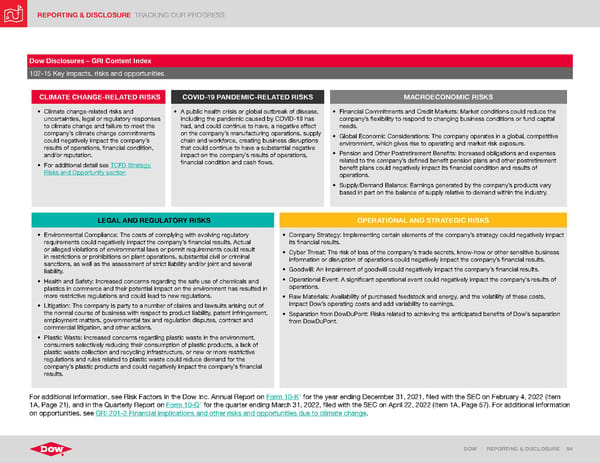

REPORTING & DISCLOSURE TRACKING OUR PROGRESS DOW | REPORTING & DISCLOSURE | 94 Dow Disclosures – GRI Content Index 102-15 Key impacts, risks and opportunities CLIMATE CHANGE-RELATED RISKS COVID-19 PANDEMIC-RELATED RISKS MACROECONOMIC RISKS • Climate change-related risks and uncertainties, legal or regulatory responses to climate change and failure to meet the company’s climate change commitments could negatively impact the company’s results of operations, financial condition, and/or reputation. • For additional detail see TCFD Strategy Risks and Opportunity section • A public health crisis or global outbreak of disease, including the pandemic caused by COVID-19 has had, and could continue to have, a negative effect on the company’s manufacturing operations, supply chain and workforce, creating business disruptions that could continue to have a substantial negative impact on the company’s results of operations, financial condition and cash flows. • Financial Commitments and Credit Markets: Market conditions could reduce the company’s flexibility to respond to changing business conditions or fund capital needs. • Global Economic Considerations: The company operates in a global, competitive environment, which gives rise to operating and market risk exposure. • Pension and Other Postretirement Benefits: Increased obligations and expenses related to the company’s defined benefit pension plans and other postretirement benefit plans could negatively impact its financial condition and results of operations. • Supply/Demand Balance: Earnings generated by the company’s products vary based in part on the balance of supply relative to demand within the industry. LEGAL AND REGULATORY RISKS OPERATIONAL AND STRATEGIC RISKS • Environmental Compliance: The costs of complying with evolving regulatory requirements could negatively impact the company’s financial results. Actual or alleged violations of environmental laws or permit requirements could result in restrictions or prohibitions on plant operations, substantial civil or criminal sanctions, as well as the assessment of strict liability and/or joint and several liability. • Health and Safety: Increased concerns regarding the safe use of chemicals and plastics in commerce and their potential impact on the environment has resulted in more restrictive regulations and could lead to new regulations. • Litigation: The company is party to a number of claims and lawsuits arising out of the normal course of business with respect to product liability, patent infringement, employment matters, governmental tax and regulation disputes, contract and commercial litigation, and other actions. • Plastic Waste: Increased concerns regarding plastic waste in the environment, consumers selectively reducing their consumption of plastic products, a lack of plastic waste collection and recycling infrastructure, or new or more restrictive regulations and rules related to plastic waste could reduce demand for the company’s plastic products and could negatively impact the company’s financial results. • Company Strategy: Implementing certain elements of the company’s strategy could negatively impact its financial results. • Cyber Threat: The risk of loss of the company’s trade secrets, know-how or other sensitive business information or disruption of operations could negatively impact the company’s financial results. • Goodwill: An impairment of goodwill could negatively impact the company’s financial results. • Operational Event: A significant operational event could negatively impact the company’s results of operations. • Raw Materials: Availability of purchased feedstock and energy, and the volatility of these costs, impact Dow’s operating costs and add variability to earnings. • Separation from DowDuPont: Risks related to achieving the anticipated benefits of Dow’s separation from DowDuPont. For additional information, see Risk Factors in the Dow Inc. Annual Report on Form 10-K ~ for the year ending December 31, 2021, filed with the SEC on February 4, 2022 (Item 1A, Page 21), and in the Quarterly Report on Form 10-Q ~ for the quarter ending March 31, 2022, filed with the SEC on April 22, 2022 (Item 1A, Page 57). For additional information on opportunities, see GRI 201-2 Financial implications and other risks and opportunities due to climate change .

ESG Report | Dow Page 93 Page 95

ESG Report | Dow Page 93 Page 95