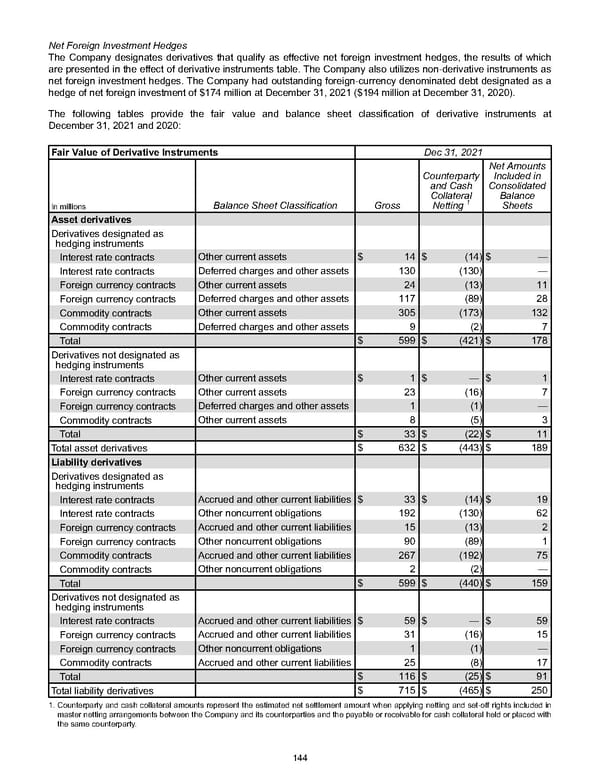

Net Foreign Investment Hedges The Company designates derivatives that qualify as effective net foreign investment hedges, the results of which are presented in the effect of derivative instruments table. The Company also utilizes non-derivative instruments as net foreign investment hedges. The Company had outstanding foreign-currency denominated debt designated as a hedge of net foreign investment of $174 million at December 31, 2021 ( $194 million at December 31, 2020 ). The following tables provide the fair value and balance sheet classification of derivative instrume n ts at December 31, 2021 and 2020 : Fair Value of Derivative Instruments Dec 31, 2021 In millions Balance Sheet Classification Gross Counterparty and Cash Collateral Netting 1 Net Amounts Included in Consolidated Balance Sheets Asset derivatives Derivatives designated as hedging instruments Interest rate contracts Other current assets $ 14 $ (14) $ — Interest rate contracts Deferred charges and other assets 130 (130) — Foreign currency contracts Other current assets 24 (13) 11 Foreign currency contracts Deferred charges and other assets 117 (89) 28 Commodity contracts Other current assets 305 (173) 132 Commodity contracts Deferred charges and other assets 9 (2) 7 Total $ 599 $ (421) $ 178 Derivatives not designated as hedging instruments Interest rate contracts Other current assets $ 1 $ — $ 1 Foreign currency contracts Other current assets 23 (16) 7 Foreign currency contracts Deferred charges and other assets 1 (1) — Commodity contracts Other current assets 8 (5) 3 Total $ 33 $ (22) $ 11 Total asset derivatives $ 632 $ (443) $ 189 Liability derivatives Derivatives designated as hedging instruments Interest rate contracts Accrued and other current liabilities $ 33 $ (14) $ 19 Interest rate contracts Other noncurrent obligations 192 (130) 62 Foreign currency contracts Accrued and other current liabilities 15 (13) 2 Foreign currency contracts Other noncurrent obligations 90 (89) 1 Commodity contracts Accrued and other current liabilities 267 (192) 75 Commodity contracts Other noncurrent obligations 2 (2) — Total $ 599 $ (440) $ 159 Derivatives not designated as hedging instruments Interest rate contracts Accrued and other current liabilities $ 59 $ — $ 59 Foreign currency contracts Accrued and other current liabilities 31 (16) 15 Foreign currency contracts Other noncurrent obligations 1 (1) — Commodity contracts Accrued and other current liabilities 25 (8) 17 Total $ 116 $ (25) $ 91 Total liability derivatives $ 715 $ (465) $ 250 1. Counterparty and cash collateral amounts represent the estimated net settlement amount when applying netting and set-off rights included in master netting arrangements between the Company and its counterparties and the payable or receivable for cash collateral held or placed with the same counterparty. 144

Annual Report Page 153 Page 155

Annual Report Page 153 Page 155