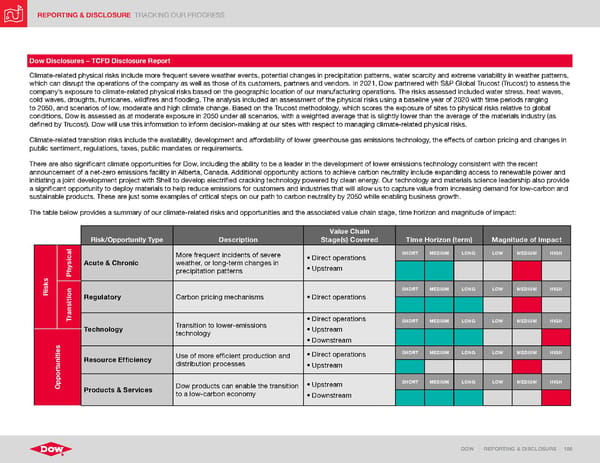

REPORTING & DISCLOSURE TRACKING OUR PROGRESS DOW | REPORTING & DISCLOSURE | 186 Dow Disclosures – TCFD Disclosure Report Climate-related physical risks include more frequent severe weather events, potential changes in precipitation patterns, water scarcity and extreme variability in weather patterns, which can disrupt the operations of the company as well as those of its customers, partners and vendors. In 2021, Dow partnered with S&P Global Trucost (Trucost) to assess the company ’s exposure to climate-related physical risks based on the geographic location of our manufacturing operations. The risks assessed included water stress, heat waves, cold waves, droughts, hurricanes, wildfires and flooding. The analysis included an assessment of the physical risks using a baseline year of 2020 with time periods ranging to 2050, and scenarios of low, moderate and high climate change. Based on the Trucost methodology, which scores the exposure of sites to physical risks relative to global conditions, Dow is assessed as at moderate exposure in 2050 under all scenarios, with a weighted average that is slightly lower than the average of the materials industry (as defined by Trucost). Dow will use this information to inform decision-making at our sites with respect to managing climate-related physical risks. Climate-related transition risks include the availability, development and affordability of lower greenhouse gas emissions technology, the effects of carbon pricing and changes in public sentiment, regulations, taxes, public mandates or requirements. There are also significant climate opportunities for Dow, including the ability to be a leader in the development of lower emissions technology consistent with the recent announcement of a net-zero emissions facility in Alberta, Canada. Additional opportunity actions to achieve carbon neutrality include expanding access to renewable power and initiating a joint development project with Shell to develop electrified cracking technology powered by clean energy. Our technology and materials science leadership also provide a significant opportunity to deploy materials to help reduce emissions for customers and industries that will allow us to capture value from increasing demand for low-carbon and sustainable products. These are just some examples of critical steps on our path to carbon neutrality by 2050 while enabling business growth. The table below provides a summary of our climate-related risks and opportunities and the associated value chain stage, time horizon and magnitude of impact: Risk/Opportunity Type Description Value Chain Stage(s) Covered Time Horizon (term) Magnitude of Impact Risks Physical Acute & Chronic More frequent incidents of severe weather, or long-term changes in precipitation patterns • Direct operations • Upstream SHORT MEDIUM LONG LOW MEDIUM HIGH Transition Regulatory Carbon pricing mechanisms • Direct operations SHORT MEDIUM LONG LOW MEDIUM HIGH Technology Transition to lower-emissions technology • Direct operations • Upstream • Downstream SHORT MEDIUM LONG LOW MEDIUM HIGH Opportunities Resource Efficiency Use of more efficient production and distribution processes • Direct operations • Upstream SHORT MEDIUM LONG LOW MEDIUM HIGH Products & Services Dow products can enable the transition to a low-carbon economy • Upstream • Downstream SHORT MEDIUM LONG LOW MEDIUM HIGH

ESG Report | Dow Page 185 Page 187

ESG Report | Dow Page 185 Page 187