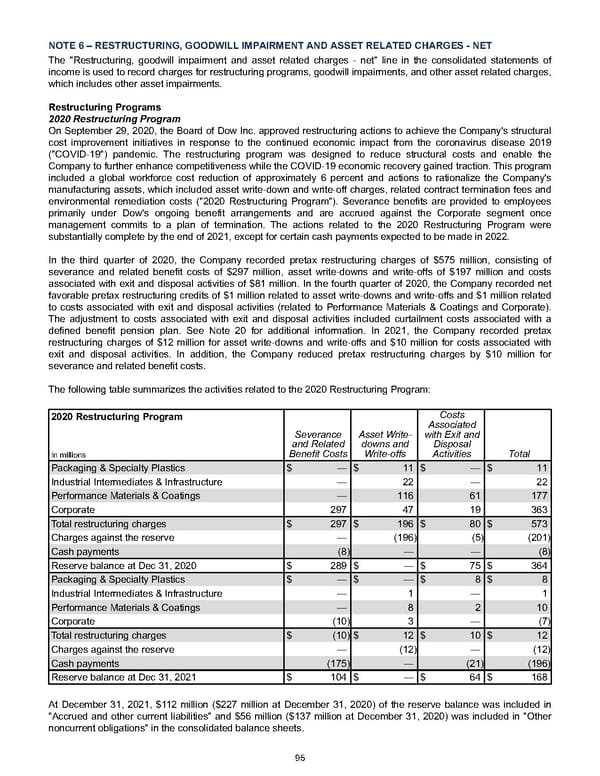

NOTE 6 – RESTRUCTURING, GOODWILL IMPAIRMENT AND ASSET RELATED CHARGES - NET The "Restructuring, goodwill impairment and asset related charges - net" line in the consolidated statements of income is used to record charges for restructuring programs, goodwill impairments, and other asset related charges, which includes other asset impairments. Restructuring Programs 2020 Restructuring Program On September 29, 2020, the Board of Dow Inc. approved restructuring actions to achieve the Company's structural cost improvement initiatives in response to the continued economic impact from the coronavirus disease 2019 ("COVID-19") pandemic. The restructuring program was designed to reduce structural costs and enable the Company to further enhance competitiveness while the COVID-19 economic recovery gained traction. This program included a global workforce cost reduction of approximately 6 percent and actions to rationalize the Company's manufacturing assets, which included asset write-down and write-off charges, related contract termination fees and environmental remediation costs ("2020 Restructuring Program"). Severance benefits are provided to employees primarily under Dow's ongoing benefit arrangements and are accrued against the Corporate segment once management commits to a plan of termination. The actions related to the 2020 Restructuring Program were substantially complete by the end of 2021, except for certain cash payments expected to be made in 2022. In the third quarter of 2020, the Company recorded pretax restructuring charges of $575 million , consisting of severance and related benefit costs of $297 million , asset write-downs and write-offs of $197 million and costs associated with exit and disposal activities of $81 million . In the fourth quarter of 2020, the Company recorded net favorable pretax restructuring credits of $1 million related to asset write-downs and write-offs and $1 million related to costs associated with exit and disposal activities (related to Performance Materials & Coatings and Corporate). The adjustment to costs associated with exit and disposal activities included curtailment costs associated with a defined benefit pension plan. See Note 20 for additional information. In 2021, the Company recorded pretax restructuring charges of $12 million for asset write-downs and write-offs and $10 million for costs associated with exit and disposal activities. In addition, the Company reduced pretax restructuring charges by $10 million for severance and related benefit costs. The following table summarizes the activities related to the 2020 Restructuring Program: 2020 Restructuring Program Severance and Related Benefit Costs Asset Write- downs and Write-offs Costs Associated with Exit and Disposal Activities Total In millions Packaging & Specialty Plastics $ — $ 11 $ — $ 11 Industrial Intermediates & Infrastructure — 22 — 22 Performance Materials & Coatings — 116 61 177 Corporate 297 47 19 363 Total restructuring charges $ 297 $ 196 $ 80 $ 573 Charges against the reserve — (196) (5) (201) Cash payments (8) — — (8) Reserve balance at Dec 31, 2020 $ 289 $ — $ 75 $ 364 Packaging & Specialty Plastics $ — $ — $ 8 $ 8 Industrial Intermediates & Infrastructure — 1 — 1 Performance Materials & Coatings — 8 2 10 Corporate (10) 3 — (7) Total restructuring charges $ (10) $ 12 $ 10 $ 12 Charges against the reserve — (12) — (12) Cash payments (175) — (21) (196) Reserve balance at Dec 31, 2021 $ 104 $ — $ 64 $ 168 At December 31, 2021 , $112 million ( $227 million at December 31, 2020 ) of the reserve balance was included in "Accrued and other current liabilities" and $56 million ( $137 million at December 31, 2020 ) was included in "Other noncurrent obligations" in the consolidated balance sheets. 95

Annual Report Page 104 Page 106

Annual Report Page 104 Page 106