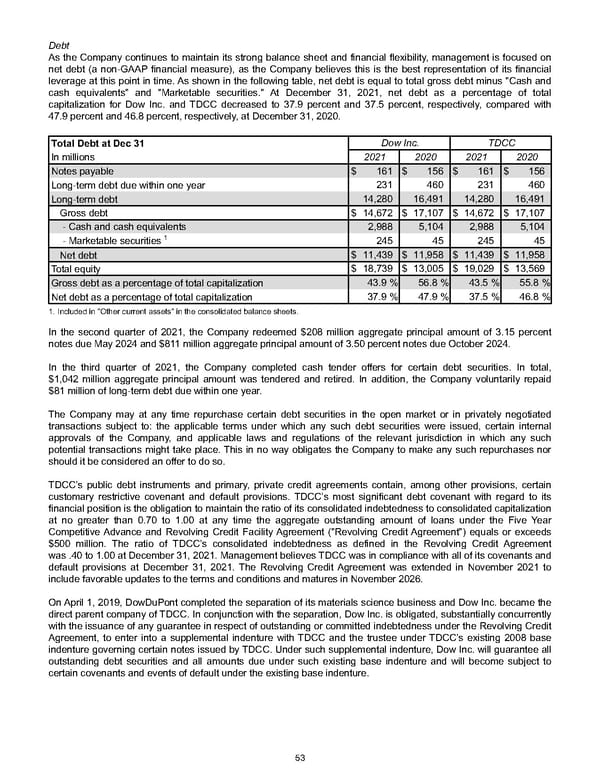

Debt As the Company continues to maintain its strong balance sheet and financial flexibility, management is focused on net debt (a non-GAAP financial measure), as the Company believes this is the best representation of its financial leverage at this point in time. As shown in the following table, net debt is equal to total gross debt minus "Cash and cash equivalents" and "Marketable securities." At December 31, 2021 , net debt as a percentage of total capitalization for Dow Inc. and TDCC decreased to 37.9 percent and 37.5 percent , respectively, compared with 47.9 percent and 46.8 percent , respectively, at December 31, 2020 . Total Debt at Dec 31 Dow Inc. TDCC In millions 2021 2020 2021 2020 Notes payable $ 161 $ 156 $ 161 $ 156 Long-term debt due within one year 231 460 231 460 Long-term debt 14,280 16,491 14,280 16,491 Gross debt $ 14,672 $ 17,107 $ 14,672 $ 17,107 - Cash and cash equivalents 2,988 5,104 2,988 5,104 - Marketable securities 1 245 45 245 45 Net debt $ 11,439 $ 11,958 $ 11,439 $ 11,958 Total equity $ 18,739 $ 13,005 $ 19,029 $ 13,569 Gross debt as a percentage of total capitalization 43.9 % 56.8 % 43.5 % 55.8 % Net debt as a percentage of total capitalization 37.9 % 47.9 % 37.5 % 46.8 % 1. Included in "Other current assets" in the consolidated balance sheets. In the second quarter of 2021, the Company redeemed $208 million aggregate principal amount of 3.15 percent notes due May 2024 and $811 million aggregate principal amount of 3.50 percent notes due October 2024. In the third quarter of 2021, the Company completed cash tender offers for certain debt securities. In total, $1,042 million aggregate principal amount was tendered and retired. In addition, the Company voluntarily repaid $81 million of long-term debt due within one year. The Company may at any time repurchase certain debt securities in the open market or in privately negotiated transactions subject to: the applicable terms under which any such debt securities were issued, certain internal approvals of the Company, and applicable laws and regulations of the relevant jurisdiction in which any such potential transactions might take place. This in no way obligates the Company to make any such repurchases nor should it be considered an offer to do so. TDCC’s public debt instruments and primary, private credit agreements contain, among other provisions, certain customary restrictive covenant and default provisions. TDCC’s most significant debt covenant with regard to its financial position is the obligation to maintain the ratio of its consolidated indebtedness to consolidated capitalization at no greater than 0.70 to 1.00 at any time the aggregate outstanding amount of loans under the Five Year Competitive Advance and Revolving Credit Facility Agreement ("Revolving Credit Agreement") equals or exceeds $500 million. The ratio of TDCC’s consolidated indebtedness as defined in the Revolving Credit Agreement was .40 to 1.00 at December 31, 2021 . Management believes TDCC was in compliance with all of its covenants and default provisions at December 31, 2021 . The Revolving Credit Agreement was extended in November 2021 to include favorable updates to the terms and conditions and matures in November 2026. On April 1, 2019, DowDuPont completed the separation of its materials science business and Dow Inc. became the direct parent company of TDCC. In conjunction with the separation, Dow Inc. is obligated, substantially concurrently with the issuance of any guarantee in respect of outstanding or committed indebtedness under the Revolving Credit Agreement, to enter into a supplemental indenture with TDCC and the trustee under TDCC’s existing 2008 base indenture governing certain notes issued by TDCC. Under such supplemental indenture, Dow Inc. will guarantee all outstanding debt securities and all amounts due under such existing base indenture and will become subject to certain covenants and events of default under the existing base indenture. 53

Annual Report Page 62 Page 64

Annual Report Page 62 Page 64