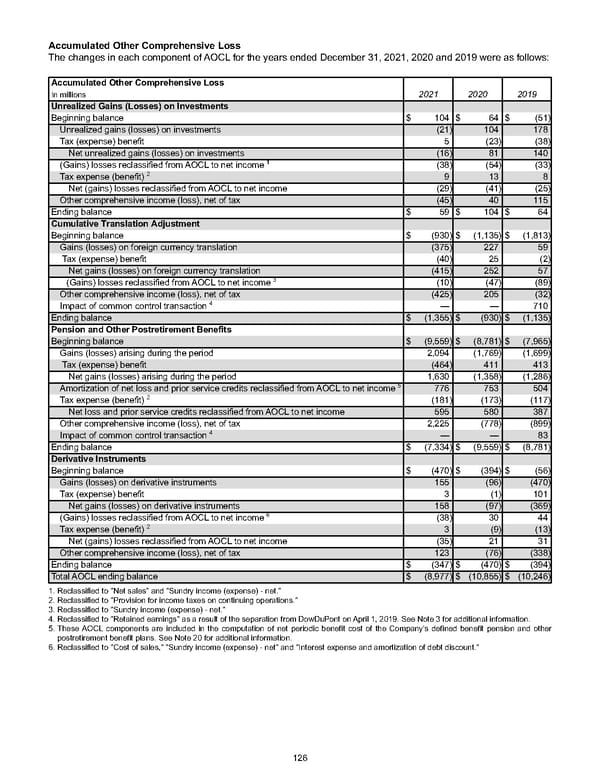

Accumulated Other Comprehensive Loss The changes in each component of AOCL for the years ended December 31, 2021 , 2020 and 2019 were as follows: Accumulated Other Comprehensive Loss 2021 2020 2019 In millions Unrealized Gains (Losses) on Investments Beginning balance $ 104 $ 64 $ (51) Unrealized gains (losses) on investments (21) 104 178 Tax (expense) benefit 5 (23) (38) Net unrealized gains (losses) on investments (16) 81 140 (Gains) losses reclassified from AOCL to net income 1 (38) (54) (33) Tax expense (benefit) 2 9 13 8 Net (gains) losses reclassified from AOCL to net income (29) (41) (25) Other comprehensive income (loss), net of tax (45) 40 115 Ending balance $ 59 $ 104 $ 64 Cumulative Translation Adjustment Beginning balance $ (930) $ (1,135) $ (1,813) Gains (losses) on foreign currency translation (375) 227 59 Tax (expense) benefit (40) 25 (2) Net gains (losses) on foreign currency translation (415) 252 57 (Gains) losses reclassified from AOCL to net income 3 (10) (47) (89) Other comprehensive income (loss), net of tax (425) 205 (32) Impact of common control transaction 4 — — 710 Ending balance $ (1,355) $ (930) $ (1,135) Pension and Other Postretirement Benefits Beginning balance $ (9,559) $ (8,781) $ (7,965) Gains (losses) arising during the period 2,094 (1,769) (1,699) Tax (expense) benefit (464) 411 413 Net gains (losses) arising during the period 1,630 (1,358) (1,286) Amortization of net loss and prior service credits reclassified from AOCL to net income 5 776 753 504 Tax expense (benefit) 2 (181) (173) (117) Net loss and prior service credits reclassified from AOCL to net income 595 580 387 Other comprehensive income (loss), net of tax 2,225 (778) (899) Impact of common control transaction 4 — — 83 Ending balance $ (7,334) $ (9,559) $ (8,781) Derivative Instruments Beginning balance $ (470) $ (394) $ (56) Gains (losses) on derivative instruments 155 (96) (470) Tax (expense) benefit 3 (1) 101 Net gains (losses) on derivative instruments 158 (97) (369) (Gains) losses reclassified from AOCL to net income 6 (38) 30 44 Tax expense (benefit) 2 3 (9) (13) Net (gains) losses reclassified from AOCL to net income (35) 21 31 Other comprehensive income (loss), net of tax 123 (76) (338) Ending balance $ (347) $ (470) $ (394) Total AOCL ending balance $ (8,977) $ (10,855) $ (10,246) 1. Reclassified to "Net sales" and "Sundry income (expense) - net." 2. Reclassified to "Provision for income taxes on continuing operations." 3. Reclassified to "Sundry income (expense) - net." 4. Reclassified to "Retained earnings" as a result of the separation from DowDuPont on April 1, 2019. See Note 3 for additional information. 5. These AOCL components are included in the computation of net periodic benefit cost of the Company's defined benefit pension and other postretirement benefit plans. See Note 20 for additional information. 6. Reclassified to "Cost of sales," "Sundry income (expense) - net" and "Interest expense and amortization of debt discount." 126

Annual Report Page 135 Page 137

Annual Report Page 135 Page 137