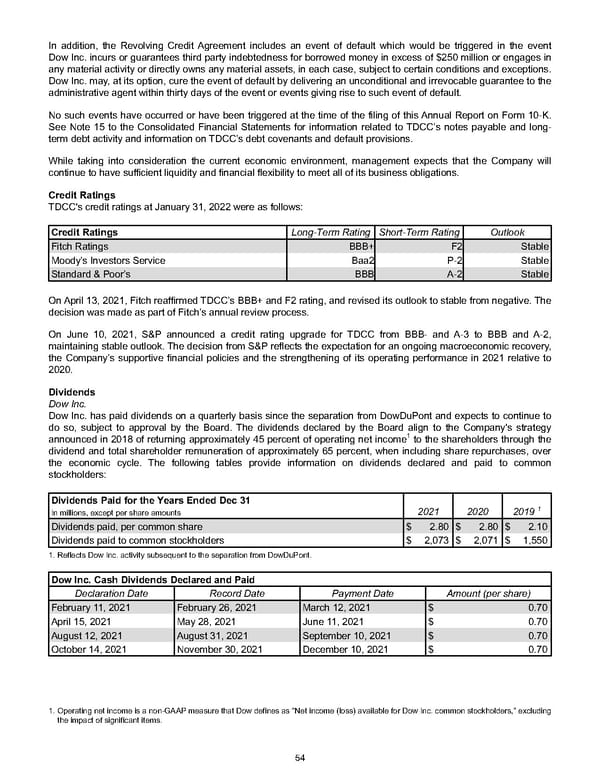

In addition, the Revolving Credit Agreement includes an event of default which would be triggered in the event Dow Inc. incurs or guarantees third party indebtedness for borrowed money in excess of $250 million or engages in any material activity or directly owns any material assets, in each case, subject to certain conditions and exceptions. Dow Inc. may, at its option, cure the event of default by delivering an unconditional and irrevocable guarantee to the administrative agent within thirty days of the event or events giving rise to such event of default. No such events have occurred or have been triggered at the time of the filing of this Annual Report on Form 10-K. See Note 15 to the Consolidated Financial Statements for information related to TDCC’s notes payable and long- term debt activity and information on TDCC’s debt covenants and default provisions. While taking into consideration the current economic environment, management expects that the Company will continue to have sufficient liquidity and financial flexibility to meet all of its business obligations. Credit Ratings TDCC's credit ratings at January 31, 2022 were as follows: Credit Ratings Long-Term Rating Short-Term Rating Outlook Fitch Ratings BBB+ F2 Stable Moody’s Investors Service Baa2 P-2 Stable Standard & Poor’s BBB A-2 Stable On April 13, 2021, Fitch reaffirmed TDCC’s BBB+ and F2 rating, and revised its outlook to stable from negative. The decision was made as part of Fitch’s annual review process. On June 10, 2021, S&P announced a credit rating upgrade for TDCC from BBB- and A-3 to BBB and A-2, maintaining stable outlook. The decision from S&P reflects the expectation for an ongoing macroeconomic recovery, the Company’s supportive financial policies and the strengthening of its operating performance in 2021 relative to 2020. Dividends Dow Inc. Dow Inc. has paid dividends on a quarterly basis since the separation from DowDuPont and expects to continue to do so, subject to approval by the Board. The dividends declared by the Board align to the Company's strategy announced in 2018 of returning approximately 45 percent of operating net income 1 to the shareholders through the dividend and total shareholder remuneration of approximately 65 percent, when including share repurchases, over the economic cycle. The following tables provide information on dividends declared and paid to common stockholders: Dividends Paid for the Years Ended Dec 31 2021 2020 2019 1 In millions, except per share amounts Dividends paid, per common share $ 2.80 $ 2.80 $ 2.10 Dividends paid to common stockholders $ 2,073 $ 2,071 $ 1,550 1. Reflects Dow Inc. activity subsequent to the separation from DowDuPont. Dow Inc. Cash Dividends Declared and Paid Declaration Date Record Date Payment Date Amount (per share) February 11, 2021 February 26, 2021 March 12, 2021 $ 0.70 April 15, 2021 May 28, 2021 June 11, 2021 $ 0.70 August 12, 2021 August 31, 2021 September 10, 2021 $ 0.70 October 14, 2021 November 30, 2021 December 10, 2021 $ 0.70 1. Operating net income is a non-GAAP measure that Dow defines as "Net income (loss) available for Dow Inc. common stockholders," excluding the impact of significant items. 54

Annual Report Page 63 Page 65

Annual Report Page 63 Page 65