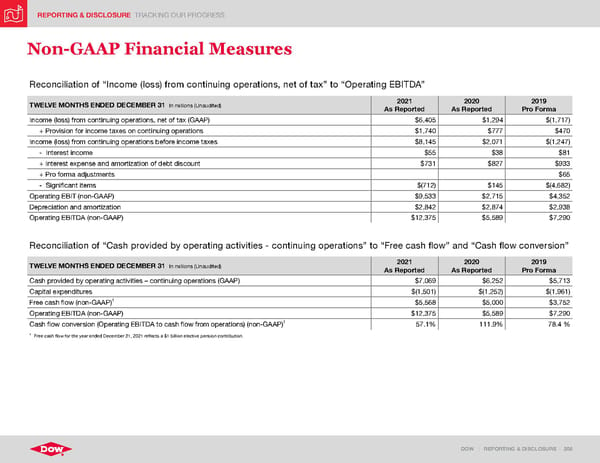

REPORTING & DISCLOSURE TRACKING OUR PROGRESS DOW | REPORTING & DISCLOSURE | 208 Non-GAAP Financial Measures Reconciliation of “Income (loss) from continuing operations, net of tax” to “Operating EBITDA” TWELVE MONTHS ENDED DECEMBER 31 In millions (Unaudited) 2021 As Reported 2020 As Reported 2019 Pro Forma Income (loss) from continuing operations, net of tax (GAAP) $6,405 $1,294 $(1,717) + Provision for income taxes on continuing operations $1,740 $777 $470 Income (loss) from continuing operations before income taxes $8,145 $2,071 $(1,247) - Interest income $55 $38 $81 + Interest expense and amortization of debt discount $731 $827 $933 + Pro forma adjustments $65 - Significant items $(712) $145 $(4,682) Operating EBIT (non-GAAP) $9,533 $2,715 $4,352 Depreciation and amortization $2,842 $2,874 $2,938 Operating EBITDA (non-GAAP) $12,375 $5,589 $7,290 Reconciliation of “Cash provided by operating activities - continuing operations” to “Free cash flow” and “Cash flow conversion” TWELVE MONTHS ENDED DECEMBER 31 In millions (Unaudited) 2021 As Reported 2020 As Reported 2019 Pro Forma Cash provided by operating activities – continuing operations (GAAP) $7,069 $6,252 $5,713 Capital expenditures $(1,501) $(1,252) $(1,961) Free cash flow (non-GAAP) 1 $5,568 $5,000 $3,752 Operating EBITDA (non-GAAP) $12,375 $5,589 $7,290 Cash flow conversion (Operating EBITDA to cash flow from operations) (non-GAAP) 1 57.1% 111.9% 78.4 % 1 Free cash flow for the year ended December 31, 2021 reflects a $1 billion elective pension contribution.

ESG Report | Dow Page 207 Page 209

ESG Report | Dow Page 207 Page 209