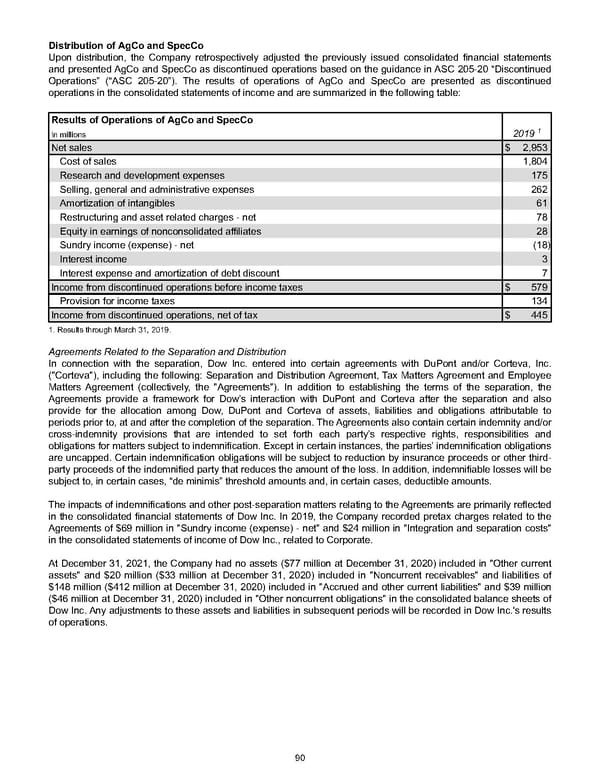

Distribution of AgCo and SpecCo Upon distribution, the Company retrospectively adjusted the previously issued consolidated financial statements and presented AgCo and SpecCo as discontinued operations based on the guidance in ASC 205-20 “Discontinued Operations” (“ASC 205-20”). The results of operations of AgCo and SpecCo are presented as discontinued operations in the consolidated statements of income and are summarized in the following table: Results of Operations of AgCo and SpecCo 2019 1 In millions Net sales $ 2,953 Cost of sales 1,804 Research and development expenses 175 Selling, general and administrative expenses 262 Amortization of intangibles 61 Restructuring and asset related charges - net 78 Equity in earnings of nonconsolidated affiliates 28 Sundry income (expense) - net (18) Interest income 3 Interest expense and amortization of debt discount 7 Income from discontinued operations before income taxes $ 579 Provision for income taxes 134 Income from discontinued operations, net of tax $ 445 1. Results through March 31, 2019. Agreements Related to the Separation and Distribution In connection with the separation, Dow Inc. entered into certain agreements with DuPont and/or Corteva, Inc. ("Corteva"), including the following: Separation and Distribution Agreement, Tax Matters Agreement and Employee Matters Agreement (collectively, the "Agreements"). In addition to establishing the terms of the separation, the Agreements provide a framework for Dow’s interaction with DuPont and Corteva after the separation and also provide for the allocation among Dow, DuPont and Corteva of assets, liabilities and obligations attributable to periods prior to, at and after the completion of the separation. The Agreements also contain certain indemnity and/or cross-indemnity provisions that are intended to set forth each party’s respective rights, responsibilities and obligations for matters subject to indemnification. Except in certain instances, the parties’ indemnification obligations are uncapped. Certain indemnification obligations will be subject to reduction by insurance proceeds or other third- party proceeds of the indemnified party that reduces the amount of the loss. In addition, indemnifiable losses will be subject to, in certain cases, “de minimis” threshold amounts and, in certain cases, deductible amounts. The impacts of indemnifications and other post-separation matters relating to the Agreements are primarily reflected in the consolidated financial statements of Dow Inc. In 2019, the Company recorded pretax charges related to the Agreements of $69 million in "Sundry income (expense) - net" and $24 million in "Integration and separation costs" in the consolidated statements of income of Dow Inc., related to Corporate. At December 31, 2021 , the Company had no assets ( $77 million at December 31, 2020) included in "Other current assets" and $20 million ( $33 million at December 31, 2020) included in "Noncurrent receivables" and liabilities of $148 million ( $412 million at December 31, 2020) included in "Accrued and other current liabilities" and $39 million ( $46 million at December 31, 2020) included in "Other noncurrent obligations" in the consolidated balance sheets of Dow Inc. Any adjustments to these assets and liabilities in subsequent periods will be recorded in Dow Inc.'s results of operations. 90

Annual Report Page 99 Page 101

Annual Report Page 99 Page 101