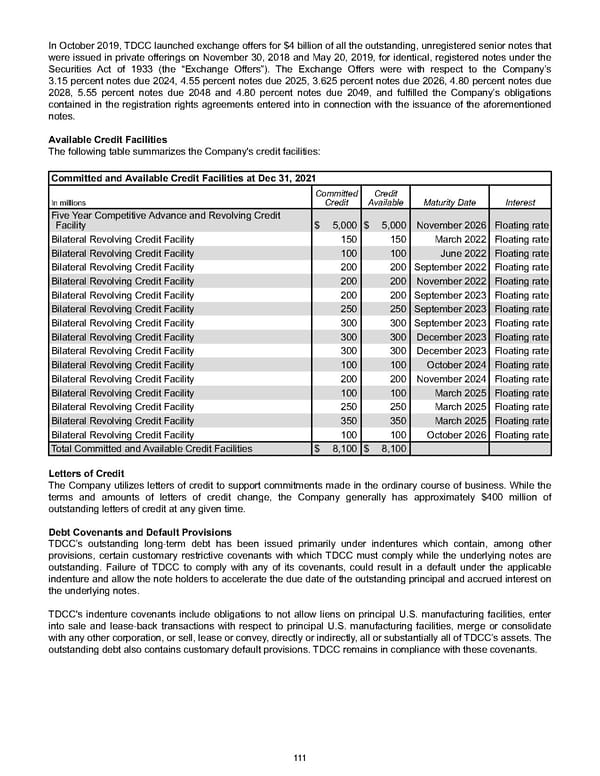

In October 2019, TDCC launched exchange offers for $4 billion of all the outstanding, unregistered senior notes that were issued in private offerings on November 30, 2018 and May 20, 2019, for identical, registered notes under the Securities Act of 1933 (the “Exchange Offers”). The Exchange Offers were with respect to the Company’s 3.15 percent notes due 2024, 4.55 percent notes due 2025, 3.625 percent notes due 2026, 4.80 percent notes due 2028, 5.55 percent notes due 2048 and 4.80 percent notes due 2049, and fulfilled the Company’s obligations contained in the registration rights agreements entered into in connection with the issuance of the aforementioned notes. Available Credit Facilities The following table summarizes the Company's credit facilities: Committed and Available Credit Facilities at Dec 31, 2021 In millions Committed Credit Credit Available Maturity Date Interest Five Year Competitive Advance and Revolving Credit Facility $ 5,000 $ 5,000 November 2026 Floating rate Bilateral Revolving Credit Facility 150 150 March 2022 Floating rate Bilateral Revolving Credit Facility 100 100 June 2022 Floating rate Bilateral Revolving Credit Facility 200 200 September 2022 Floating rate Bilateral Revolving Credit Facility 200 200 November 2022 Floating rate Bilateral Revolving Credit Facility 200 200 September 2023 Floating rate Bilateral Revolving Credit Facility 250 250 September 2023 Floating rate Bilateral Revolving Credit Facility 300 300 September 2023 Floating rate Bilateral Revolving Credit Facility 300 300 December 2023 Floating rate Bilateral Revolving Credit Facility 300 300 December 2023 Floating rate Bilateral Revolving Credit Facility 100 100 October 2024 Floating rate Bilateral Revolving Credit Facility 200 200 November 2024 Floating rate Bilateral Revolving Credit Facility 100 100 March 2025 Floating rate Bilateral Revolving Credit Facility 250 250 March 2025 Floating rate Bilateral Revolving Credit Facility 350 350 March 2025 Floating rate Bilateral Revolving Credit Facility 100 100 October 2026 Floating rate Total Committed and Available Credit Facilities $ 8,100 $ 8,100 Letters of Credit The Company utilizes letters of credit to support commitments made in the ordinary course of business. While the terms and amounts of letters of credit change, the Company generally has approximately $400 million of outstanding letters of credit at any given time. Debt Covenants and Default Provisions TDCC’s outstanding long-term debt has been issued primarily under indentures which contain, among other provisions, certain customary restrictive covenants with which TDCC must comply while the underlying notes are outstanding. Failure of TDCC to comply with any of its covenants, could result in a default under the applicable indenture and allow the note holders to accelerate the due date of the outstanding principal and accrued interest on the underlying notes. TDCC's indenture covenants include obligations to not allow liens on principal U.S. manufacturing facilities, enter into sale and lease-back transactions with respect to principal U.S. manufacturing facilities, merge or consolidate with any other corporation, or sell, lease or convey, directly or indirectly, all or substantially all of TDCC’s assets. The outstanding debt also contains customary default provisions. TDCC remains in compliance with these covenants. 111

Annual Report Page 120 Page 122

Annual Report Page 120 Page 122