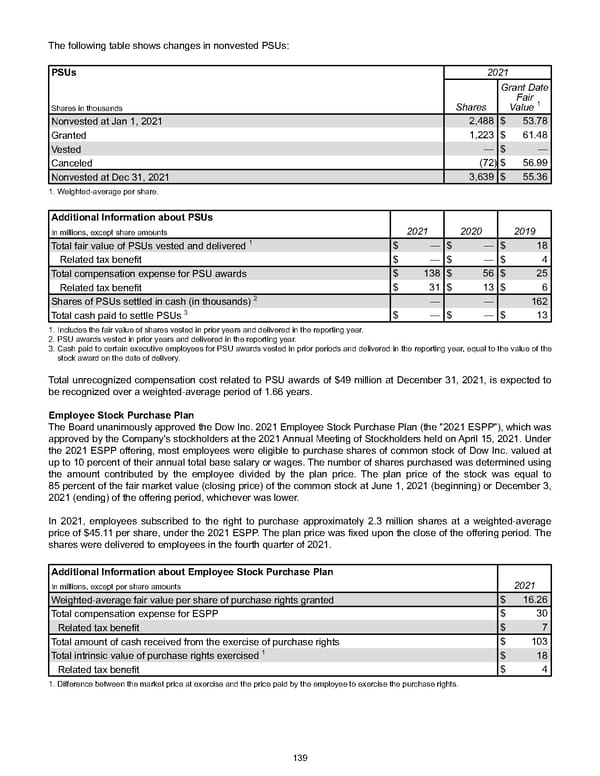

The following table shows changes in nonvested PSUs: PSUs 2021 Shares in thousands Shares Grant Date Fair Value 1 Nonvested at Jan 1, 2021 2,488 $ 53.78 Granted 1,223 $ 61.48 Vested — $ — Canceled (72) $ 56.99 Nonvested at Dec 31, 2021 3,639 $ 55.36 1. Weighted-average per share. Additional Information about PSUs In millions, except share amounts 2021 2020 2019 Total fair value of PSUs vested and delivered 1 $ — $ — $ 18 Related tax benefit $ — $ — $ 4 Total compensation expense for PSU awards $ 138 $ 56 $ 25 Related tax benefit $ 31 $ 13 $ 6 Shares of PSUs settled in cash (in thousands) 2 — — 162 Total cash paid to settle PSUs 3 $ — $ — $ 13 1. Includes the fair value of shares vested in prior years and delivered in the reporting year. 2. PSU awards vested in prior years and delivered in the reporting year. 3. Cash paid to certain executive employees for PSU awards vested in prior periods and delivered in the reporting year, equal to the value of the stock award on the date of delivery . Total unrecognized compensation cost related to PSU awards of $49 million at December 31, 2021 , is expected to be recognized over a weighted-average period of 1.66 years . Employee Stock Purchase Plan The Board unanimously approved the Dow Inc. 2021 Employee Stock Purchase Plan (the "2021 ESPP"), which was approved by the Company's stockholders at the 2021 Annual Meeting of Stockholders held on April 15, 2021. Under the 2021 ESPP offering, most employees were eligible to purchase shares of common stock of Dow Inc. valued at up to 10 percent of their annual total base salary or wages. The number of shares purchased was determined using the amount contributed by the employee divided by the plan price. The plan price of the stock was equal to 85 percent of the fair market value (closing price) of the common stock at June 1, 2021 (beginning) or December 3, 2021 (ending) of the offering period, whichever was lower. In 2021 , employees subscribed to the right to purchase approximately 2.3 million shares at a weighted-average price of $45.11 per share, under the 2021 ESPP. The plan price was fixed upon the close of the offering period. The shares were delivered to employees in the fourth quarter of 2021. Additional Information about Employee Stock Purchase Plan In millions, except per share amounts 2021 Weighted-average fair value per share of purchase rights granted $ 16.26 Total compensation expense for ESPP $ 30 Related tax benefit $ 7 Total amount of cash received from the exercise of purchase rights $ 103 Total intrinsic value of purchase rights exercised 1 $ 18 Related tax benefit $ 4 1. Difference between the market price at exercise and the price paid by the employee to exercise the purchase rights . 139

Annual Report Page 148 Page 150

Annual Report Page 148 Page 150