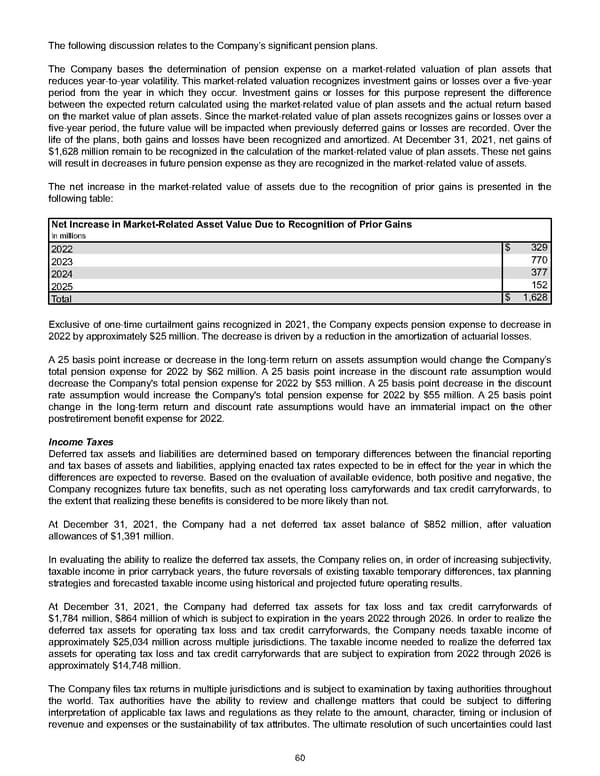

The following discussion relates to the Company’s significant pension plans. The Company bases the determination of pension expense on a market-related valuation of plan assets that reduces year-to-year volatility. This market-related valuation recognizes investment gains or losses over a five-year period from the year in which they occur. Investment gains or losses for this purpose represent the difference between the expected return calculated using the market-related value of plan assets and the actual return based on the market value of plan assets. Since the market-related value of plan assets recognizes gains or losses over a five-year period, the future value will be impacted when previously deferred gains or losses are recorded. Over the life of the plans, both gains and losses have been recognized and amortized. At December 31, 2021 , net gains of $1,628 million remain to be recognized in the calculation of the market-related value of plan assets. These net gains will result in decreases in future pension expense as they are recognized in the market-related value of assets. The net increase in the market-related value of assets due to the recognition of prior gains is presented in the following table: Net Increase in Market-Related Asset Value Due to Recognition of Prior Gains In millions 2022 $ 329 2023 770 2024 377 2025 152 Total $ 1,628 Exclusive of one-time curtailment gains recognized in 2021, the Company expects pension expense to decrease in 2022 by approximately $25 million . The decrease is driven by a reduction in the amortization of actuarial losses. A 25 basis point increase or decrease in the long-term return on assets assumption would change the Company’s total pension expense for 2022 by $62 million. A 25 basis point increase in the discount rate assumption would decrease the Company's total pension expense for 2022 by $53 million. A 25 basis point decrease in the discount rate assumption would increase the Company's total pension expense for 2022 by $55 million. A 25 basis point change in the long-term return and discount rate assumptions would have an immaterial impact on the other postretirement benefit expense for 2022 . Income Taxes Deferred tax assets and liabilities are determined based on temporary differences between the financial reporting and tax bases of assets and liabilities, applying enacted tax rates expected to be in effect for the year in which the differences are expected to reverse. Based on the evaluation of available evidence, both positive and negative, the Company recognizes future tax benefits, such as net operating loss carryforwards and tax credit carryforwards, to the extent that realizing these benefits is considered to be more likely than not. At December 31, 2021 , the Company had a net deferred tax asset balance of $852 million , after valuation allowances of $1,391 million . In evaluating the ability to realize the deferred tax assets, the Company relies on, in order of increasing subjectivity, taxable income in prior carryback years, the future reversals of existing taxable temporary differences, tax planning strategies and forecasted taxable income using historical and projected future operating results. At December 31, 2021 , the Company had deferred tax assets for tax loss and tax credit carryforwards of $1,784 million , $864 million of which is subject to expiration in the years 2022 through 2026 . In order to realize the deferred tax assets for operating tax loss and tax credit carryforwards, the Company needs taxable income of approximately $25,034 million across multiple jurisdictions. The taxable income needed to realize the deferred tax assets for operating tax loss and tax credit carryforwards that are subject to expiration from 2022 through 2026 is approximately $14,748 million . The Company files tax returns in multiple jurisdictions and is subject to examination by taxing authorities throughout the world. Tax authorities have the ability to review and challenge matters that could be subject to differing interpretation of applicable tax laws and regulations as they relate to the amount, character, timing or inclusion of revenue and expenses or the sustainability of tax attributes. The ultimate resolution of such uncertainties could last 60

Annual Report Page 69 Page 71

Annual Report Page 69 Page 71